Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Is The Time Right To Refinance Your Car Loan

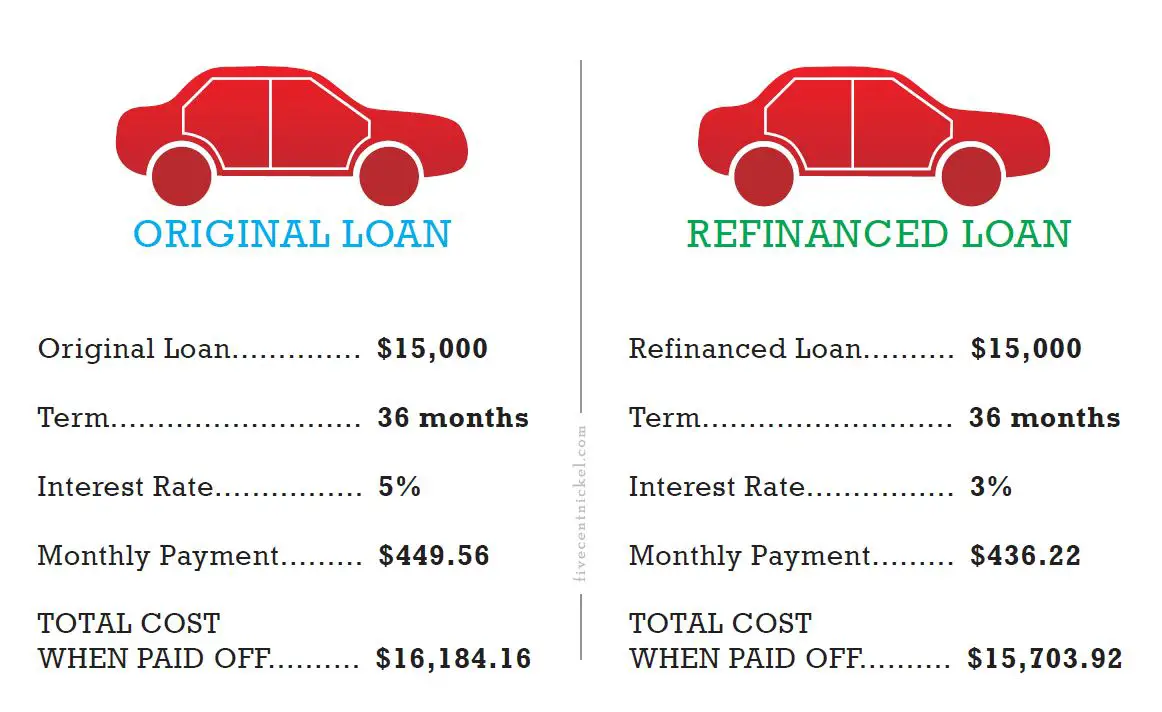

Interest rates are still hovering near historic lows for mortgages, but did you know that those same super low rates also may make it wise to refinance your car loan?

You may have heard of refinancing a mortgage but did you know you can also refinance a car loan? If you decide to refinance, you may save money in a number of ways.

- Your current interest rate is high. When you first bought your car, you may not have qualified for the best rate. Or, since you originally took the loan, your credit score may have improved, entitling you to a better, lower rate. In some cases, rates in general may be lower and can be applied to your balance.

- You want to lower your monthly payments. A lower interest rate can reduce your monthly payments without increasing the term of the loan.

- You want to pay your loan off sooner. If you qualify for a lower interest rate, you can continue to make the same monthly payments and pay off the loan faster than you originally planned because more of the monthly payment will be applied to principal.

Sounds great, right? For some people, it’s a beneficial financial choice. One way to decide is to use a calculator tool to estimate your potential savings.

Can You Refinance A Car With The Same Lender

If youre considering refinancing, you may think that you have to start from scratchsearching for lenders, getting prequalified, submitting an application, and so on. But you dont always have to refinance a car loan with a different bank. In fact, you may be able to speed up the process by refinancing your loan with your current lender.

Some banks and lending companies even offer special refinancing rates for established borrowers. That means you could leverage your relationship to snag a more affordable loan with better terms. You may have to provide updated personal and financial information, but the process is often faster and less complicated.

With that said, refinancing with the same lender may not be the best option for you financially. To make sure youre getting the best deal, take some time to shop around and compare rates from other lenders first.

You May Like: How To Change The Interior Color Of Your Car

When Should I Refinance My Car Loan

The best time to refinance your car loan is when it can save you money in the long term, but it may also help if youre hoping to catch a break on your monthly payments. Here are a few situations where it may make sense to refinance:

- Refinance car loan rates have gone down: Most car loan interest rates fluctuate based on the prime rate and other considerations. If you purchased your car a while ago, its possible that car loan rates have decreased since then.

- Youve improved your credit score: Even if market rates havent changed, improving your credit score may be enough to get a lower rate. The better your credit, the more favorable loan terms youll receive. If youve improved your credit score since signing for your initial loan, you may qualify for better loan terms.

- You got your initial loan from the dealer: Dealers tend to charge higher rates than banks and credit unions. If you took out your initial loan through dealer-arranged financing, refinancing directly with a lender could get you a lower rate.

- You need lower monthly payments: In some cases, refinancing a car loan may be your ticket to a more affordable payment, with or without a lower interest rate. If your budget is tight and you need to reduce your car payment, you could refinance your loan to a longer term . Keep in mind, though, that while you will pay less per month with this strategy, you can expect to pay more over the life of the longer loan.

Myautoloan: Most Popular Marketplace

Starting APR:1.89%Loan terms: 24 to 84 monthsAvailability: 48 states Minimum credit score:575

Rather than a direct provider of auto loans, myAutoloan is an online marketplace where you can compare offers from a number of lenders in one place. After you enter your personal information, lenders will provide loan offers for you to choose from.

The myAutoloan marketplace can help borrowers looking to refinance their auto loans find rates as low as 1.89%. Those with less-than-ideal credit history can refinance their vehicle loans through the site, which can find loans for people with credit scores of 575 and above. However, the lowest rates are reserved for people with the highest credit scores.

Also Check: How To Fix Cigarette Burns In Car Seats

Who Shouldnt Refinance A Car

So far, weve talked a lot about who should refinance their cars. As a general rule of thumb, if youve owned your car for at least six months, made regular payments, and think you could get a better deal, refinancing could work for you.

There is a flip side, though. We mentioned that refinancing isnt for everybody, and thats especially true if youve already repaid most of your loan. If youre down to your final payments, its probably best to stick with your existing loan.

In another scenario, if your car is older or has a lot of miles on it, youre less likely to get approved for a refinancing loan. Some lenders wont consider refinancing a car loan if the vehicle is over 10 years old. Others have a mileage cap, which means the lender wont approve your loan if youve put more than 100,000 miles on your car. Upstart, however, offers refinancing on cars with up to 140,000 miles.

Its always a good idea to consider the potential fees youd face if you refinance your car, too. Some loans come with prepayment penalties, or charges for repaying a loan early, that could counteract any potential savings. The same goes for loans with precomputed interest, or interest thats calculated when you take out your loan instead of as you make payments.

Refinancing Your Car Loan: What To Watch Our For

While any of the reasons above could make refinancing your car loan a good deal, there are some serious pitfalls to watch out for. For example, you have to watch out for fees involved in refinancing, including prepayment penalties on your existing car loan and fees related to the new auto loan you’re considering.

While most car loans don’t have any prepayment fees, you’ll still want to read over your loan contract to check. In the meantime, you’ll also want to compare new auto loans to look for options that don’t charge origination fees or application fees.

Also remember that refinancing your car loan to extend the term can come with its share of pros and cons. You may be able to secure a lower monthly payment, for example, but you can wind up paying off your car loan a lot longer than you wanted.

You should also consider whether refinancing your car loan is worth the time and effort. If you don’t owe a lot and you can afford to pay more than the minimum, you can ditch your car loan faster by making larger monthly payments instead.

Also Check: Knocking Noise From Rear Of Car When Accelerating

Speak To A Credit Counselor

If youre not sure refinancing your auto loan is the right move, you may want to seek professional help, like talking to a certified counselor with the National Foundation for Credit Counseling . The NFCC is the largest nonprofit financial counseling service in the U.S. and helps people get financial control over their lives. It offers debt and credit counseling for free or at a minimal charge, and can help you figure out if refinancing is right for you.

Even though an auto loan cant be included in a debt settlement plan, theres still a benefit to talking with a credit counselor if youre having trouble making payments. A nonprofit credit counselor could provide solutions that you may not be able to find on your own. You can use the NFCC locator to find a credit counselor in your area.

You Have Better Options With A New Lender

Does the lender youre with offer conveniences that Rivermark doesnt? Services such as Skip a Payment, easy online payments and no payments for the first 60-days are values that not all lenders will offer.

If you are looking to pay off your car faster, be sure to choose a lender with no prepayment penalties, like Rivermark.

Think youre ready to refinance? Fill out an application online, or within Online Banking for faster approval.

Read Also: Carcareone Gas Stations

Understanding Refinancing Your Car

Refinancing a new car means that you take out a new loan to pay off the old one. The new loan can be for the remaining duration of the old one or even shorter, though in most cases, the more popular choice is to extend the length of time youll need to pay off the loan. If you do choose this, know that taking on a longer loan term could reduce or even eliminate any savings you might get from refinancing. Depending on your choices, refinancing can save you a lot of money.

Refinancing a car loan is easier and faster than refinancing a mortgage, and none of the lenders we checked charge fees you may still need to pay a small title transfer fee imposed by your states Department of Motor Vehicles.

One thing to keep in mind is the earlier you refinance, the more you can save. For example, using the LendingTree auto loan refinance calculator, suppose you were a year into a 72-month, $30,000 new car loan at 7.00% APR with a payment of $511. If you refinanced at 3.00% APR for the remaining 60 months of the original loan, youd save about $4,450.

When To Refinance Your Car: A Decision

5-minute readMarch 23, 2022

If youre in the process of paying off the auto loan you took out to purchase your car, you might be wondering if its possible for you to refinance that loan. More importantly, you may find yourself asking, Should I refinance my car?

The great allures of an auto refinance include more manageable monthly payments, lower overall interest costs and even changing your loan term. That said, the cost of the new loan may be more money than its worth.

We broke down a complicated financial decision into a simple screening process for yourself.

Read Also: Cost To Get A Car Painted

Can You Refinance With The Same Lender

- If you have made your payments on time and your credit is in good standing, it may be possible to refinance with your current lender. To see if you qualify contact your lender.

- Consider your options. If you are unable to refinance with your current lender, shop around and compare quotes to make sure they line up with why you want to refinance.

What Factors Affect Your Refinance Interest Rate

A number of factors go into calculating your interest rate when you refinance your auto loan. Lenders use the following to determine the interest rate and repayment terms they offer you:

- : A higher credit score will result in lower interest rates. Borrowers with poor credit will receive much higher rates and may have trouble securing loans.

- Loan term: In most cases, the longer the loan term is, the higher your interest rate will be.

- Vehicle age: Some banks dont offer loans for older cars. For those that do, borrowing money for a vehicle of an older model year will often come with a higher interest rate.

- Loan-to-value ratio: Your lender may adjust its rate based on how much you still owe on the car compared to how much it is worth. This is known as LTV.

No matter what rates you see advertised, your rates will likely vary. Only borrowers with the best credit can qualify for a lenders starting APR or a rate near it. Most lenders offer free quotes online or over the phone. We recommend getting personalized quotes from several lenders and comparing them before making a decision.

An auto loan calculator or other similar tool can help you see the full cost of your loan.

Recommended Reading: Fix A Burn Hole In Car Seat

Does Applying For An Auto Loan Affect My Credit Scores

If the lender pulls your credit, your loan application will show up on your credit reports as a hard inquiry. While hard inquiries can affect your credit, each one may only knock a few points off your scores. And shopping around may not hurt depending on the credit-scoring model, any auto loan inquiries that take place within a given time span ranging from 14 to 45 days will count as a single inquiry.

Mistakes To Avoid When Refinancing Your Auto Loan

Refinancing your car loan doesnt always make financial sense. The main mistake you can make when it comes to refinancing is timing. If any of the following scenarios apply to you, it may be worth it to stick with your current loan.

- Youre far along in your original loans repayment: Through the amortization process, your interest charges gradually decrease over the life of the loan. As a result, a refinance has more potential to save money when youre in the earlier stages of repaying the original loan.

- Your odometer is hitting big numbers: If youre driving an older car with high mileage, you may be out of luck. Most auto lenders have minimum loan amounts and wont find it worthwhile to issue a loan on a car that has significantly depreciated in value.

- Youre upside-down on the original loan: Lenders typically avoid refinancing if the borrower owes more than the cars value .

- Your current loan has a prepayment penalty: Some lenders charge a penalty for paying off your car loan early. Before you refinance your loan, investigate the terms of your existing loan to make sure that there are no prepayment penalties.

Recommended Reading: Remove Scuff Marks From Car Interior

Waiting Too Long To Refinance

If you run the numbers and you determine that it makes sense to refinance, waiting can cost you. Rates are typically lowest on new vehicles, and some lenders wont refinance loans for cars over a certain age . You might even get a new car rate if you refinance immediately after purchasing from a dealer and taking advantage of dealer incentives. Used car loan rates are typically higher than new car rates.

Pros And Cons Of Refinancing A Car Loan

Now that you know the potential savings, let’s hit the brakes and look at the advantages and disadvantages of refinancing your car loan.

| Pros of Refinancing | |

|---|---|

| You have the opportunity to lower your interest rate and monthly payment | Your refinanced loan could have a higher interest rate than your original loan |

| Lowering your monthly payments could increase your cash flow | Some lenders may issue a prepayment penalty for paying off your original loan early |

| You could save money on interest if you shorten your loan term | You could pay more over time if you extend your loan term |

Those are some of the basic pros and cons of refinancing a car loan. But one area that could be a pro or a con is your credit score.

Also Check: How Do Car Salesmen Make Money

You Got A Bad Deal On Your Current Loan

This can happen if you financed through a dealership without doing your due diligence. Dealership financing typically comes from banks, independent lenders and captive financial arms owned by the car manufacturer. But sometimes dealers dont quote those lenders best rates and instead quietly mark them up to pad their profits. The best course to avoid this is to get a preapproved car loan before going to the dealership.

The 4 Best Companies To Refinance Your Auto Loan

If youre stuck with a bad rate on your current auto loan, you could be paying significantly more than you need to. Refinancing your auto loan can help you get a better rate and pay less for your car over time if your car is worth more than you owe or your credit score has improved or interest rates have dropped since you got your loan. Auto refinancing may not be the right option if your loan has prepayment penalties or you owe more than your car is worth.

In this review, we at the Home Media reviews team will take a close look at which lenders offer the best auto loan rates for refinancing. Our experts have researched the top lenders in the industry based on their rates, reputations, availability and customer experience to help you get started.

Recommended Reading: Fastest Production Car In The World 2021

Understand The Costs Of Refinancing

Sometimes you can refinance with a lower interest rate, but because the loan is extended, you will actually pay more over the length of the loan. Use a loan calculator to make sure you are saving money overall. Getting the lower monthly rate might be what you are looking for, but if you really want to pay less overall, it is important to do the math.

For example, if you have a $5,000 loan with a 10% interest rate paid throughout two years, you will pay $5,537 in total. However, that same loan extended throughout five years will end up costing you $6,374. Thats $837 that could have been spent on something else. So make sure you extend your loan only if you need to do so.

Freeing up cash quickly is sometimes the only reason for refinancing a car loan. Beware of higher interest rates, though, because most lenders charge higher rates on older vehicles. When you’re looking to refinance your aging car, you might be surprised at the interest rate available to you compared to what you received when the car was new or almost new.

Many banks, including USAA Bank and Bank of America, do not charge an application fee for an auto loan refinancing.