How Much Should You Spend On A Car Payment

Auto Approve: Top Choice For Refinancing

We named Auto Approve one of the best auto loan companies of 2022. It has a reputation for being a refinance auto loan specialist, and the companys lease buyout option makes it a viable option for those looking to purchase a vehicle. Auto Approve offers rates as low as 2.25% APR for those with good credit scores.

Learn more about the companys refinancing options in our Auto Approve review.

In Fact Dont Go To A Dealership At All

For decades, car dealerships have employed seedy manipulation tactics like including hidden costs, undervaluing your trade-in, and telling outright lies just to get you in the door.

And now, with lower inventory and increasing pressure from Carmax and Carvana, theyre getting bolder and more desperate.

You can still negotiate a good deal with dealerships, but youll need to enter the lions den ready to fight. For everyone else, Carmax is a much better choice.

Read more: Ex-car salesman tells all: how to beat the auto dealerships at their own game

Read Also: Who Is The Cheapest Car Insurance Company

You Need A Simple Functional Car For 10

- If you view a car as more of a functional tool than a lifestyle item or a status symbol, its best to budget about 10 to 15 per cent of your annual income. According to the National Office of Statistics, the average weekly earnings in the UK is £598*. Based on these figures, this gives you a budget of £2,870.40 – £4,305.60 to spend on a car.

- Since most new cars exceed this budget, its best to look at the used car market. For less than £4,305.60, you will be able to find a range of high-quality used cars less than eight years old with reasonable mileage and in good condition.

- While it can be tempting to go over your budget in order to get a higher quality car for your money, or alternatively to buy a brand new car, its important to remember that the cost of buying a car isnt the only cost of owning a car.

- From repairs and maintenance to registration fees and insurance, youll also need to pay a range of other costs in order to own and operate your car. This makes it worth sticking within your budget, even if it means buying a used car.

Technical Specification: Do Car Research

If you are one who can afford premium cars, this itself is a big screener . After this step, just decide your price bracket and brand & Model. Balance deliverables will be ensured by the car manufacturer.

But if you are like me, a lot of further research needs to be done. The requirement is to buy a right car. What is a right car? One which satisfies our purchase philosophy.

How to do it? By doing a simple car research. This also builds our taste for the “perfect car” which also stays within our affordability limits.

Where to start car research? Car portals will help you to screen cars of your choice. Use the following screening criteria:

Another effective way of car research is to ask a friend who is driving the same model you want to buy. It is also important to take test rides of as many cars as possible. This helps the buyer to get a better understanding of the look and feel of the car.

Try to take the test ride on roads you drive more frequently , or on your favourite expressway.

If idea is to spend on a car, one can make the purchasing memorable by doing a detailed car research. But more importantly, an effective research will let you buy a perfect car, which you’ll love each day.

Also Check: How To Get Rid Of Mold In Car

Calculate The Car Loan Amount You Can Afford

Now that youve calculated your affordable monthly car payment amount, you can start to get a sense of how much you can borrow. This will depend on several other factors, including:

-

Your credit score, which will in part determine your annual percentage rate, or APR, on the loan.

-

Your loan term: how many months you have to pay off the loan.

-

Whether you buy new or used. New car loans tend to have lower APRs.

With a monthly payment, an estimated APR and loan term, the car affordability calculator works backward to determine the total loan amount you can afford.

Determine How Much Car You Can Afford

A vehicle is often one of the most expensive purchases people make so it is critical that you crunch the numbers to determine whether you can truly afford the car youre considering. And remember the true cost of a vehicle goes well beyond the sticker price or monthly loan payments. Ongoing costs like fuel, maintenance and car insurance can vary significantly based on the type of car you purchase and should also be factored into your affordability calculations.

Don’t Miss: How Long Do Car Batteries Usually Last

File All Documents And Forms Properly

In some situations, the adjuster who is assigned to your case will request that you fill out and return some documents and forms. Some believe that this is something required and that they must complete and sign all the forms they are given. However, this isnt always the case. There are some situations where you do not have to sign anything that is given to you by the insurance company. The attorney you hire to help with the car accident claim will ensure that you dont sign anything you shouldnt.

So How To Find The Right Car For Your Budget

The first step towards having a car is calculating the budget. Most people simply go with the flow and pick a car they like. However, thats not always the best decision as its easy to overestimate the amount you can afford.

The best starting point is your salary. Ask yourself these simple questions:

1. How much do you take home after tax?

2. What are your monthly expenses? You can create a simple spreadsheet to monitor your spending or download a budgeting app for a quicker and more convenient solution.

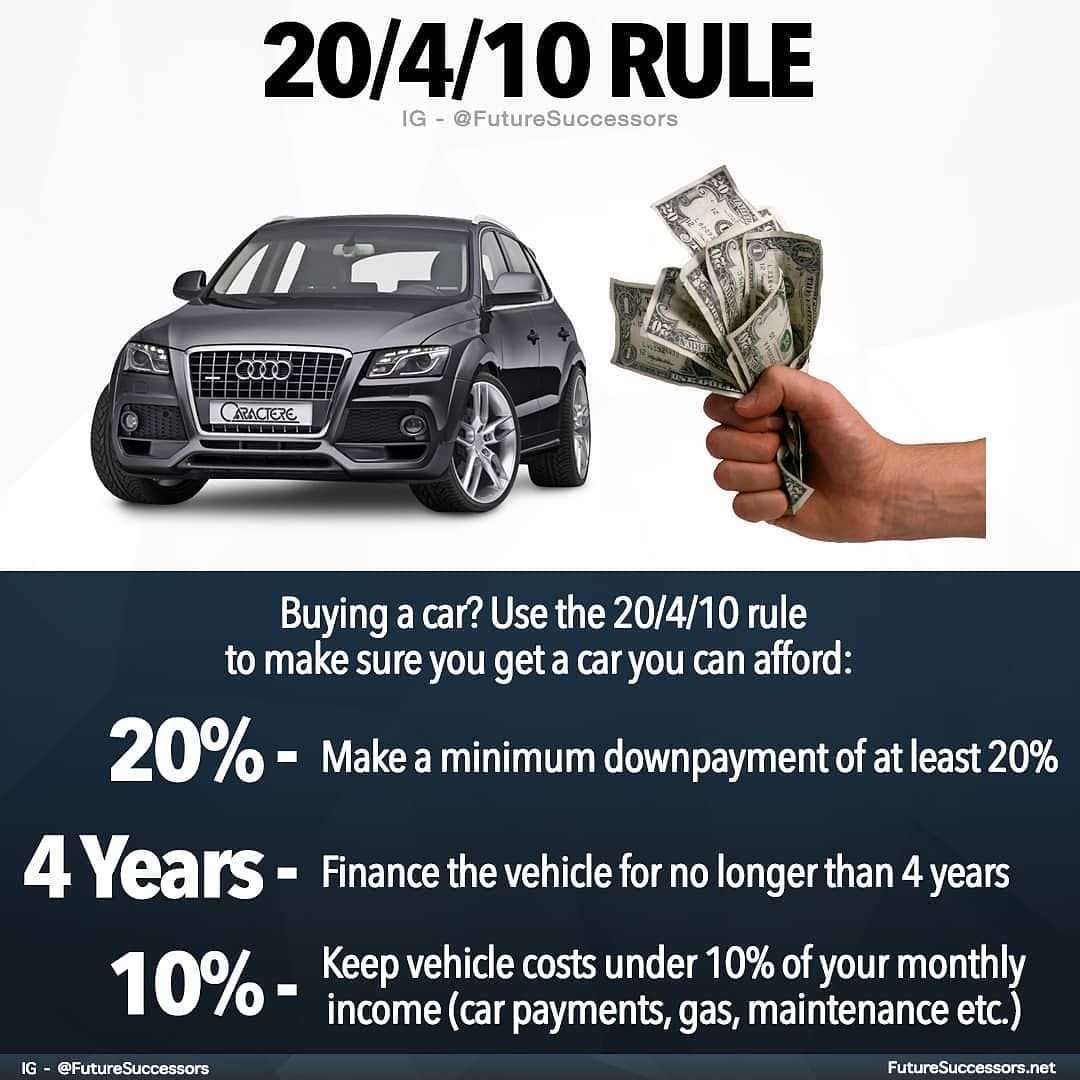

10-15% Rule

As a rule of thumb, spending 10-15% of your annual salary after the expenses is a sensible way to budget for a car. This includes not only monthly car finance payments, but the running costs as well.

Read Also: What Trim Is My Car

Is It Ok To Finance A Car

Your personal finance situation will dictate if it is okay for you to finance a car. Keep in mind, your car will depreciate in value while you are making payments. New cars depreciate 20 to 30% in the first year. Therefore, your car may be worth less than you owe on the car.

Again, this will all come down to your personal budget if you can make the payments. Personally, I would avoid taking on additional debt. What would happen if you lost your job tomorrow?

You should also factor in the cost of your car payments when building your emergency fund. Remember, losing your job is hard, but it is even harder when you have a car payment. Failure to repay your car loan may result in repossession of your car.

Your car tends to depreciate in value very rapidly. The more you drive your car, the further away from the original value your car gets. Your car loses value quicker, the newer it is.

Imagine, purchasing a car from a dealer for $25,000. Youve been driving the car for one year and lost your job. Youve decided that you cannot make the payments and want to sell your car.

Unfortunately for you, cars depreciate 20 to 30% in the first year. You owe the bank $24,000, but the car is now only worth $18,000. Its a bad situation to be in, but it happens all the time.

How Much Car Can I Afford

Fitting a car into your household budget is no easy task, and financial experts do not agree on how to determine its affordability. One school of thought holds that all your automotive expenses gas, insurance, car payments should not exceed 20% of your pretax monthly income. Other experts say that a vehicle that costs roughly half of your annual take-home pay will be affordable. Then some frugal personal-finance gurus say you should spend no more than 10%-15% of your annual income on a vehicle purchase. Pretax, post-tax, annual income these terms are enough to make a person ask: “How much car can I afford?”

There’s no perfect formula for how much you can afford, but our short answer is that your new-car payment should be no more than 15% of your monthly take-home pay. If you’re leasing or buying used, it should be no more than 10%. The reason for finding a vehicle that falls below 10%-15% is that the payment isn’t the totality of what you will be spending. You’ll need to factor in the costs of fuel and insurance, and many people overlook that. We put those costs at another 7% of your take-home pay. So, all in, you’re looking at a total budget that is ideally, no more than 20% of your monthly take-home pay.

While the 10%-15% rule may not work for everyone, it’s a good starting point for finding a target price that won’t leave you scrambling to pay your bills every month. Here’s how you can get a more customized number for yourself.

You May Like: What Car Insurance Is Required By Law In Florida

Summary: How Much Car Can I Afford On $50k Salary

As you can see, you probably shouldnt spend more than 10% of your $50,000 salary on a used car. Dave Ramsey recommends no more than half of your gross salary for a new car. However, you need to consider the opportunity cost when buying a car.

You can earn more money investing the cost of a car. Cars tend to depreciate in value and lose money over time. Most people make the mistake of buying high end cars, which has a significant impact on their finances.

Auto loans should also play a factor in your decision. Your $25k car would end up costing you much more in interest. Your car will depreciate in value, meaning youre going to owe more than the car is worth.

Before you buy a car, its important to have a budget in place. A good budget allows you to understand how much money you really have for a car.

My personal recommendation is to avoid financing a car. Pay in cash when you can. Avoid buying expensive cars, because investing will lead to more money later down the road.

How Much Should I Spend On A Car

The question, âHow much car can I afford?â is based on budget. Weâre personal finance writers, itâs what we do. What if we altered the question ever so slightly to âHow much should I spend?â If itâs not based on budget, and strictly preference, there is another rule of thumb you can follow.

- 10% of your salary â If you believe buying a car is a necessary evil. You only drive because your work requires it, but you get no joy out of it.

- 20% of your salary â You want a safe, reliable, and affordable car for commuting and errands. Itâs not about power or aesthetics, itâs about function.

- 50% of your salary â Cars are life.

Knowing the ârules,â hereâs a quick reference chart. We used gross annual income in this scenario because the question is less about budget. However, because of the personal finance angle, we opted to not show the 50% to spend on a car, itâs not wise financial choice for a depreciating asset. Itâs smart choice if thatâs what you value and you can afford it.

| Gross income |

Read Also: What All Do I Need To Register My Car

Your Total Car Monthly Payment Should Not Exceed 10% Of Your Gross Monthly Income

This is sort of a more granular version of the 35% rule.

The 35% rule gives you a general budget to plug into the search filters on Carmax, Edmunds, etc.

But when it comes down to brass tacks, youll want to zero in on the monthly payment. Take your annual income, divide it by 120, and thats the most youll want to pay for a car each month including insurance.

Examine Your Buying Patterns

In addition to the formula for car affordability, recognizing your own car-buying habits, good and bad, can offer clues to the best strategy for you.

For example, are you someone who buys a car, pays it off and then keeps it for a few years? Buying a new car would work for you: You have a track record of shopping within your means, finishing off the loan and going payment-free for a while. That’s smart.

Do you get bored with a car after a few years? Then leasing is your best bet. What good is it to take out a six-year loan if you’re going to trade in the vehicle during the fourth or fifth year? You’ll likely owe more than the car is worth and will have to roll that balance into the next loan. You’d be better off leasing and paying less per month. Leasing also lets you get a nicer car for less money.

Finally, are you trying to make the most financially sound decision possible? Then buy a lightly used car, pay it off, and keep it for many years. The first owner takes the depreciation hit, and you’ll have a car that’s new enough to avoid major repairs for a while.

You May Like: How Much Is It To Get Your Car Wrapped

How Much Car Can I Afford Its A Question Asked By Many Car Shoppers And Its Easy To Understand Why For Many Of Us A Car Purchase Is A Big Expense Second Only To Purchasing A Home

In September 2020, the estimated average price of a new vehicle in the United States was $38,723, according to Kelley Blue Book. But whats a comfortable fit for your budget?

To answer this question, you have two choices: You can follow conventional wisdom, or you can take a more customized approach to budgeting.

Fighting The Insurance Companies

Even if you are involved in a car accident but dont suffer injuries, its a good idea to have a car accident attorney handle your case from the beginning. They can also advocate for the insurance companies for you.

As mentioned above, the role of insurance companies is to reduce the payment you receive as much as possible. This helps to increase profits for the companys shareholders. As a result, the adjuster assigned to your case will try anything possible to keep the company from being considered liable or having to pay you damages.

When you hire a car accident lawyer for help with your situation, they will file the claim on your behalf and help level the playing field. It also allows you to pursue the damages you deserve as a victim of someone elses negligence. The attorney may even be able to help you recover damages that you arent aware you are owed.

Recommended Reading: What Size Wheels Are On My Car

How Much Is Homeowners Insurance And What Does It Cover

Homeowners insurance is a combination of two types of coverage:

- Property insurance: protects homeowners from a variety of potential threats such as weather-related damages, vandalism, and theft.

- Liability insurance: protects homeowners from lawsuits or claims filed by third parties for accidents that happen within the home.

In 2019, the average annual cost of homeowners insurance was $1,083 nationwide. The cost of homeowners insurance policy will vary depending on the type of property being insured and the amount of coverage the owner desires. Lenders require that buyers obtain homeowners insurance in order for the insurance premium to be included in the monthly mortgage payment.

Factor In Your Vehicle Expenses

Youll need gas to get from A to B, and youre also going need auto insurance to protect it. Youll also need to set aside some money for oil changes, tune-ups and other regular maintenance work.

According to a AAA report on the cost of owning a vehicle in 2017, the average new vehicle will cost you nearly $8,500 annually for the car payment, insurance, maintenance costs and gas. Thats about $706 per month.

Heres a breakdown of those car ownership expenses:

License, registration and taxes: $753 annually, which comes to roughly $63 per month

Maintenance and repair: $1,200 annually, or $100 per month

Fuel: $1,500 annually, or $125 per month

Full-coverage insurance: $1,194 annually, or $100 per month

Recommended Reading: What To Do If Scammed By Car Dealership

Monthly Payments Should Be Less Than 10

I used the neuvoo income tax calculator to figure out that a $50,000 salary means you take home $38,869. If we calculate 15% of that take-home pay, we end up at $5,830.35 or car payments of $485.86 per month.

If you want the best car you can afford at that salary, you could buy a $30,000 car, put a $6000 down-payment, get a 5-year loan at 4% interest and end up at monthly payments for 5 years at $442.

But, you still need to compare car insurance plus evaluate the gas mileage and maintenance costs of your new vehicle. If youâre setting aside $100 per month in maintenance, $200 for gas, $200 of insurance, and $50 in parking fees â youâre spending almost $1000 per month to drive a vehicle.

That $100 transit pass might not look so bad anymore.

If weâre staying with above example, at about $1000 per month on your car, youâre left with $26,869, or roughly $2,200 a month, for rent, groceries, clothes, dining out, tax free savings accounts, GICs, etc. for 5 years.