Final Thoughts: Car Insurance Doesn’t Always Pay Off Your Totaled Car

Unfortunately, even if you have gap insurance to cover the rest of your loan amount, you won’t get money to put toward a replacement car.

To have money from your insurance claim to put down on a replacement car, you would need to owe less than your loan amount. In that case, you would receive the money remaining after the lender was paid off. Or if you owned the car outright, all of the money would come to you to put toward a new car.

But your insurance company isn’t obligated to buy you another car, just to pay you the pre-accident value of your old one.

Consider a gap policy essential if you can’t put a hefty down payment toward the new car.

And don’t forget to shop around. When you look for a replacement vehicle, compare car insurance quotes with multiple auto insurance providers to find who will offer you the best rates. You could save hundreds, or more, by shopping around and finding the insurer that doesn’t rate as severely for an accident on your record.

Calculate The Cost To Repair Your Damaged Vehicle

First, your insurance company will connect you with a claims adjuster. They will then assess the damage to your vehicle and estimate the repair costs.

Much like how insurers use software to determine a vehicles value, they use software to determine repair costs, too. One common example, Mitchell, provides them with extensive information on parts and labor costs for thousands of cars.

After the insurer establishes the value of your car and the cost of needed repairs, it’s time to decide if the car is totaled. These are the two most common methods used to determine if a car is totaled:

Total-loss threshold

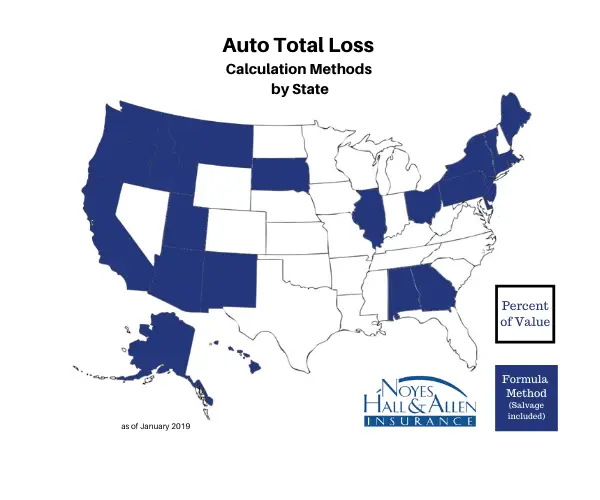

Insurers automatically declare a car totaled if the damage or repair costs exceed a set percentage of the cars ACV. That percentage, known as the total-loss threshold, is usually dictated by state law.

In many states, the total-loss threshold is 75%, which is sometimes referred to as the ¾ ratio. For example, let’s say your car is worth $20,000. If the cost to repair the damages is $15,000 or higher, your car is totaled. If the damages are less than 75% of the car’s market value, it’s reparable.

The 75% rule isn’t a guarantee. Each state has different laws and requirements. In Texas, the total-loss threshold is 100%. That means the repair cost must meet or exceed the car’s ACV to be totaled.

Total-loss formula

So, if the cost to repair the car plus its salvage value is greater than the car’s initial market value, it’s usually a total loss.

Option : Donate The Car

Donating a totaled vehicle to a nonprofit organization is another option. There are a number of charities that accept vehicle donations, including cars that have been totaled, to support their operations.

An added benefit of donating a totaled vehicle to charity is that you may be able to claim it as a tax deduction. If the nonprofit you donate your vehicle to sells it for less than $500, you can deduct the lesser of $500 or the fair market value of the car on the date that you donated it. If your donated vehicle is sold for more than $500, you can claim the amount for which it was sold.

To support your tax deduction, be sure to get a receipt showing the date of your donation and the name of the nonprofit organization.

Some car dealers will take a totaled vehicle as a trade-in.

Don’t Miss: What Is The Best Car Insurance For Young Drivers

If You Are Renting A Car While Waiting

Many drivers need a rental car while waiting for a decision on a payout, and use insurance to cover the rental costs. But be aware there is a limit to rental car coverage.

After issuing your payout documents, insurance companies will typically keep paying for the rental for a day or two, Miller says.

In other words, once you have the documentation in hand from the carrier with the payout, you have a limited amount of time to make a decision about a new car and turn over your rental.

If You Still Want To Keep Your Car

If you still cant bear to part with it, and your state doesnt prevent it, you should be able to come to an arrangement with your insurer to keep your beautiful wreck. Your carrier will determine payment on your accident claim the same way it would if you were not keeping your car, except that the settlement amount will be decreased by the vehicles salvage price.

You May Like: How To Transfer Car Title In Illinois

What Happens When A Car Is Totaled

If youve been in an accident and your car takes a serious beating, it may be deemed totaled by your insurance company. But what does it actually mean if your car is totaled, and what do you do about it?

Because you need the right insurance in place before you hit the road, were going to review important additional protections that really can make a big difference like rental car reimbursement coverage. With it, when youre wondering is my car totaled? after an accident, youll have some peace of mind knowing you can rent a car and get where youre going.

The two types of insurance coverage youll want on your car insurance policy to ensure your vehicle damage is insured are collision and comprehensive coverage.

Heres a detailed breakdown of when a car is considered totaled and what to do if your car is totaled, to help you get back on the road and keep your dreams moving forward.

Should You File A Lawsuit To Cover Your Losses

If you were involved in an accident where the other driver was clearly at fault, you might get a phone call from the drivers insurance company. They may want to know your version of what happened, how youre feeling, and where you work. You are under no obligation to give them a recorded statement. Insurance agents can be tricky they may be looking for any excuse to pay you less than what your claim is worth. Sure, youd like a fast resolution, but not if its far less than you deserve for your medical bills, lost wages, and property damage. For this reason, it is always wise to have a team of New York City personal injury lawyers advocating on your behalf and communicating with the insurance companies for you. Professional representation costs nothing upfront, but rather, costs you a third of the total settlement if compensation is secured. Keep in mind the statute of limitations for filing a lawsuit following a car accident in New York is three years, but its best to start working with a law firm right away, while the evidence is fresh.

“*” indicates required fields

You May Like: How Much Is A Rental Car

What If Insurance Wants To Total My Car But I Want To Keep It

If you decide to accept the insurers decision to total your car but you still want to keep it, your insurer will pay you the cash value of the vehicle, minus any deductible that is due and the amount your car could have been sold for at a salvage yard. It then will be up to you to arrange to make repairs.

They will cut you a check, says Ward, and then youre on your own.

Can I Keep A Car Deemed A Total Loss

The Balance / Hilary Allison

If you have recently been in a car accident, and your insurance provider has determined that your vehicle is a total loss, you still may be able to bring your car home before it hits the salvage yard. The big question to ask yourself, however, is whether you really want to keep it.

Recommended Reading: What’s The Safest Car To Drive

What Happens When You Total A Financed Car Without Insurance

Most states require drivers and car owners to have some form of liability insurance or proof of financial responsibility to driver or register a car. Liability coverage pays for other people’s injuries and property damage when you are legally responsible for an accident.

Collision coverage is optional coverage that pays for damage to your carâminus your deductibleâno matter who is at fault for the accident. If you total your car in an accident that you caused without collision coverage, you have to pay out of pocket to replace your totaled car.

Even if you are not at fault for the accident, your compensation might be limited if you don’t have insurance. Several states have “No Pay, No Play” laws. In these states, if you don’t have car insurance at the time of an accident, your ability to recover damages is restricted or barred entirely.

Learn more about what happens when you’re in a car accident and uninsured.

The Bottom Line On Who Pays

The bottom line is that the other driver’s or car owner’s insurer will pay for your totaled car if the other driver was at fault for the accident . But your compensation might be limited if you don’t have valid insurance in place at the time of the accident, even if you aren’t at fault for the accident.

If the at-fault driver is underinsured or uninsured, you’ll have to turn to your collision or UIM coverage.

If you caused the accident, your liability coverage will pay other people for their injuries and damage to their property, but you’ll have to rely on your collision coverage to pay for your totaled car.

If you total a car without collision insurance, then your insurer will not reimburse you for the ACV of your car. Learn more about what happens when you’re in a car accident and uninsured.

Don’t Miss: How To Install Graco Car Seat

Can A Totaled Car Affect My Credit Score

A totaled car does not directly affect your credit score.

However, there could be some indirect effects either positive or negative, of paying off your car. For example, if your car loan is your oldest credit account and you pay it off, you will sometimes see a decrease in your credit score. On the other hand, if your car loan is contributing to a high debt-to-income ratio and you pay it off, it may increase your credit score.

What Is A Total Loss Car Or Vehicle

A “total loss” car is a car that an insurance company decides is not worth the cost to fix. Most states have formulas for determining when a car is totaled. State law might say, for example, that an insurer has to total a car when the cost to repair it is more than 80% of the car’s value.

So, let’s say you wreck your car. Your insurer decides your car’s actual cash value on the day of the accident was $10,000. Applying the “80% Rule,” the insurance adjuster will see if the cost to repair your car will be more or less than $8,000 .

If the repairs cost less than $8,000, the insurer will pay for your repairs. But if repairs cost more than $8,000, your car is a total loss and the insurer won’t pay to repair it. Instead, the insurer will essentially buy your totaled car from you. You will provide the insurer with the title of your car in exchange for your car’s ACV . If your car is financed, the insurance settlement check will go to your lender first to pay off the balance of your car loan and you will receive whatever money is left over, if any.

Also Check: How Much Is My Car Worth Carmax

When Does An Insurance Company Consider A Car Totaled

An insurance company will total a car when the cost to repair it is more than what the car was worth immediately before the damage occurred. An insurer might also declare a car to be a total loss if it cannot be repaired safely or repaired at all.

Sometimes, state law dictates the amount of damage necessary to total a car, and this threshold can be as low as 50% of its value.

Learn more about when an insurance company totals a car.

My Car’s Airbags Deployed Is It A Total Loss

If your vehicle’s airbags deploy in a car accident, that doesnt necessarily mean your car is a total loss. Your insurers will assess the situation and determine if the cost of replacing the airbags and repairing your vehicle would exceed its actual cash value. If the cost of repairs is less than the value of your car, your vehicle will likely not be declared a total loss.

Also Check: How To Add Heated Seats To Your Car

How Much Is A Totaled Car Insurance Payout

An insurance company will pay the actual cash value of a totaled car. The ACV is how much a car was worth immediately prior to being damaged, taking into consideration factors such as age, make, model, and condition.

Once you and the insurer agree on a value, you will be paid that amount minus any deductible. In some states, the payout will also include the taxes and fees associated with purchasing a replacement car.

Learn more about how much a totaled car payout is.

Tow The Vehicle To An Approved Body Shop

Youre not required take your car to a specific body shop, but using a mechanic that has already been approved by your insurer is the most efficient way to go. The body shop will give the insurance adjustor a full assessment of the cars condition and the cost of repairs. Based on that information, the adjustor will decide whether to declare the car a total loss.

Don’t Miss: How To Hotwire A Car With A Screwdriver

Can An Insurance Company Force You To Total Your Car

If you disagree with your insurance after a total loss is declared, you can often dispute it. However, if the cost of repairs still ends up being over Oklahomas total-loss threshold of 60% of ACV, the vehicle is a total loss.

You still have options, though. You can keep your car if its totaled and change its title to a salvage title. The insurance company may then subtract the cars salvage value from the ACV and pay you the difference. Salvaged vehicles still need to be repaired, though, before plates can be issued. And you may have trouble getting it insured again.

What Should You Do After A Total

After a car accident, its common to be in literal shock. These events are traumatic, and it can be difficult to gather your thoughts and pull it together enough to deal with insurance companies. But since youll have to anyway, one way to make it just a little easier is to have an idea of what happens when your car is totaled and the order of what to do next. Your next steps include the following:

Also Check: Where Can I Buy Fuses For My Car

Do I Still Have To Pay A Loan On A Totaled Car

If your vehicle is financed or leased, youre still responsible for paying off the loan, says U.S. News. A claim payout will likely have to go toward covering the costs.

You may still owe your lender more for the car than the insurance payment you receive. In that case, youre responsible for paying the remaining balance on the car lease or loan.

For instance, suppose you owe $15,000 on your car loan, but your vehicle’s value has depreciated to $13,000 when it’s totaled. If you have collision coverage, your insurer may reimburse you for the actual cash value of your car in this case, $13,000. You would have to pay your lender that amount, plus the remaining $2,000 out of your own pocket.

Adding loan or lease gap coverage to your car insurance policy is one way to help protect against paying a lender out of pocket for a totaled vehicle. In fact, most lenders require it. This covers the difference between what you owe on your vehicle and its ACV at the time of the accident.

Totaled Car Meaning: When Is A Car Considered Totaled

Insurers consider a vehicle a “total loss” when the cost to repair it is greater than its “actual cash value” .

A vehicle’s ACV is its market value at the time of the accidentnot what you paid for it. Many people are surprised at how much a vehicle’s ACV goes down . A brand new car famously loses value the second a buyer drives it off the lot.

You can figure out your vehicle’s actual cash value by looking at the going rate for similar cars in your area using tools like Kelley Blue Book.

Most states have a “total loss formula” for when insurers must total a car. For example, state law might require an insurer to total a car when the cost to repair it is more than 75% of the car’s ACV. Other states might set the threshold lower or higher. States without a TLC typically weigh the cost to repair and salvage a car against the car’s ACV. An insurer might also total your car if it can’t be repaired safely.

For example, let’s say you live in a state where lawmakers set the total loss threshold at 60%. You crash your Honda Civic valued at $4,800. If your mechanic says repairs will cost $2,880 or more, the insurer will likely total your car. If your mechanic can fix it for less than that, the insurer will likely authorize repairs.

If the insurer declares your car a total loss, it will typically pay you the fair market value and take possession of the car.

You May Like: Are Duracell Car Batteries Good