Lakh Unregistered Bsiv Vehicles Will Trash

But its not all that common. Buy insurance for an unregistered motorcycle by contacting our customer service.

Finding an affordable insurance quote as a young driver is. Any construction and use offences all in the main carry points, fines and potential disqualification.

Free scrap car collection auckland get up to 12000. Australia post car insurance offers comprehensive cover for things like theft, fire, new for old replacement and.

Incredible photo flooddamage. Auto insurance companies dont enforce registration laws, but driving unregistered affects your driving record, which will.

Its just a fact of car ownership 5 most common car. Average rates can be around $79.58/mo but compare auto insurance quotes online to save.

Pin by auctionexport on auctionexport promotions best. But its not all that common.

Pin by car finance blog on gravatar car buying go car car. Buy insurance for an unregistered motorcycle by contacting our customer service.

Pin by john rahimi on cash for cars sell car scrap car. Excessive claims and accidents are two other reasons why car insurance wont cover an accident.

Pin by olivia hayden on auto removals brisbane how to. Here at aj insurance, we can offer an annual policy from which a cover note can be issued on the basis of the chassis number.

Pin on uk classic bike. However, in many cases, your homeowners insurance will not cover the damage.

Pin on dvla driving license. However, there are some exceptions.

Free Car Insurance Comparison

Secured with SHA-256 Encryption

|

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states.After several years she expanded her insurance expertise, earning her license in Health and AD& D insurance as well. She has worked for small health in… |

Written byRachael Brennan Licensed Insurance Agent |

|

Jeffrey Johnson is a legal writer with a focus on personal injury. He has worked on personal injury and sovereign immunity litigation in addition to experience in family, estate, and criminal law. He earned a J.D. from the University of Baltimore and has worked in legal offices and non-profits in Maryland, Texas, and North Carolina.He has also earned an MFA in screenwriting from Chapman Univer… |

Driving With Expired Registration

While expired registration may not have an impact on your car insurance, it may be the cause of a driving ticket. Getting caught driving a car that has expired registration may cause you to have to pay a small fine. Keep in mind that driving with expired insurance is a lot more serious than driving with expired registration, but it is important to be prepared nonetheless.

Read Also: Does Form Reg 227 Need To Be Notarized

Penalties For Driving Without Auto Insurance

Once you have a New York auto insurance policy, your insurer electronically files the information with the New York Department of Motor Vehicles and sends you an insurance identification card to carry while driving.

As long as your car is registered in New York state, you must have liability coverage along with an insurance card, a driver’s license and a vehicle registration. If you fail to provide these documents during a traffic stop, the officer will assume you don’t have coverage even if you have a policy and simply forgot to bring your ID card. That’s why it’s so important to carry your information.

You could face a penalty of $150$1,500 each time you’re found driving without insurance or if you let someone else drive your uninsured vehicle. A New York court may also impound your car, imprison you for up to 15 days, or revoke your driver’s license and registration. If the department of motor vehicles has suspended your driving privileges, you may receive a notice in the mail resembling this form. To reinstate your license, you may also have to pay the DMV a $750 fee.

You have fewer options if your insurance has lapsed for more than 91 days or if you have already paid a civil penalty within the last three years. Instead of paying the $750 fee, you’ll need to serve the suspension period before reinstating your New York license.

Progressive: Best For High

We also give Progressive 4.5 out of 5.0 stars. Progressive has a wide range of policy options that you can easily fit your budget with the convenient Name Your Price® tool. Progressive comes highly rated by industry professionals and has choices like roadside assistance, rental car reimbursement, and custom parts and equipment value coverage. For more information, read our Progressive insurance review.

To collect and compare quotes from providers available in your state, use the tool below or call :

Read Also: Sap Off A Car

Do You Have To Show Proof Of Insurance To Register A Vehicle

Can you drive a car with insurance but no registration? No, this is also against the law. Also, you cant get your car registered without insurance, but you can get insurance on a car without registration. Its not a two-way street.

Ideally, you should be prepared to show proof of insurance when you go to register your car at the DMV. Bring your ID and insurance card. You can easily get new car insurance without a registration number online or over the phone if you dont have it already.

Can I register a car without an insurance card? If youve just recently gotten insurance and dont yet have a card, you can call your insurer and have them fax your papers right over to the DMV as proof.

Once they obtain your insurance card or fax printout, DMV personnel check for specific criteria. They want to see the following:

- Your insurance is valid

- Your insurance is current

- There is an adequate amount of coverage

If your DMV uses an electronic database, you dont need to bring or fax anything. All you have to do is tell them your insurers name. When it comes time for renewal, electronic databases have the added convenience of enabling you to renew your registration online.

This option can be helpful provided your insurer submits information via the states insurance database. If you do belong to such an insurance company, be advised that they use this same system if your insurance ever lapses or is canceled.

Can You Get Car Insurance If You Are Not The Registered Owner

Typically, you buy insurance on a car that has a title in your name or is registered to you. However, you can insure a car thats not registered in your name if you meet a few key requirements.

If youre ever stopped by a police officer for running a red light, the first thing youll be asked to show is your license, registration, and proof of insurance. But what if the car isn’t registered to you so you cant show proof of insurance?

If you’re a driver, we don’t have to tell you how important it is to get comprehensive car insurance. If you have any concerns about insurance coverage and you frequently hit the road, make sure you visit the multi-lender site Credible to view all of your auto insurance options whether you’re the registered owner or not.

You can get insurance coverage on a car that’s not registered to you. But its not all that common. The car must be registered in the owners name or the person who holds the title, and the owner’s name must also be included on the car insurance policy. Or, you can get non-owners insurance.

Don’t Miss: How To Transfer Car Title In Az

Can You Insure A Car Thats Registered To Someone Else

Its a common practice to get someone elses car added to your own policy. People typically do this for their children, spouses, or significant others. If you want to be able to drive someone elses car, it can be as simple as having a conversation with your insurance agent.

If your agent agrees, then they will require proof that you have access to the vehicle or know the person who owns it. A VIN typically satisfies this requirement.

When you add someone elses car to your insurance policy, you are only insuring yourself. The car add-on does not cover the other person when they drive the car, only you when you drive it.

You can, however, opt to add another person to the policy and not just their car. This addition can affect your rates depending on the other persons age, experience, and driving record.

Can you get insurance without a car? Can you get insurance without registration in your name?

If you want to occasionally drive another persons car but are not on their policy, a non-owners auto insurance policy can help. This specialized policy protects you from accident liability when you occasionally get behind the wheel of another persons car.

It is only effective in the event of an auto collision. Because it is not comprehensive, it does not cover theft, acts of God, or collisions with flagpoles and trees. It is also unsuitable for a car you drive every day.

I Have Insurance But No Registration Will This Affect My Claim

If you have been involved in a car accident and you have the proper insurance coverage, but you dont have your vehicle registration, you might be wondering how your case will proceed. When you get on the road, there are specific documents that you must have with you, including your valid drivers license, a valid vehicle registration, and proof of active auto insurance coverage.

If you dont have any of these documents with you, you could face fines and citations. There are different laws that come into play for operating a vehicle that isnt registered or operating a vehicle without the current registration or proof that it is registered.

Also Check: How To Get Internet In Your Car

What Happens To Your Registration When Your Car Insurance Lapses

Can you register a car without insurance if your car insurance has lapsed?

If your insurance lapses, most states will suspend your registration. The same will happen if you are allowed to register a car without proof of insurance but fail to provide that proof within the allotted window of time.

Most states require some sort of minimum car insurance, and driving without insurance is illegal. Penalties vary by state, but, generally speaking, you can expect the following punishments:

- Pay around $500 for the first offense

- Pay $1,000 for the second offense

- Have your cars registration revoked for the third offense

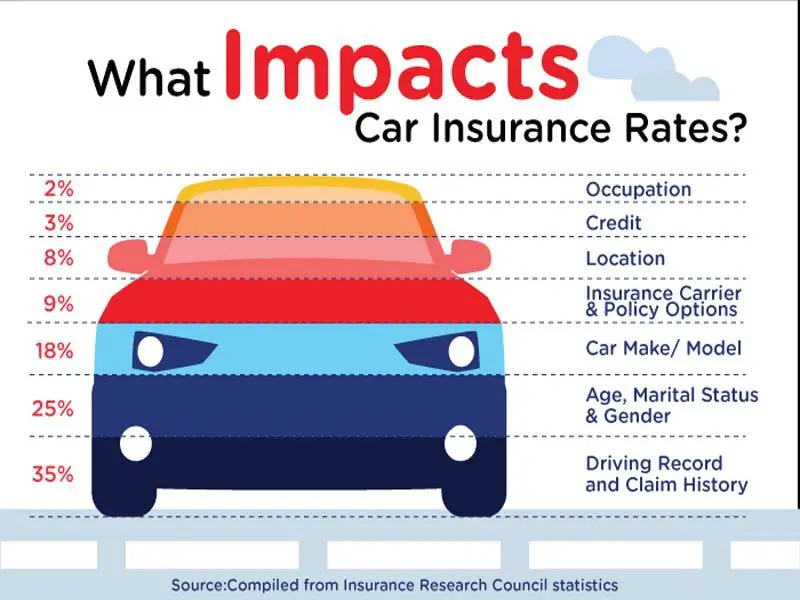

In fact, the Insurance Information Institute cites a 2015 study conducted by the Insurance Research Council that found nearly 13 percent of all drivers are uninsured. Most states require people to get their car insured before driving in hopes of reducing this percentage.

As registration implies intent to drive, most states arent willing to take the risk that youll take your newly registered ride on the road uninsured.

In fact, if you allow a lapse in car insurance, most states will immediately suspend your registration after a specified period.

For example, in New York, you have 90 days after an insurance lapse to pay a penalty and have your registration restored. If the lapse is 91 days or over, registration for that vehicle may never be restored, even if you pay the penalty.

Watch this video to learn how to get a car registration.

How Registration Affects Insurance

You may not know that your expired vehicle registration does not have any effect on your car insurance. This is due to the fact that your insurance company is separate from your states Department of Motor Vehicles. The two separate entities mean that an expired registration will not have an impact on your insurance policy. Continue to pay your minimum insurance premiums and you will be covered.

Don’t Miss: How To Get Car Title In Florida Online

Does Car Insurance Cover Mechanical Or Electrical Breakdowns

This could be a problem in that âuh ohâ moment when the hood starts spewing smoke while youâre driving, or if a million revs just wonât get the engine started. While comprehensive car insurance covers a lot of accidental events or natural disasters, most policies donât insure breakdowns related to mechanical, electrical or structural faults in the car.If youâve got a newer car and itâs within a warranty period, these issues may be covered under by the seller or manufacturer. Or, if youâve elected to include roadside assistance in your policy, some smaller mechanical issues can be addressed under this cover at the time of the breakdown.

How Much Does It Cost To Register A Vehicle

Typically, it costs about $50 to $100 to register a vehicle in most states.

In some states, you can register your vehicle online. In other states, youll need to visit your local Department of Motor Vehicles.

You will need to provide proof of insurance to register your vehicle. All but a few states require you to bring proof of insurance to complete the registration process. If you do not have proof of insurance, then you may not be able to complete the registration process.

Typically, your vehicle registration is good for one year, although some states now offer two year registration periods. Youll be required to renew your registration every year or every two years around the same time, unless you turn in your license plates..

As a vehicle owner, youre responsible for keeping your vehicle registration up-to-date.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Also Check: Milk Smell Out Of Car

What Are The Penalties For Driving Without Insurance In Ontario

In addition to fines, there are other penalties for driving without insurance. They include :

- Suspension : You could face a drivers license suspension for up to one year.

- Impound : You could have your vehicle impounded for up to three months.

- Additional fees : The Provincial Offense Act tacks on an additional 25% surcharge to your fine.

Adding Other Drivers To Your Car Insurance Policy

Your insurance provider will want to add a regular, but occasional, driver to your policy. A friend who borrows your car once every few months will not need to be named on your policy. However, a friend who uses your car every Monday to do their shopping is a regular driver. Inform your insurer to ensure coverage. If you add them, know their personal information and driving history is required. Also, if your insurer views their driving risk escalates the risk, expect to pay more to cover additional named drivers. Again, if the premium goes up, evaluate a few new auto insurance quotes since different auto insurance providers will weight this differently.

Recommended Reading: How To Program A Car Computer With A Laptop

Is There Proof Of Insurance Time Limits

If the state did not require proof of insurance when you registered your vehicle or you registered your vehicle online, you have between 30 and 45 days to provide the DMV with proof of your insurance policy.

If you fail to provide proof of insurance, your vehicle registration and drivers license could be suspended.

To avoid fines, penalties, and the suspension of your drivers license, you can use an insurance comparison quote tool to quickly locate a policy for your new vehicle.

I Was In An Accident And The Other Driver Did Not Have Insurance Can You Provide Me With Their Insurance Information

If an accident occurred and proof of insurance was not available or was not valid, you may submit an Insurance Information Request along with a copy of the police report and a $3 fee. We will then release any insurance information on record for the date of the accident. If no information is available, you will be so advised. Please mail the Insurance Information Request to the address shown at the top of the form.

Don’t Miss: Cleaning Mold From Car

Does Car Insurance Cover You If You Haven’t Paid Your Premium

If you want a pay-out, you need to pay your premium. Insurance companies are required to provide at least 14 days noticed before your policy period ends so you can renew it. Many providers will give you a heads-up well before this and there are often options to set up automatic renewal. So, hopefully you wonât forget to pay your premium, as any claim made under a lapsed policy wonât be valid.Make sure you can stay on top of your car insurance costs by comparing and choosing the best value policy to suit your needs. You can start with some of the comprehensive options below.

What Should I Do If My Claim Was Denied

If you are denied a claim, the insurance company must provide a reason. If you believe your claim is valid, you can appeal your denial. Each insurance provider has a process for appealing a denial. Check with your provider to find out the process. Begin by gathering all of the evidence and documentation to submit to the insurance company.

Another avenue would be to file a lawsuit if your initial appeal is rejected or ignored. Talk to an attorney to find out if your case could hold up in court. Also, contact your states insurance department to file a grievance with your insurer.

You May Like: Kill Spiders In Car

What Kind Of Insurance Do I Need

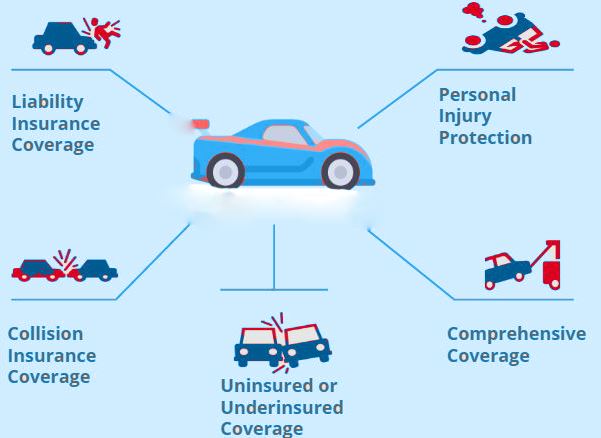

New York law requires that you have auto liability insurance coverage. The minimum amount of liability coverage is

- $10,000 for property damage for a single accident

- $25,000 for bodily injury and $50,000 for death for a person involved in an accident

- $50,000 for bodily injury and $100,000 for death for two or more people in an accident

Your liability insurance coverage must

- remain in effect while the registration is valid, even if you dont use the vehicle

- be New York State insurance coverage, issued by a company licensed by the NY State Department of Financial Services and certified by NY State DMV – out-of-state insurance is never acceptable

- be issued in the name of the vehicle registrant, and remain in the name of the registrant at all times 2

The New York State Department of Financial Services website has more information about liability insurance and insurance companies licensed in New York: .