How To Tell If Your Negative Equity Is Part Of Your New Car Loan

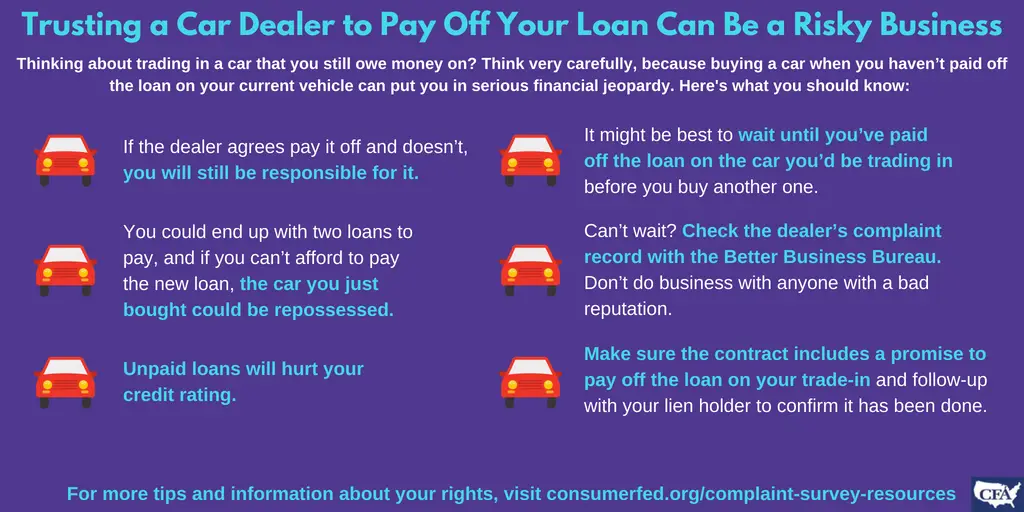

Before you sign a financing contract, the dealer must give you certain disclosures about the cost of that credit. Read them. Look for details about the down payment and the amount financed on the installment contract. Make sure you understand how your negative equity is being treated before you sign the contract. Otherwise, you may wind up paying a lot more than you expect.

Look for a section on your contract with this information:

Down Payment

B. Less Prior Credit or Payoff by Seller

C. Net Trade-In

D. Deferred Down Payment

G. Cash Total Down Payment

Early Auto Loan Payoff Calculator Faqs

What is a pay-off car loan early calculator? +

A pay-off car loan early calculator is a calculator that helps you know how much time you can shave-off from your car payment and the interest you can save by increasing your monthly car payments.

How will an auto loan calculator help me with extra payments? +

Auto loans that span for a long period are great, but they accrue a lot of interest to be paid over time. Our auto loan calculator will show you just how much you can save on these interests by making extra monthly payments.

Why Buy A Car With Mission Fed

Mission Federal Credit Union offers a variety of tools to help you get a great car at a great price. Our Auto Loan calculator can help you figure out how much car you can afford and estimate your car payment before you sign the dotted line on your new or pre-owned car. With our bottom line rates on Auto Loans and the option of buying your car through Autoland, Mission Fed is happy to help make your car buying experience as wonderful as your car-driving experience. Your success is our bottom line, and that includes buying your next car. Let our Car Loan calculator get you started on the right foot, and then explore our Auto Loan options. We cant wait to serve you!

Also Check: Carcareone/synchrony Bank

Dealing With Negative Equity

Here are some steps to take if you think you might have negative equity in a car youd like to trade in:

- Find out what your current vehicle is worth before you negotiate the purchase of a new car. Check the National Automobile Dealers Associations Guides, Edmunds, and Kelley Blue Book.

- If you have negative equity in a car, either because of your current car loan or a rollover from a previous loan, consider these options:

- wait to buy another car until you have positive equity in the one youre still paying for. For example, consider paying down your loan faster by making additional, principal-only payments.

- sell your car yourself. You might get more for it than what a dealer is says its worth.

- ask the dealer how theyll handle negative equity, if you decide to go ahead with a trade-in. Read the contract carefully. Make sure any oral promises are included. Dont sign the contract until you understand all the terms and the amount of your monthly payment. o negotiate your new loan for the shortest time frame you can afford, especially if the negative equity amount is rolled into the new loan. The longer your loan term, the longer it will take to reach positive equity in your new car.

Think We Can Do Better

Adding extra to your monthly payment would reduce your principal balance faster since more money would be left over after finance charges. Having a lower balance sooner in turn reduces your interest payments, as your interest rate would apply to a smaller amount and compounding would be diminished. In short, youll save a lot of money in the long run and get out of debt much sooner if you can afford to scrimp now. But we know that adding extra to your monthly bills could be a big deal!

| Loan Comparison |

|---|

Making smaller payments more frequently is a great way to build discipline and improve budgeting efforts. It will also save you money on interest and help you get out of debt sooner. How? By making more than one payment per month, you would reduce your average daily balance the amount your APR applies to. You would therefore pay less in interest each month. With lower monthly costs, more of your budgeted monthly payment will apply to your principal balance and youll be back above water ahead of schedule.

| Loan Comparison |

|---|

| Loan Comparison |

|---|

Read Also: Where Do You Put Oil In A Car

What Is A Loan

The loan-to-value ratio, commonly referred to as LTV, is a comparison of your cars value to how much you owe on the loan.

An LTV over 100% means you owe more on the loan than your vehicle is worth. This is considered negative equity. Its also often referred to as being upside down or underwater on your loan. The higher your LTV, the harder it may be to qualify for a car refinance loan.

An LTV under 100% means that you owe less on the loan than your vehicle is worth. This is considered positive equity and is more desirable by lenders.

What Happens After A Repossession

After your car is repossessed, you may have time to redeem it. To redeem the car, you will likely have to pay enough to bring the loan current. This typically includes the full amount of the missed payments, interest, penalties, and other charges on the loan, as well as towing and storage fees. Your state will have specific rules about what you and the car company must do to redeem your vehicle.

If you canât afford to pay the redemption amount, the car company will sell your car at a public auction. The loan company must tell you the date and location where it will sell the car. Your stateâs laws will list exactly what the loan company must do when it sells the car.

In general, loan companies must sell the car for a reasonable price. Nevertheless, the sale price might not be the full market value of the vehicle and it might not match the amount thatâs still owed. However, your individual state laws make sure that the auction happens in a reasonable manner.

Don’t Miss: Where To Donate Old Car Seats

Pay Off The Negative Equity

You can diligently pay off the negative equity with windfalls, like tax refunds or work bonuses. Alternatively, you can make extra payments or round up your car payments each month.

Paying off an auto loan that you owe too much on with a lump sum isnt the easiest option for many borrowers, especially if you have a higher than average interest rate. Most car loans use a simple interest formula. This means youre charged interest daily on the balance of your loan. The more you borrow, the longer your loan typically is and the higher your interest rate, the harder it can be to stay out of negative equity.

However, the faster you pay off your loan, the less interest charges stack up. The quicker you pay off the vehicle, the more money you save in interest charges.

What If Im Paying Cash

Paying cash for a car is always best. If youre able to, how much you have saved and what youre comfortable spending on a car can guide you rather than the 35% of monthly income. That said, you may want to check out this post that talks about the wider range of how much you should spend on a car based on your annual income.

Read Also: What Kind Of Car Did Columbo Drive

Get A Budget Stick To It And Make Your Car Affordable

There are a lot of areas people could cut back on if they need an extra $50 or $100 a month to afford their car payment, but to identify them, you need a budget.

If that were easy, the millions of Americans in auto-loan jams wouldnt be honking for help. The New York Federal Reserve reported in early 2019 that a record 7 million car owners were over 90 days late on payments, a 1 million increase since 2010. And that was before most people had heard the word coronavirus.

Many of the people who cant pay their car loans have bad credit scores though they may have bad credit scores because they cant pay their car loan. No matter which came first, lower credit scores raise the cost of borrowing for everything.

Millions of Americans have found relief through debt consolidation. A nonprofit credit counseling company combines your monthly bills into a single, affordable monthly payment and works with lenders to lower interest rates. That one payment should be lower than the combined total of all those previous bills.

A certified credit counselor then works with clients to construct a budget that will get them out of debt. Or in this case, get them out of a jam.

The only thing worse than being stuck in a traffic jam is to be stuck in one while sitting in a car you cant afford.

The Three Rules Of Car Financing

The rule of thumb when it comes to smart auto financing is the 20/4/10 ratio.

According to this rule, when buying a car, you should put down at least 20%, you should finance the car for no more than 4 years, and you should keep your monthly car payment at or below 10% of your gross monthly income.

Why is the 20/4/10 ratio smart? Heres why:

Read Also: Fix Burn In Car Seat

What Happens When I Miss A Payment

A lot of bad things can happen when you stop paying your car loan. Each month you miss a payment lowers your credit score. If you cant resume payments and get caught up, your car can be repossessed. Worse, you could still owe money on your former car after you no longer have it. The repercussions can stick with your credit rating for years, making it hard to borrow money again, and increasing the interest on any loan you do get.

How To Calculate Your Loan

Calculating your vehicles LTV is pretty simple.

Recommended Reading: How To Make Freshies For Car

Looking For A Dealership To Work With

Ideally, your car should have equity if you want to trade it in for a new one. It makes the process easier on you, and you dont have to worry about paying the negative equity of a vehicle you no longer have.

If you need help selling your car, our trusted partner can help you. If you simply need a dealer to work with, we can assist with that as well.

AtAuto Credit Express, we’ve helped countless people get connected to special finance dealerships in their area for over 20 years. These dealers are teamed up with lenders that specialize in helping people with bad credit, no credit, and even unique credit situations like bankruptcy.

To get started today, simply fill out our auto loan request form. The process is fast, easy, and free of charge and obligation.

Shop For Car Insurance

Keeping your monthly payment under 10% of your gross income is the most important thing. Thats whats going to keep you from feeling pinched and stretched. Here are some of the top insurance providers on the market today that are operating in your local area. Find the policy that best suits your needs.

If you prefer to work with an agent, can help you save money. If youre an excellent driver, this insurer may be a great option for you. Sign up for Drivewise and earn as much as 25% back for every six months you go without an accident.

Those who have multiple types of insurance may want to look at . You can save big by bundling your auto policy with your renters, homeowners, or condo insurance. Their website makes it easy to get a quick quote to find out if you can save money by switching to them.

Related: Tips for Saving on Your Car Loan

Recommended Reading: How To Cancel Geico Auto Insurance Online

How To Use Our Car Trade

Your monthly payment will vary, based on the cost of your new vehicle, the value of your trade in, the interest rate on your loan, and the length of your loan .

Lets assume your new car has a purchase price of $30,000. You plan to make a $5,000 down payment, your old vehicle has a trade-in value of $10,000, and you plan to finance the purchase for a term of 5 years at 6% interest.

Adjust the data below to calculate your monthly payment based on the details of your new car purchase and your trade-in value.

Our vehicle payment calculator with trade in will determine your new monthly payment and a full repayment schedule.

Early Auto Loan Payoff Calculator

Have an auto loan that you want to pay off sooner? Wondering how much faster you could pay it off by paying a bit more each month? And how much interest you could save in the process?

This Early Auto Loan Payoff Calculator has the answers.

Enter how much extra you want to pay each month, and the calculator will immediately tell you how many months you’ll shave off your loan and your total savings in interest. It can also show how quickly you’re paying down the loan, with the balance remaining for each month until the vehicle is paid off.

This is good information to have if you’re thinking of trading in the vehicle before it’s paid off and wondering how much to knock off the anticipated trade-in value.

Don’t Miss: Does Carvana Do Leases

Do I Still Owe After My Car Is Repossessed

4 minute read â¢Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

Unfortunately, having your car repossessed isnât the end of the road on your car loan. Many Americans owe more on their car than it is worth and their loan is âunderwater.â Hereâs what you need to know about vehicle repossession and how Chapter 7 bankruptcy can offer some debt relief.

Written byAttorney Amelia Niemi.

Unfortunately, having your car repossessed isnât the end of the road on your car loan. Many Americans owe more on their car than it is worth and their loan is âunderwater.â Hereâs what you need to know about vehicle repossession and how Chapter 7 bankruptcy can offer some debt relief.

Tips For Avoiding An Upside

Its best to avoid an upside-down car loan altogether whenever possible. Be diligent with research before you buy a car and understand all the costs of options, financing and taxes so you arent already upside down when you drive out the door.

For most people, that means accepting that you cant afford to purchase a new car. Instead, look for a late-model used car with low mileage. The original owner will have paid the price for depreciation in the first year, so the purchase price should be at least 20% off the original cost.

If you are still tempted to buy new, try using the 20-4-10 rule, which means 20% down payment no more than 4-year loan and the monthly car payment plus insurance cant be more than 10% of your gross income. If you cant make those numbers work, its time to go back to the used-car lot.

The following tips can help you avoid an upside-down auto loan:

Choose the shortest repayment plan you can afford. Shorter repayment plans mean lower interest rates and faster payoff. For example, borrowing $25,000 for three years at 6.93 interest would result in $2,764 in interest paid. The same deal over four years would cost $3,716 in interest and a five-year loan would be $4,715 in interest. Thats about $1,000 more each year for the same loan. The difference would be magnified even more if your credit score was under 650.

Make a down payment of at least 20% of the cars total cost. This equals the 20% depreciation on the car that happens when you leave the lot.

You May Like: What Car Dealerships Use Equifax

How Is Interest Calculated On A Car Loan

An auto loan calculator shows the total amount of interest you’ll pay over the life of a loan. If the calculator offers an amortization schedule, you can see how much interest you’ll pay each month. With most car loans, part of each payment goes toward the principal , and part goes toward interest.

The interest you pay each month is based on the loan’s then-current balance. So, in the early days of the loan, when the balance is higher, you pay more interest. As you pay down the balance over time, the interest portion of the monthly payments gets smaller.

You can use the car loan calculator to determine how much interest you owe, or you can do it yourself if you’re up for a little math. Here’s the standard formula to calculate your monthly car loan interest by hand: