Compare Quotes Every 6

To make sure youre still getting the best deal, you should shop around for quotes every time you need to renew your policy. This is especially important if you recently received a ticket or were in an accident, or if youve been with the same insurer for a while. For instance, the cheapest car insurance company when you were a teenager might not be the cheapest option for you 10 years later.

You can use WalletHubs cheap car insurance analysis as a starting point to find the cheapest companies in your state.

The Minimum Requirements For Arizona Car Insurance

All drivers that have a car registered in the state of Arizona are required to carry at least the following amounts of general liability car insurance:

- Bodily injury liability: $25,000 per person

- Bodily injury liability: $50,000 per accident

- Property damage: $15,000 per accident

Keep in mind that these are the bare minimum coverage amounts of Arizona car insurance that you are able to carry. Because damage to cars and medical treatment for drivers sustaining injuries after an accident donât tend to be cheap, itâs highly recommended that you carry at least $10,000 more for each respective minimum coverage. Being underinsured can leave you responsible for outstanding damage and injury costs. So, car insurance will protect you not only legally, but also financially. How much coverage you would carry exactly depends on your own needs and budget when it comes to your car.

The Basics About Car Insurance In Arizona

You donât need to be a resident of Arizona to know how important it is to have car insurance in the United States. Nearly every state has its own requirements for car insurance that every driver must at least carry in order to drive legally. Arizona is one such state.

The legally required auto insurance, that nearly every driver has, is known as general liability coverage. This is meant to cover any damage, or injuries, you cause to other drivers and their vehicles. Not having car insurance in Arizona, and such states, can result in legal penalties that go beyond just fines âdriving privileges can be outright revoked in some cases of uninsured drivers. But, just because something like auto insurance is legally required, doesnât mean it has to be expensive. So, local and national car insurance companies are able to compete for the cheapest rates in town.

Also Check: How To Know If Car Battery Is Dead

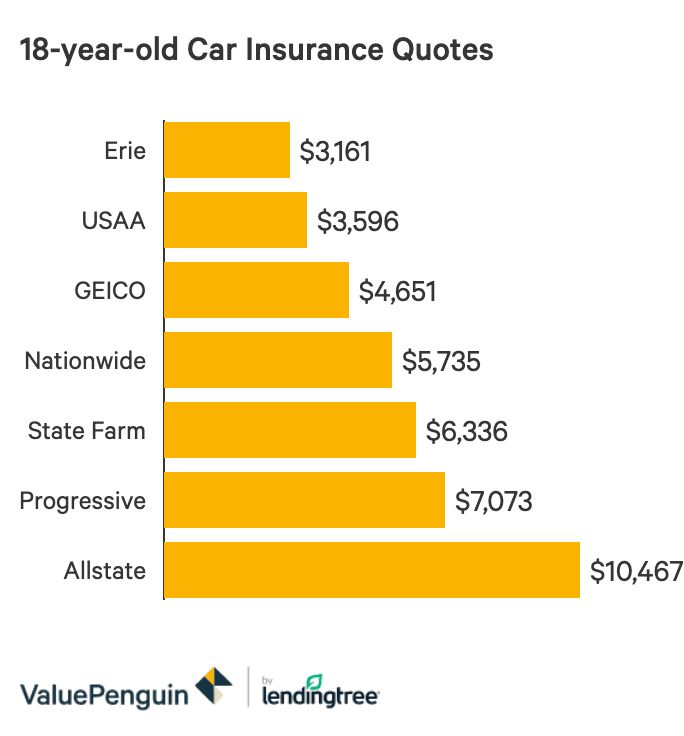

How Much Is Car Insurance For An 18 Year Old Compared To Other Ages

The cost of car insurance for 18-year-olds is cheaper than for 16-year-olds, but 18-year-olds pay an average of 198% more than 30, 35, and 45-year-olds.

Car insurance rates for 18-year-olds are much higher than for older drivers because theyre more likely to drive recklessly, get tickets, cause accidents, and file claims than more experienced drivers.

According to the Department of Transportation, 18-year-old drivers were behind the wheel for 9,500 fatal crashes from 2011 to 2020. This is why younger drivers pay more for coverage than older people.

But as long as 18-year-olds keep their driving records clean, their rates will go down with age, and level out around 25, when they age out of the highest-risk age group.

Full-coverage car insurance, ordered by age.

How Do You Get Cheaper Insurance For 18 Year Olds

Rather than skimping on coverage, a better idea is to maximize discounts and shop around regularly for the best insurance coverage. Accident- and ticket-free driving, comparison shopping and maximizing discounts will help you find the cheapest car insurance rates for teens.

Many big car insurance companies offer discounts to good students. Students are eligible for discounts if they have excellent academic performance, such as a high GPA or high test scores on SAT or ACT, says associate professor Ting Liu of the College of Arts and Sciences at Stony Brook University.

Some companies offer multiple policy discounts. For example, if a student needs renters insurance and car insurance, it is a good idea to buy the two policies from the same company and ask for a multiple policy discount.

You May Like: How Much Does It Cost To Get A Car Wrapped

Assemblingthe Appropriate Amount Of Coverage

1- Confirm the minimumcoverage requirements in your state.

Almost every state requires drivers toobtain liability insurance, which covers damage to another person’s property orharm to another person if you cause an accident.

Some states require drivers toacquire a certain level of vehicle insurance. Licensees in your state will beconversant with the state’s minimal standards.

If you wish to do your own studyon your state’s requirements, go to your state’s Department of Motor Vehicleswebsite .

2- Recognize the manyforms of vehicle insurance coverage.

When it comes to auto insurance, do yourresearch or speak with an insurance representative about all of youralternatives. Some may be required, while others may be optional. The quantityof coverage and the cost are determined by the conditions of your insurance.

Ifyou want to keep your vehicle insurance prices low, get just the coverage youtruly need.

3- Select coverage thatmeets your requirements.

If you want to save money on vehicle insurance, getonly the least amount of coverage you require. When making these decisions,keep in mind your risk tolerance and the needs of your family, as well as anyother insurance coverage you may currently have.

Your insurance agent can alsoassist you in determining which coverages you require and can live without.

Our Take On Car Insurance Providers For Teens

It’s important to compare the average car insurance rates for your 18-year-old to save on annual auto premium costs. Whether you’re looking for the most cost-effective plan, or the safest plan for your teen, you should keep a lookout for policies from Geico and Progressive. Our research found that these providers have affordable rates and good coverage for young drivers.

The best way to know that youre getting the most affordable car insurance is to compare quotes from multiple car insurance companies side-by-side. Enter your zip code in the quote box below or call to get started.

Don’t Miss: Where To Find Vin On Car

Shop Around For Cheap Car Insurance Rates

Carefully compare online quotes from different insurers. Premiums for the same coverage will vary considerably from one company to another.

Remember to compare apples to apples and be sure that the lower quote provides all the coverage you need. This will help you find cheap auto insurance for new drivers, whether its the cheapest car insurance for 18-year-olds or 16-year-olds.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How To Lower The Cost Of Teenage Car Insurance

Even though car insurance is typically expensive for teenagers, there are still ways to lower the cost of covering a young driver. One of the best ways to reduce the cost of teen car insurance is to add them to an existing policy rather than have them purchase their own policy. Adding a teen to a policy raises rates by an average of $1,461 per year, but it’s still cheaper than the cost of a separate policy. Also, look for discounts that are specifically for young drivers, like good-student and student-away-at-school discounts.

If your teen does need to purchase their own policy, they should compare quotes from at least three different insurers in order to find the best deal. The cheapest car insurance companies for teens are Travelers, USAA, and Progressive, according to WalletHub’s analysis.

It costs an average of $1,461 per year to add a teenager to your car insurance policy – an increase of 173% compared to the average driver’s premium. The exact amount your insurance will go up depends on many factors, including where you live, your driving history, and your credit score.

Below you can see how adding a 16-year-old driver to an existing policy compares to paying for a separate policy. Quotes assume Geico coverage and a 2014 Hyundai Sonata that is shared between the primary policyholder and the teen driver.

You May Like: What Is The Cheapest Car

Consider A Telematics Policy

Telematics car insurance bases premiums on actual data about your driving, which is recorded by either a black box fitted in the vehicle or a mobile phone app.

As an added bonus the black box acts as a tracker if your car gets stolen.

Telematics insurance can make your car insurance cheaper, whatever your age, as long as youre a careful driver.

Choose Your Car With Insurance Costs In Mind

As a general rule, valuable cars are more expensive to insure, as are powerful vehicles and cars that are particularly likely to be stolen. So if youre looking to save in the long run, its a good idea to get quotes for different vehicles before you buy a new car. This way, you know how much you can expect to pay for coverage.

Don’t Miss: How To Organize Music On Usb For Car

How To Get Cheap Car Insurance For Young Drivers

Whether you are a parent helping your young adult with coverage, or a young driver responsible for paying your own insurance, we know you want to save. And we dont blame you. Just taking a look at the average, monthly insurance rates for teenage drivers is enough to bring on a case of sticker shock.

Below, weve put together the average car insurance premiums for a 17-year-old male and female drivers. This data is a result of partnering with Quadrant, and factors in drivers from various backgrounds and locations:

Average Monthly Car Insurance Rates for Teens by Company

| Group | |

|---|---|

| Get Your RatesQuote Now | #blank# |

The numbers say it all: insuring new drivers is costly. However, its obvious that some car insurance companies charge significantly more or less than others.

For instance, where the average monthly rate for 17-year-old drivers is in the $400 dollar range for USAA customers, that figure skyrockets to over $1,000 for 17-year-old males insured with Travelers and Liberty Mutual.

But heres the deal: the savings wont come unless you take action.

Lucky for you, weve come up with a comprehensive list of savings strategies you can begin putting into practice. Simply put? How to get cheap car insurance for young drivers starts now. Lets begin with some of the most common discounts for teens.

Pay A Higher Deductible

Its simple: higher auto insurance deductibles mean lower payments. As a result, opting for a higher deductible could be a valid option in the quest to find cheap insurance for young drivers.

When parents consider the option of buying auto insurance for teenagers, they need to weigh their options. Are you willing to pay a higher deductible if your child gets into an accident?

Consider this: the amount of the deductible should at least be in an amount that is reasonable and can be met in case of an accident.

Also Check: What Oil Do I Need For My Car

How Much Does Car Insurance Cost For 18

How much does car insurance cost for 18-year-olds?

Drivers under the age of 25 pay the most for car insurance on average. However, many auto insurance providers offer discounts that make the cost of car insurance for teens more manageable.

The average annual car insurance premium for 18-year-old drivers is over $400 per month. That might sound intimidating, but there are ways to lower your rates, such as selecting insurance coverage limits carefully and choosing the right insurance provider. Enrolling your teen driver in driving school or a defensive driving course can also lead to savings on insurance premiums.

Telematics apps are another great way to score savings for safe drivers. These programs track driving habits and help insurance companies better understand policyholder risk. Safe drivers should consider policies with telematics tracking capabilities.

See More:Car Insurance Quotes

Cars That Get The Cheapest Car Insurance In Arizona

Another generally well-known fact about auto insurance is that more expensive vehicles will usually cost more to insure. This is especially the case for high-performance, high-valued luxury and sports cars. Cars with the latest technical features also fetch hefty annual rates. If a car of that kind of value were to be damaged, then the auto insurance company would have to pay out a lot âso they compensate with higher rates.

Arizona is generally a better state for sports cars as it gets no snowfall, and roads do not become icy in the winter. Still, there are criminal and traffic rates for the auto insurance provider to consider.

Older and more standard makes, and models with proven track records of reliability and safety are the vehicles subject to the cheapest car insurance. Despite this, Insurance Navy strives to set a new average for drivers with higher valued cars in Arizona by competitively comparing several local quotes to find the cheapest coverage options for any given make and model.

Don’t Miss: How To Program Garage Door Opener In Car

Consider The Cost Of Coverage Before You Buy A Car

Before you purchase a car, its important to know that some cars are more expensive to insure than others. This is crucial to keep in mind, especially if youve been eyeing that luxury sports car. The cost to insure will depend on the year the car was made, its make and model, the cost to repair it, and the likelihood of theft and vandalism.

For instance, luxury cars tend to be more expensive to insure, because the cost of repairs is much higher for these vehicles. Sports cars are also more expensive to insure because they are more prone to reckless driving and increasing the risk of fault accidents.

If you are looking for how to get cheap car insurance, start by looking at the car you drive. Sedans, vans, and other family-friendly cars have the lowest insurance rates. You can also get better rates when your car has collision-avoidance technology or anti-theft features. Check out more of the cheapest cars to insure when youre shopping around.

Shop Around For The Right Quote

You won’t be surprised to hear that our top tip for getting the car insurance cover you need at the right price is to shop around.

It doesnt have to take a long time to check whether you could get a cheaper deal – just compare car insurance quotes with us.

Shopping around individual insurer websites, phoning them all up or using a high-street broker is time-consuming. Compare prices with us and youll have lots of quotes to choose from in minutes.

You May Like: What Is An Automatic Car

States With The Highest Car Insurance Cost For A 18

Auto insurance rates are determined at the state level. This means that the same person could see a significant difference in their insurance rates by moving from one state to another. Teens in Michigan, Louisiana and New York will have some of the highest insurance rates in the nation.

Top 10 Most Expensive States for 18-Year-Old

Scroll for more

Compare Car Insurance Quotes For Cheaper Car Insurance

When youre determining how to get cheap car insurance, you must remember to avoid strictly comparing your premium to someone elses. You cant always compare rates, even if you live in the same neighborhood. What you can do, though, is get auto insurance quotes from a number of providers and compare your own quotes to ensure youre paying the best price for your coverage.

Here are a few popular providers and their annual average costs for a 35-year-old driver according to our rate estimates.

| Car Insurance Company |

|---|

Recommended Reading: How Long Is An Average Car

How Young Drivers Can Get More Affordable Car Insurance

The cost of liability insurance, your state minimum car insurance required to drive, has more to do with the driver than the car. In your search for the best cheap car insurance, these are the factors you have some control over:

- Your driving record: More than one violation or accident is going to hurt.

- Your credit: If its dismal, youre seen as a bigger risk of a claim and thus charged more in many states.

- Your mileage: The less you drive, the less risk of your hitting someone.

- Your insurance history: If youve let your policy lapse, even for a few days, youll pay more for coverage.

- Your insurance company: No two insurers offer identical rates, and even on state-minimum policies, premiums can differ by hundreds, sometimes thousands, of dollars a year.

- Your car: If your car has a significantly higher rate of claims than most , your liability rates will reflect that risk.

- Your ability to qualify for discounts: You may be able to earn a good student discount, or other car insurance discount, for instance, for paying online, so be sure to research which ones you can get and ask for them.

How Do Car Insurance Companies Set Rates

Car insurance premiums are developed based on the statistical likelihood that a driver will get into accidents or have a vehicle become damaged. Many personal qualities determine how much you pay.

Your rate will depend on your age, sex, driving record, marital status, credit score, zip code, car model, and more. And because you cant change many of these personal factors, its difficult to compare one persons auto policy to anothers. So, whats right for someone else may not be right for you.

Here are some examples of how these characteristics impact your monthly premium:

- Younger people and seniors tend to pay more.

- Young males pay more than women.

- Having multiple tickets and driving citations on your record means you may pay more.

- A history of clean, safe driving means you pay less.

- Your location determines the insurance requirements by state and whether there are dangerous driving conditions around you.

Many of these factors can change over the years as you resolve tickets and citations or improve your credit. However, factors like the state you live in may not be as easy to change. Each state requires its own minimum coverage. The more coverage that is required, the higher your premium will be.

Now that you understand what factors will determine your auto insurance rate, heres our advice on how to get cheaper car insurance.

Read Also: Where Can I Find The Vin On My Car