Paying Off A Finance Charge

Making your minimum credit card payment is usually enough to cover your finance charge plus a small percentage of the balance. However, if you’re only paying the minimum payment, your balance won’t decrease by that muchit takes the bulk of a monthly payment just to cover interest charges. Since your balance isn’t decreasing significantly, you’ll face another interest charge during the next billing cycle. You’ll need to increase your minimum payment if you want to pay off your balance and avoid finance charges.

For those with substantial debt, the minimum payment may not cover the month’s finance charge. In this case, paying the minimum will result in a bigger balance. Reducing debt will require payments beyond the minimum.

After You Get The Car

If you financed the car, understand

- The creditor has a lien on the cars title until youve paid the contract in full.

- Late or missed payments can have serious consequences. Late fees, repossession, and negative entries on your credit report can make it harder to get credit in the future. Some dealers may put tracking devices on a car, which helps them find the car if they have to repossess it. Ask the dealer if it plans to put a device on your car as part of the sale, what the device will be used for, and what to do if the device sets off an alarm.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: How To Make Freshies For Car

What Finance Charge Means In Most Personal Finance

When it comes to personal finance matters, such as for a payday loan or buying a used car on credit, the finance charge refers to a set amount of money that you are charged for being given the loan. Some lenders will charge you this amount regardless of whether or not you pay off the loan early. By contrast, when you are charged an interest rate you will pay less to borrow the money if you pay it off quickly.

It can be debatable which is more, a straight finance charge or an interest rate, or the combination of interest and fees. We offer reasonable interest rates and minimal fees at our used dealership in Tampa, making your experience affordable even if you have bad credit.

If you are looking for a used car for bad credit, contact us today to schedule an appointment with us.

Calculating The Monthly Finance Charges For A New Car Loan

Materials Needed

- Pencil and paper

- Scientific calculator

In addition to knowing what you owe on a new car loan overall, having an idea how much you can expect to spend on a monthly basis is helpful as well. Knowing what you owe on a monthly basis allows you to better prepare a monthly budget.

Step 1: Calculate your monthly payment. Determine your monthly payment by using the following formula:

To figure out the “principal times the interest rate due per payment” part of the equation, you can start by converting the APR to a decimal by dividing it by 100. Then you should take that number and divide it by 12 to convert the monthly percentage rate into a decimal. Then, it is just a matter of multiplying the principal by the monthly percentage rate.

Calculate the other half of the equation by adding 1 to the the interest rate due per payment. Next, hit the x^y button on the scientific calculator and enter the number of payments. Then, subtract the figure obtained from the number 1.

Divide the first figure obtained by the second figure to get your total monthly payment, including finance charges.

Next, figure out how much principal you have to pay monthly. This is as simple as dividing the total amount of the loan by the number of payments.

Step 2: Figure out the monthly principle. Next, you need to figure out how much principal paid each month. To get the principal paid each month, divide the principal amount by the expected payments in months.

Read Also: How To Connect A Car Amp To A Wall Plug

Cost Basis Of Business Asset

Publication 551 of the Internal Revenue Service rules state that the cost basis of purchased property, such as a company-owned vehicle, includes the price, sales tax, freight charges and even installation charges if you add some equipment. The cost basis will be the total amount paid for the vehicle, not including registration fees if the dealer collects those in your state.

What Is Finance Charge

In finance theory, while it represents a fee charged for the use of credit card balance or for the extension of existing loan, debt of credit it can have the form of a flat fee or the form of a borrowing percentage. The second option is most often used within US. Usually people treat it as an aggregated or assimilated cost of the financial product they use as it proves to be treated as the other ones such as transaction fees, account maintenance costs or any other charges the client has to pay to the lender.

Finance charges were introduced with the aim to permit lenders register some profits from allowing their customers use the money they borrowed. Its value may vary on the debt type as well as on the risk profile from lenders perspective. Regarding the regulations across the countries it should be mentioned that there are different levels on the maximum level allowed, however extreme practices from lenders side occur as the limit of the finance charge can go up to 25% per year or even higher in some cases.

You May Like: Cancelling Geico Policy

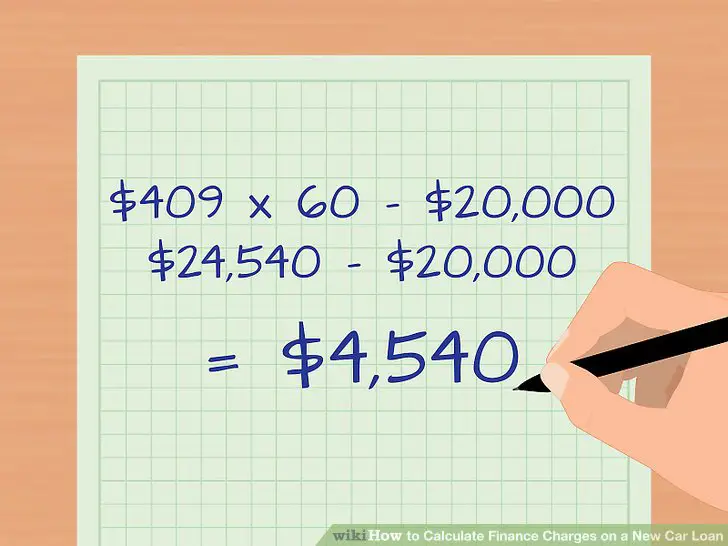

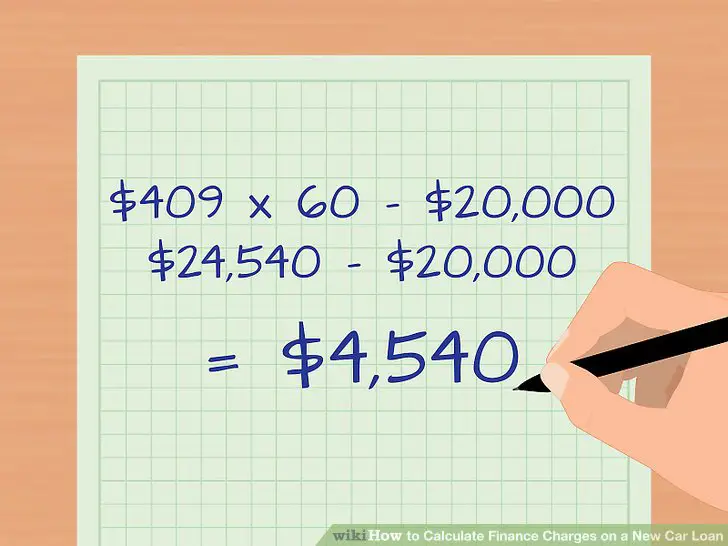

The Finance Charge Formula

There is one easy way to calculate the finance charge:

- Take your required monthly payment and multiply it by the number of months of your loan. This is the total cost of your loan. Lets say its $23,000

- Then take the amount you borrowed initially. Lets say it is $20,000.

- The finance charge is equal to the total cost of your loan minus the amount you initially borrowed. In this example: $23,000-$20,000=$3,000.

There are other ways as well but it requires spreadsheets and/or finance calculators. Those ways are more for those in finance classes than for us in this article.

One important item to note, the finance charge formula above is for a fixed rate loan. The finance charge on a variable rate loan cant be calculated with 100% certainty because the interest rate changes. Therefore, in your disclosure it will have a finance charge that assumes the same interest rate throughout the loan. For more on fixed vs variable rate loans, check out our guide.

What Does The Finance Charge Is Non

This confuses a lot of people when they read it on their loan documents. What it simply means is that once you make a payment you cant get a refund of that money.

What it does NOT mean is you absolutely have to pay the full finance charge. Again, if you make prepayments or refinance the loan, you wont pay the full amount of the original finance charge and this is perfectly fine, regardless of what the initial lender would like you to believe.

If youd like to read more about money, be sure to check out FitBUXs main blog page.

More Financial Resources For You

You May Like: How Much Does A Car Salesman Make Per Car

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and reviewed by subject matter experts, who ensure everything we publish is objective, accurate and worthy of your trust.

It’s why over 100 million people not to mention top publications such as The New York Times, Wall Street Journal and CNBC depend on Bankrate as a trusted source of financial information every year.

See The Terms Of The Bbva Loan Calculator

At BBVA, we can offer you the finance you need. With our loan calculator, you can choose the amount and repayment period, calculate your monthly payment and determine the interest.

You can also calculate the monthly payment and the interest on the loan, as well as get information on the NIR and interest rates and the fees in order to find out the total amount to be repaid.

Remember that the information provided by the simulation does not constitute an offer. It only provides information for that specific example.

Terms and Conditions of Personal Online Loan for Customers

- With your paycheck or pension directly deposited into BBVA, the cost will be: Fixed 7.20% NIR

- Without a paycheck or pension direct deposited into BBVA: Fixed 8.20% NIR .

- Amount: from 3,000 to 75,000. Term: from 2 years up to 8 years. Payment of the monthly installment: the last day of each month.

- Total or partial early repayment fee of 0.50% of the repaid amount if the outstanding term does not exceed 12 months and 1% if it does.

Example with paycheck or pension direct deposited at BBVA for a loan of 10,000 over 96 months . 7.20% NIR, 8.28% APR. Constant monthly payment: 137.33. Commitment fee on the borrowed amount : 230. Mail expenses: 0.70 monthly. Total debited amount: 13,476.67.

Oferta válida hasta el 30 de noviembre de 2021. Financing subject to approval from Banco Bilbao Vizcaya Argentaria, S.A.

Terms and Conditions of Fast Loan for New Customers

Don’t Miss: How Much Mileage Is Too Much For A Used Car

Finance Charges And Regulation

Finance charges are subject to government regulation. The federal Truth in Lending Act requires that all interest rates, standard fees, and penalty fees must be disclosed to the consumer. Additionally, the required a minimum 21-day grace period before interest charges can be assessed on new purchases.

How To Avoid Finance Charges

The best way to avoid finance charges is by paying your balances in full and on time each month.

As long as you pay your full balance within the grace period each month , no interest will accrue on your balance. If, instead, you pay just the minimum amount due, youll find finance charges calculated into your next statement based on whichever method your issuer uses.

Other types of finance charges, like balance transfer fees, late fees and cash advance fees are difficult to avoid if you incur them, and they dont have the same grace periods as interest charges. Consider whether taking on these charges is worth the benefits youll receive.

Similarly, if your card has a zero percent introductory APR promotional offer, make sure you read your terms to understand the finance charges youll take on if you havent paid your balance in full by the end of the introductory period, so you can avoid them when the time comes.

Don’t Miss: How To Add Bluetooth To Car

What Does Apr Mean For A Car Loan

When it comes time to finance a new or pre-owned car, several terms are important to understand. One such concept is the annual percentage rate, or APR. The APR expresses the total cost of borrowing and may differ among lenders based on how they set their rates, and the fees they charge. Your credit score and the amount you borrow will also affect the APR on your loan. Learn the APR meaning for car loans and how to use this information when purchasing your next auto.

How A Lower Monthly Payment Can Cost You More

One of the most important things to understand about how auto loans work is the relationship between the loan term and the interest you pay. A longer loan term can dramatically lower your monthly payment, but it also means you pay more in interest.

Consider a $25,000 car loan at a 3.00% APR and a 48-month term. Over 4 years of payments, youll pay $1,561 in total interest on the loan. If you extend that same loan to a 60-month term , youll lower your monthly payment by $104but youll increase the total interest you’ll pay from $1,561 to $1,953.

Read Also: How To Buff Out Scratches On Your Car

What Is Apr On A Car Loan

Unless youre paying cash for your new automobile, a car loan will likely be necessary. But a loan comes with a cost, as lenders charge interest on money borrowed. A loans APR reflects the interest charged by a lender, but it also takes into account certain fees associated with the loan. These fees are called prepaid finance charges and may vary widely between lenders, so watch for them.

One good example of a prepaid finance charge is an origination fee which some lenders may charge to cover costs associated with underwriting their loans, and/or to simply increase their fee income. This fee could be a lot or a little or may not be charged at all. Such fees are factored into the APR so you can compare the true, total cost of borrowing between different lenders.

Tips To Reduce Finance Charges

Most of your car loans finance charges are usually dependent on your loan amount interest rate, and loan term. You can modify these variables to get the best deal, save money and pay off your car loan early or within its scheduled term.

1. Get a Good Credit Score

A good credit score not only helps you get approved for financing faster but also helps you negotiate for better loan terms, especially the interest rate. The lower your loan interest, the more money you can save.

2. Offer a Big Down Payment.

If you can provide a substantial down payment for your car loan, your monthly payment amount lessens.

3. Choose the Best Term for Your Financial Circumstance

A short-term car loan of 1 to 3 years will require a bigger monthly repayment amount but will help you save money on interest in the long run. A long-term car loan that can take up to 10 years or more will help you afford a small monthly repayment amount but will cause you to pay too much money on interest and any maintenance fee. It also puts you at greater risk of getting upside down on your car loan since the value of a car depreciates fast

Positive Lending Solutions works with hundreds of banks and lending companies to find the best car loan deal for you. Our dedicated, locally-based consultants will ensure your satisfaction every step of the application process.

Call us on or request a Car Loan Pre-Approval now!

See also:

Don’t Miss: How To Make Car Freshies

What Are Dealer Fees On Used Cars

For all cars, dealers charge document and TT& L fees, as allowed or as required by the state. You face the same type of car-buying fees whether you buy a new or used car. The exception is that used cars do not have destination fees. And the good news is that the total used car fees often add up to a lower amount than new car fees because used cars are less expensive.

Other Factors Affect Your Finance Charges

Despite the usefulness of online loan calculators or manual car loan formulas in determining the total cost of your loan, there remain several factors that are not included in the calculation. These include your credit score and the other fees that differ from one lender to another.

Your credit rating affects the interest rate of your loan. The average interest rates associated with credit scores are usually the following:

- 740-850: Excellent – 0 to 3.2% interest rate

- 680-739: Average – 4.5% interest rate

- 680 and below: Subprime – 6.5 – 12.9% interest rate

Hidden Fees

There are several fees that are not usually factored in when calculating car financing but affect the total cost of your loan. These include:

- One-time application fee

- Early Repayment Penalty

- Missed or Late Payment Fee

Most of these fees are not mentioned while youre still inquiring for a car loan or asking for a pre-approval, but they can have a significant effect on the total cost of your loan. Hence, they are sometimes called hidden fees.

Not all lenders charge hidden fees. If they do, the amount varies from one lender to another. It is important to shop for car loans and know all the charges involved before taking out one.

You May Like: How To Connect A Car Amp To A Wall Plug