State Farm: Editors Choice

J.D. Power regional rating: 851/1,000AM Best financial strength score: A++Better Business Bureau rating: A+

We rate State Farm as the best car insurance in Texas for its extensive coverage options, strong reputation and reliable claims. Its also one of the most affordable choices on average for many Texans especially for students. State Farm has the best student discounts among leading auto insurance companies with up to 25% off and offers its Steer Clear® educational program.

BBB rating: D-

Fred Loya is a small car insurance company headquartered in El Paso, Texas, that focuses on providing affordable rates for high-risk drivers in Texas. The company caters to Spanish-speaking customers and has been in business since 1974.

If youve had issues finding affordable coverage from other companies, Fred Loya auto insurance is worth considering. Many drivers find cheap car insurance in Texas through the company.

What Is Pip What Is The Importance Of Pip In Texas

PIP insurance is a type of first-party auto insurance that covers your medical bills, lost earnings, and other costs if you are injured in a car accident. Medical expenditures for passengers in your car who are injured in a collision are also covered by PIP.

Unless you sign a waiver denying coverage, personal injury protection insurance is required in Texas. If you decline the coverage, you may find yourself uninsured if you are unexpectedly wounded in an accident and face large medical bills or lost pay.

In Texas, personal injury protection coverage compensates for you and your passengers if you or your passengers are injured in an automobile collision, regardless of who is at fault.

PIP includes:

- Reasonable medical costs, including necessary surgeries, X-rays, dental or eye treatments, medical procedures, prosthetic devices, and professional nursing

- Ambulance services

- Funeral services

- Lost income resulting from the accident

- Replacement of necessary services provided by the injured party, such as family care or household maintenance, if the injured is not an income producer.

Texas Auto Insurance Alternatives

Texas does offer some alternatives to traditional car insurance coverage if drivers cannot find an insurance company to cover them or if they feel they would benefit better from being self-insured.

If you are struggling to find an insurance company to provide you with coverage, the Texas Automobile Insurance Plan Association can assist you with an auto insurance policy.

For drivers who wish to take the self-insurance coverage route, Texas allows you to prove financial responsibility through the following avenues:

- Surety bond with the Texas Department of Public Safety – Drivers can file a surety bond with at least two other people who own property in Texas. The property connected to the bond has to be worth at least as much as the mandated insurance coverage amounts.

- Making a deposit – Drivers can file a $55,000 deposit with either a Texas comptroller or your county judge can work to cover insurance. You can make your deposit in either cash, securities, or check. Make sure that the county you file your deposit with is the same Texas county that your vehicle is registered under.

- Certificate of self-insurance – If you promise to pay up to the same amount specified in Texas insurance laws, you can qualify for a self-insurance certificate. Please note that this option is only available if you have at least 25 vehicles. This may be ideal for business owners.

It is highly recommended that Texas drivers take the traditional auto insurance route if they are able to find coverage.

Read Also: How To Fix Car Door Lock

Which Vehicles Have Cheap Car Insurance In Texas

As a segment, compact SUVs tend to have the overall cheapest car insurance in Texas. The Mazda CX-5, Chevrolet Trailblazer, Nissan Kicks, and Toyota C-HR all have cheap insurance rates.

Texas drivers like their full-size pickup trucks, and the Ford F150, GMC Sierra, and Nissan Titan are the cheapest to insure in Texas. Average insurance rates for those three trucks are $1,388, $1,464, and $1,516 per year, respectively.

Other models that rank well for car insurance cost in Texas include the Nissan Rogue Sport at an average annual cost of $1,196, the Hyundai Venue at $1,220, and the Buick Envision at $1,220 per year.

The most popular car in Texas, the Toyota Camry, doesnt fare as well as some of the other vehicles, as the cost to insure a Camry in Texas costs an average of $1,412 per year, or around $118 per month.

The table below includes the top 100 cheapest vehicles to insure in the state of Texas. The list was created from all vehicle segments, including compact, midsize, and full-size cars, trucks, and SUVs, including luxury models.

| Rank |

|---|

Get Rates in Your AreaWhy is this important?

Table Data Details:

How Much Life Insurance Do You Need 3 Methods

An estimate can be a simple approach to receive a price if youre trying to figure out how much life insurance you currently need. Although these approaches are superior to a wild guess, they frequently overlook crucial aspects of your financial situation.

To get a more accurate picture of how much life insurance you require, use the calculator above, then compare the result to these figures.

You May Like: How To Get A New Car After Total Loss

Age And Car Insurance Premiums

A 16-year-old driver can expect to pay roughly $7,371 annually for a full coverage premium. If they just want minimum coverage, theyll pay an average of $2,770.

Luckily, these costs decrease the older a person gets. Theyre still quite high at 18 years old $5,385 and $1,965, respectively but as soon as a driver turns 25, they drop to $1,989 and $666, respectively. The savings keep building from there until you reach age 65, at which point they start to increase again slightly.

This is because older drivers can face a lot of problems that put them at risk behind the wheel, including decreased eyesight, slower reaction times, and other disabilities. By the time youre 85 years old, a policy with full coverage will cost $2,165, while a minimum coverage policy is $770.

Proof Of Auto Insurance In Texas

Drivers in the state shall have evidence of insurance or alternative documents. You need to provide proof of insurance under a variety of circumstances:

- As ordered by the police.

- Involved in a traffic accident

- Registration and renewal of vehicle registration

- When applying for and renewing a license for a driver

Auto insurers are expected to send insurance cards to policyholders. Individuals depending on insurance alternatives will obtain certificates instead of an insurance card. You can use your mobile to hold your card.

You May Like: How Long Do Electric Car Batteries Last

Cheap Texas Car Insurance For Senior Drivers Age 65+

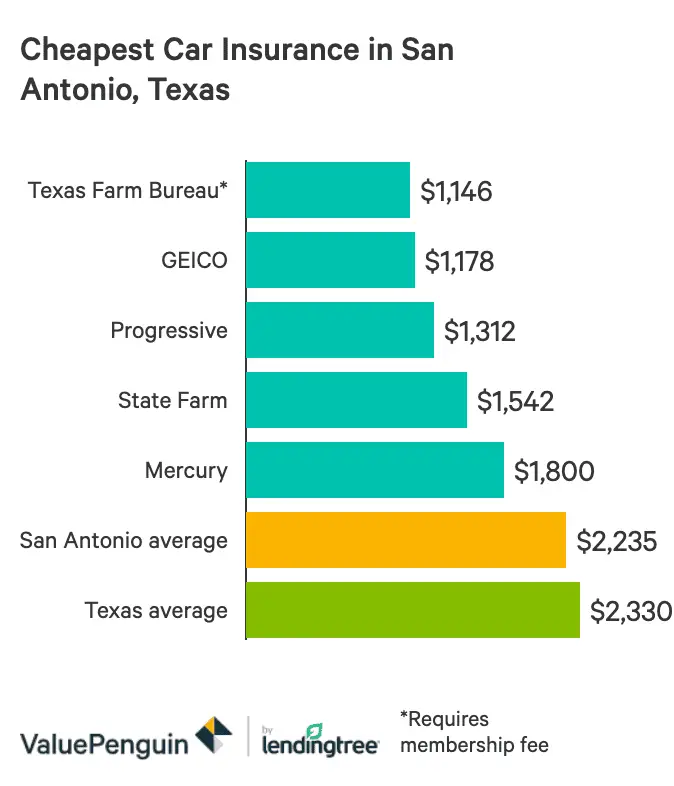

Senior drivers may see their rates increase as they reach their late 60s. Insurance companies vary on how they set rates, so some insurers like Texas Farm Bureau and Geico offer superior average rates to seniors compared to other insurers in the state evaluated by Forbes Advisor.

Car insurance companies may also offer discounts if you take a mature driver or defensive driver course, which are ways to reduce your auto insurance costs. If youre retired and dont use the car much, a usage-based car insurance program is another option that may save you money in the long run.

| Cheapest companies |

|---|

Related: Best Car Insurance for Seniors

Cheapest Car Insurance For Texas Drivers With Speeding Tickets

Drivers who accumulate traffic violations like speeding tickets on their driving record is guaranteed to raise their premiums. It may not be as much of a rise as a DUI conviction, but it still will be noticeable. Even a single violation could raise a drivers rates depending on the severity.

This increase, though, is rarely permanent. Usually, after three to five years, your premiums will come back down, but that is still quite a bit of time, and you want to make sure youâre not draining your budget on insurance.

When it comes to the cheapest auto insurance policy following a speeding ticket in Texas, premiums average around $1,000-$1,500 per year for drivers. If you are lucky enough, you may be able to find a cheaper car insurance policy in Texas, but it largely depends on your personal factors.

Insurance providers do not take traffic violations or an accident lightly, so do not be surprised if cheap insurance is hard to come across.

Read Also: What To Do If You Lock Keys In Car

Texas Car Insurance Rates By Vehicle Type

Car insurance rates vary by make and model. Insurance companies may factor in the crash statistics of a certain vehicle, how likely it is to be stolen, which safety features it has and whether the driver is likely to engage in high-risk driving. For instance, drivers of coupes are more likely to speed and engage in risky driving than sedan drivers. Coupes are also more likely to be stolen. For these reasons, coupe drivers pay more than sedan drivers for their car insurance, on average.

Below, we compiled average car insurance rates for a few common makes and models.

| Vehicle | Average annual full coverage premium |

|---|---|

| Toyota Prius | |

| $1,606 |

Texas Car Insurance Requirements

Like in most states, drivers in Texas must carry the state minimum required coverage. Minimum coverage limits include:

- Bodily injury liability: $30,000 per person and $60,000 per accident

- Property damage liability: $25,000 per accident

The minimum required liability insurance only covers injuries and property damage you cause to other drivers, not damage to your own vehicle. Texas car insurers are required to offer uninsured motorist coverage , underinsured motorist coverage and personal injury protection , all of which you can decline in writing.

Full coverage auto insurance policies include collision and comprehensive coverage to cover your own vehicle after an accident or non-collision event.

You May Like: How Long Should A Car Last

Cost To Insure Your Car In Texas By Age

- Texas has a graduated licensing system, which is intended to help foster safe driving habits among new drivers

- Young drivers can take a defensive driving course to help secure lower car insurance premiums

- Maintaining a good average can qualify student drivers for a good student discount

What Are Car Insurance Minimum Requirements In Texas

To comply with Texas’ financial responsibility law, you will need to purchase a minimum amount of liability coverage. As long as you provide for the minimum coverage required, you will be in compliance with the financial responsibility laws. In Texas, the minimum liability limits are $30,000 for every person injured up to a maximum of $60,000 per accident. Additionally, you must also carry at least $25,000 in coverage for property damage. This minimum level of coverage is referred to as 30/60/25 coverage.

It’s worth noting that you can purchase more than the minimum liability rates. In fact, it’s a good idea to invest in more robust coverage. Many new vehicles cost more than $25,000, and it’s not uncommon in major accidents for medical bills to far exceed $30,000 per person. And while your liability insurance is required to pay up to the policy limits, any damages that exceed your coverage are on you.

You should also remember that this minimum coverage is for liability only. There are no requirements that you carry insurance to cover your own injuries or vehicle, but it’s still a good idea. When car accidents happen, comprehensive coverage can take a lot of pressure off of an already difficult situation.

Read Also: How To Bypass Car Alarm To Start Car

Anamarie Waite Car Insurance Writer

@anamarie.waite08/10/22 This answer was first published on 04/21/20 and it was last updated on 08/10/22.For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Drivers in Texas need $30,000 of bodily injury liability insurance per person and $25,000 of property damage liability insurance. Collision, comprehensive and gap insurance may also be required by a lender or lessor if your vehicle is financed.

In addition, an optional but recommended type of coverage in Texas is uninsured/underinsured motorist insurance. It replaces the liability coverage an at-fault driver shouldve had and pays for your costs up to your policy limits.

Texas Car Insurance Calculator: Get An Instant Free Estimate

To acquire an accurate car insurance quote, you must provide a variety of personal information to your prospective insurer. The entire process typically takes around 1015 minutes to complete.

Using your age, coverage levels, vehicle type and driving record, Moneygeek’s auto insurance calculator for Texas estimates how much your car insurance might cost you per year or per month.

MoneyGeek found that the factors that most significantly affect your car insurance in Texas are adding a teen driver to your policy, the coverage levels you choose and your age.

Auto Insurance Calculator

Average Annual Auto Insurance Rates

low end

Company

The cheapest car insurance company in Texas for you depends on a number of factors, but you can get a close estimate of your premium using MoneyGeek’s calculator. Farmers is the cheapest widely-available company for our default 40-year-old driver in Texas, at an average of $452 per year.

In addition to cost, the insurance providers customer service quality and availability of the coverages you want are other important factors to consider.

When youre researching how much insurance you need and how much it will cost, we recommend using our car insurance calculator and browsing our collection of sample drivers in MoneyGeeks cheapest car insurance in Texas guide.

Weve analyzed the average cost of auto insurance in Texas, the results of which can give you a better understanding of how insurance rates compare across the state.

Don’t Miss: Does Car Insurance Cover Scratches And Dents

Is Uninsured Motorist Coverage Required In Texas

No, uninsured or underinsured motorist coverage is not required by law in Texas. Insurance companies, however, must offer you the opportunity to add it to your policy and it must be rejected in writing if you dont want it.

Keep in mind that the insurance of the driver who is at fault typically helps cover the cost of damages. Without uninsured or underinsured motorist coverage, you could be stuck with the bill if they dont have enough coverage.

How Does Type Of Vehicle Affect Your Texas Car Insurance Premiums

The kind of vehicle you purchase will be taken into consideration when establishing your annual insurance coverage rates. Some cars simply cost more to insure than others. Drivers with a high-performance, brand-new luxury vehicle, will be paying more for insurance coverage as opposed to someone that drives a decade-old sedan.

Some insurance providers may also be concerned about drivers who have high-powered vehicles, thinking that they are likely to get into an accident, and the company will adjust premiums to reflect this. Be mindful of the make, model, year, and value of your vehicle if you are in the process of shopping for a new one.

Don’t Miss: How Do Car Salesman Get Paid

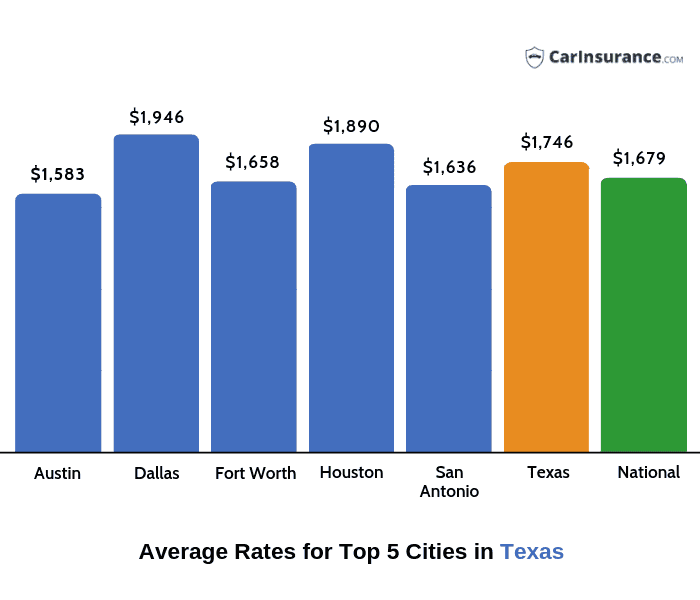

How Does Location Affect Your Texas Auto Insurance Premiums

While the fact that you live in Texas certainly is a defining factor when it comes to your Texas car insurance coverage rates, companies will get even more detailed with their consideration. A drivers address and zip code will be analyzed to determine their car insurance policy rates.

This is due to the fact that highly-populated cities tend to have higher crimes rates, whereas rural communities stay relatively lower. Living in a major city puts your vehicle at a greater risk for vandalism and theft, which your insurance coverage may have to pay for.

While cheap coverage should still be readily easy to find in your area, drivers should be mindful of this when shopping for insurance.

If You And Your Passengers:

- Dont have health insurance, or have a plan that doesnt cover car accidents or has low limits, we recommend that you add medical coverage of at least $5,000 to your car insurance policy.

- Do have health insurance, its still a good idea to have medical coverage if you want the best protection in your policy, as it can pay out after your health benefits are maxed out.

Don’t Miss: How To Make Car Freshies

Cheapest Auto Insurance In Texas For Young Drivers

Texas Car insurance companies will consider you to be a young driver when you are between the ages of 16 and 25.

Drivers in this age range are thought to be inexperienced and may get in an accident, and insurance providers will increase auto coverage rates to make up for this. Teenage Drivers and even young adults can be reckless, and this belief is justifiable.

According to various data, teen drivers and young adults are responsible for numerous accidents every year. Young drivers may pay thousands of dollars each year for coverage.

However, relatively cheap car insurance policies in Texas do exist for young drivers. Your insurance coverage rate will shift slightly every year as you age, but, on average, the cheapest car insurance premiums for young drivers in Texas range from $1,000-$3,000 per year.

This may seem like a big gap, but you have to remember the many variables that go into determining your auto coverage rates.

Itâs not uncommon to find a policy that is almost, on average, $4,000 per year for young drivers in Texas. That may even be the most affordable policy available to you.

To curb some of these expensive rates, young drivers should try to be added to their parentâs insurance policy.

Cheapest Auto Insurance In Texas For 40

Drivers with poor credit in Texas can check out the following insurers with the lowest average rates for full coverage:

Nationwide: $1,846 per year, or about $154 per month.

Geico: $2,140 per year, or about $178 per month.

Mercury: $2,165 per year, or about $180 per month.

Houston General: $2,278 per year, or about $190 per month.

Redpoint County Mutual: $2,305 per year, or about $192 per month.

You May Like: Who Is The Cheapest Car Insurance Company