Cheapest Minimum Coverage Car Insurance In Arizona For 30

Drivers in Arizona who want their state’s minimum coverage can check with the following companies, which had the lowest average rates:

Geico: $307 per year, or about $26 per month.

Travelers: $433 per year, or about $36 per month.

QBE: $451 per year, or about $38 per month.

Encompass: $497 per year, or about $41 per month.

Farm Bureau Financial Services: $514 per year, or about $43 per month.

Least Expensive Vehicles To Insure In Arizona

In Arizona, the Honda CR-V, Jeep Wrangler Sport and Subaru Forester are among the cheapest vehicles for insurance, based on average rates for 50 top-selling 2021 models. The 20 least expensive are below.

Cars with the most expensive insurance rates in Arizona among popular models are the Lexus ES 300H and Tesla Model S Performance .

| Vehicle |

|---|

Related: Most and least expensive cars to insure nationwide

Which States Have The Cheapest Car Insurance Rates

“States that have the lowest overall car insurance premiums on average may have lower populations, which result in fewer car accidents and less money paid out by insurance companies, resulting in cheaper insurance premiums,” says Lauren McKenzie.

Cudd agrees.

“Some of these states have generally milder weather than others, and many have rural areas. That generally means less chance of accidents and weather-related claims, which means car insurance companies will have to spend less money,” he says.

Don’t Miss: What Is The Average Cost Of Car Insurance Per Month

Cheapest Full Coverage Car Insurance In Arizona For 20

Drivers in Arizona with clean driving records may want to consider the following companies, which had the lowest average rates:

Geico: $1,712 per year, or about $143 per month.

QBE: $1,801 per year, or about $150 per month.

Travelers: $2,311 per year, or about $193 per month.

ACCC Insurance: $2,483 per year, or about $207 per month.

Farm Bureau Financial Services: $2,489 per year, or about $207 per month.

Does Arizona Have A Teen Driver Graduated Licensing Program

Getting your drivers license is exciting, and if you live in Arizona, all teen drivers must partake in the graduated licensing program. After passing written and vision tests, your teen will be issued a graduated driver license permit that must be maintained for at least six months. During this time, Arizona requires parents or guardians supervise their teens during a set amount of driving hours. Or, young drivers can complete a high school driver education course or an authorized third-party driver license driver education program. There are still a few restrictions after your teen receives their graduated driver license, but theyre one step closer to driving independently.

Also Check: Who Invented The First Car

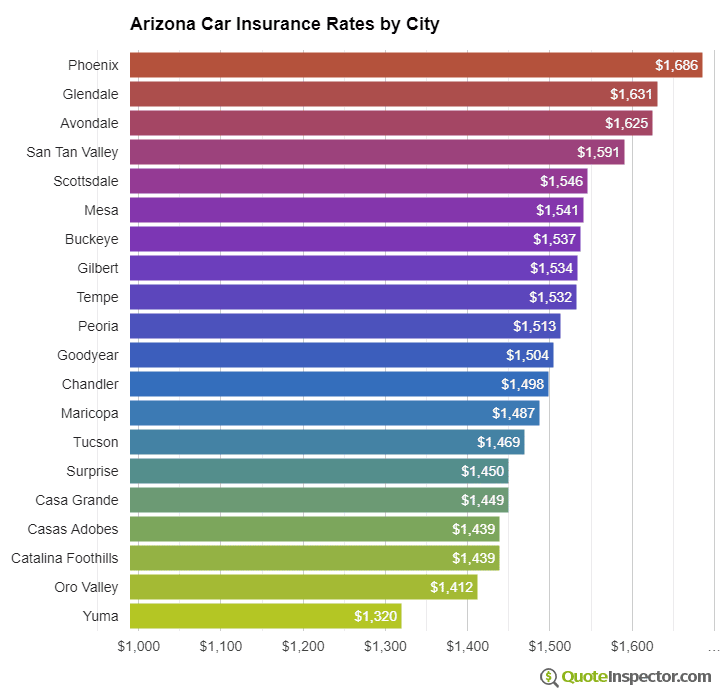

How Do Rates Compare Across Major Cities In Arizona

Rates across major cities in Arizona differ. Some cities are considered riskier due to the higher percentages of incidents that happen there per year, plus the number of personal injury lawsuits filed there every year. Your rates will reflect the risk factors of your location. Here are the average monthly rates in the states top cities.

| City |

|---|

What Else Should I Have

Uninsured motorist coverage. Arizona requires car insurance companies to offer uninsured motorist coverage. UM insurance pays for property damage and injuries if a driver without insurance crashes into you. You dont have to accept UM coverage you can reject it on a state-approved form. If you do buy UM insurance, you must purchase at least 15/30. This is a good coverage to have.

Underinsured motorist coverage. Arizona also requires that car insurance companies offer you underinsured motorist coverage. You can reject this coverage on a state-approved form. This coverage pays for injuries and damage when a driver crashes into you but doesnt carry enough insurance. When their insurance runs out, your UIM coverage will kick in. Generally, this is a good coverage type to have.

Medical coverage. Medical payments helps pay for medical and funeral expenses for you and your passengers after a car accident, no matter who is at fault. Even if you have health insurance, MedPay can be a valuable coverage because it helps cover your health plan deductibles and co-insurance.

Collision and comprehensive coverage. Youre not required to purchase collision and comprehensive coverage, but together they cover a wide range of problems, such as car accidents, car theft and vehicle damage from vandalism, riots, floods, fire, hail, failing objects and collisions with animals. If you have a car loan or lease, your lender or leasing company will likely require that you buy these coverage types.

You May Like: How To Avoid Paying Sales Tax On A Used Car

How Much Does Car Insurance Cost In Scottsdale Az

The average cost of car insurance in Arizona is lower than the national average. Premiums in Scottsdale tend to be higher than the state average but are still lower than the national average rate.

- National average annual car insurance cost: $1,311

- Arizona average annual car insurance cost: $1,103

- Scottsdale average annual car insurance cost: $1,286

The price for coverage can vary significantly from one driver to the next because insurance companies calculate rates based on several factors such as:

- The year, make, model, and value of the vehicle you are insuring

- Your age, occupation, driving record, claims history, and credit score

- Information about other licensed drivers in your household

- The amount of liability insurance you want

- The coverage options you wish to include

- The amount of your deductible

Comparing rates lets you know you are getting your coverage at a competitive price. You may also be able to save money through car insurance discounts. Some potential discounts you may see offered by car insurance companies include rate reductions for:

Independent insurance agents can help you find a good policy at a great price. These agents will also help to ensure that you are taking advantage of any discounts for which you may qualify.

Cheapest Full Coverage Car Insurance: State Farm

State Farm offers the cheapest quotes for full coverage as well at $1,431 a year, or $119 a month 36% cheaper than the state average.

Full coverage auto insurance in Arizona costs $2,219 per year on average. Full coverage quotes include comprehensive and collision coverages, in addition to liability coverage. Comprehensive coverage pays for damage from incidents beyond your control, such as hail or theft, while collision coverage pays for damage to your own car if you crash into another car.

| Company |

|---|

| $183 |

*USAA is only available to current and former military members and their families.

Auto insurance premiums go up after an at-fault accident because drivers with a recent accident pose a higher risk for insurers than drivers with a clean record. Average rates increase by 49% after an at-fault accident in Arizona. This translates to an extra $1,070 per year in premiums compared to the rate you would have with a clean driving record.

Recommended Reading: How Long Does It Take To Charge A Tesla Car

Car Insurance Rates In Arizona Cities

The cost of car insurance in Arizona varies by city, and sometimes even from neighborhood to neighborhood. Thatâs because population, weather, crime rates, and road conditions all affect how risky your car is to insure. Average rates for car insurance in major Arizona cities are shown in the table below.

| City |

|---|

The Most Expensive States For Insurance

On average, auto insurance is most expensive in Florida, where rates are 76% more expensive than for most drivers nationwide. We found that the cost of car insurance in Florida is $105 more expensive per month, or $1,262 per year, compared to the national average.

Besides Florida, Louisiana, Michigan, New Jersey, and New York are the states with the most expensive average car insurance rates. The combined average cost of auto insurance in these states is 53% more expensive than the national average.

What if car insurance costs are too high in your state?

You can still get affordable coverage in states where average insurance costs are high. You can keep costs low by avoiding accidents and tickets, taking advantage of discounts, and by comparing quotes when its time to renew your policy and switching companies if you find a better deal.

Read Also: How Long Can You Rent A Car

Cheapest Auto Insurance In Arizona For 50

Drivers with poor credit in Arizona can check with the following companies, which showed the lowest average rates for full coverage:

Geico: $1,283 per year, or about $107 per month.

Nationwide: $1,499 per year, or about $125 per month.

Safeway: $1,749 per year, or about $146 per month.

Mercury: $1,810 per year, or about $151 per month.

QBE: $1,851 per year, or about $154 per month.

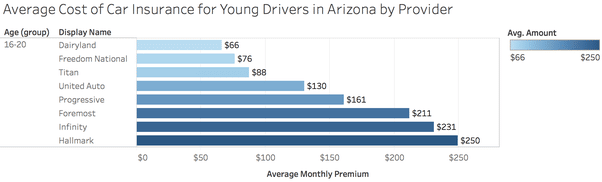

Cheap Car Insurance In Arizona For Young Arizona Drivers

THE GENERAL offers the most economical car insurance for 18-year-olds, with minimum coverage starting at $1772 and comprehensive coverage starting at $3255 per year.

Young drivers pay significantly more for car insurance than older drivers, particularly if their parents’ policy does not cover them. A car insurance policy for an 18-year-old driver will cost almost 200 percent more than one for a 30-year-old driver.

| COMPANY |

|---|

| $3423 |

Don’t Miss: Does Car Loan Help Credit

Minimum Car Insurance Requirements In Phoenix Az

Phoenix, Arizona has a minimum liability coverage requirement known as the 15/30/10 rule. This rule means drivers are required to maintain policies that include at least:

- Individual Bodily Injury Liability : $15,000.The total amount your insurer will pay for one person injured in a car accident.

- Total Bodily Injury Liability: $30,000.The total amount your insurer will pay for every person injured in a car accident.

- Property Damage Liability : $10,000.The maximum amount your insurer will pay for property damage caused by a car accident.

Arizona lets residents to get a certificate of deposit of $40,000 assigned to the Office of the Arizona State Treasurer.

State Farm: Most Popular Provider

J.D. Power regional rating: 847/1,000

AM Best Financial Strength Rating: A++

BBB Rating: A

State Farm is another strong contender for the best car insurance in Arizona. It offers some of the states most affordable insurance rates for drivers with recent accidents or speeding tickets. State Farm also stands out for its two usage-based programs, Steer Clear and Drive Safe & SaveTM.

The Steer Clear program can be used by drivers under the age of 25 and includes several courses designed to help drivers earn discounts on auto premiums. Drive Safe & Save is a usage-based program that monitors driving behaviors and rewards customers with up to 30% off their insurance premiums for safe practices behind the wheel.

Recommended Reading: How Much To Expect From Car Accident Settlement

Compare Car Insurance Quotes Instantly

- Personalized quotes in 5 minutes or less

- No signup required

- Methodology

Data scientists at Insurify analyzed over 40 million auto insurance rates across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers’ vehicles, driving records, and demographic information. With these insights, Insurify is able to offer drivers insight into how their car insurance premiums are priced by companies.

Insurance Writer

What Else Affects My Car Insurance Rate

There are even more factors that can affect your car insurance rates besides location, coverage levels, age, gender, marital status, car type, driving history, and credit score. The cost of car insurance can also be influenced by:

-

The company you choose: Even if you live in a state where rates are higher than average, some companies offer more competitive rates than others, which is why its important to shop around.

-

Discounts: Some of the most common car insurance discounts include savings for bundling policies, completing a driving safety course, and paying your annual policy in full.

-

Insurance history: You may pay more for car insurance if you’ve had past coverage with a high-risk provider or if you have a lapse in coverage on your record. If you have a history of consistent coverage and on-time payments, on the other hand, you could see lower rates.

-

Your annual mileage: If you use your car often, your auto insurance will cost more than for someone who drives infrequently.

-

Your job and education: In some states it’s illegal for insurers to use your occupation and education to set rates. However, in many places you could pay more for car insurance if you’re unemployed or if you didn’t graduate from college

Don’t Miss: Where To Register My Car

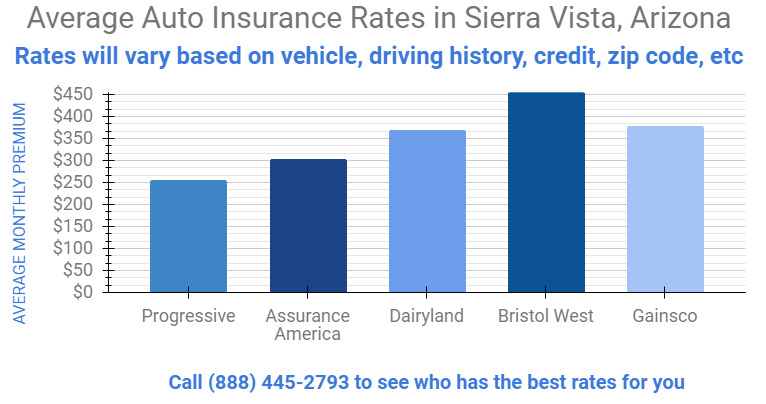

Cheap Auto Insurance For Young Drivers

Inexperienced drivers pose a higher risk to insurance providers so their rates can be significantly higher than average drivers. Novice drivers should be especially careful to maintain a clean driving record and comply with all speed limits and other driving regulations. Some AZ insurance companies can provide more favorable rates than others for younger drives. It’s worth getting multiple quotes so you can save money on your monthly insurance premiums.

Am I Required To Report An Accident In Arizona To Authorities

You are not required to report a motor vehicle accident in Arizona, but you should call 911 once you are safely situated. If certain thresholds are met, the responding law enforcement agency will file the report.

- Anybody was injured or killed

- There was damage of more than $1,000

- Anyone received a citation

However, you must remain at the scene of an accident until law enforcement arrives. Leaving can result in a felony charge and suspension of your license.

Also Check: How To Transfer Car Title In Illinois

Cheapest Auto Insurance In Arizona For 30

Drivers with poor credit in Arizona should consider the following companies with the lowest average rates for full coverage:

Geico: $1,357 per year, or about $113 per month.

Nationwide: $1,705 per year, or about $142 per month.

QBE: $1,915 per year, or about $160 per month.

Farm Bureau Financial Services: $2,130 per year, or about $178 per month.

Travelers: $2,169 per year, or about $181 per month.

Get An Affordable Car Insurance Quote Online In Arizona Today

Finding Arizona car insurance is simpler than ever when you work with an insurance agent who can make all the cost comparisons for you. Whether you need comprehensive coverage, minimum liability, or SR-22 insurance after a DUI, Freeway Insurance can show you all the plans available to you in your area. Get back on the open road in Arizona and drive safely and legally with coverage that will give you peace of mind.

You can get a fast and free online car insurance quote, visit us at an Arizona office near you, or call us at for a quote today!

Read Also: How To Remove Tree Sap From Car

What Is The Average Cost Of Car Insurance In Arizona

The average price of car insurance in Arizona is $897 per year, or $75 per month, for minimum coverage. The average cost of full coverage in Arizona is $2,219 per year, or $185 per month. However, every insurer offers different prices, and what you’ll pay depends on your age, driving history, location and credit score.

Auto Insurance In Arizona

When it comes to the cheap car insurance AZ drivers are looking for, every state has state-requiredspecifications for how much insurance is required. These specifications can be simple in some states and more complicated in others. In Arizona, its important to know about state-specific auto insurance factors like SR-22 regulations, penalties for driving while uninsured, special liability insurance requirements, and proving financial responsibility when required. When drivers in Arizona are insured and informed, everyone is safer.

You May Like: When Checking Transmission Fluid Should Car Be On

How Much Car Insurance Costs By City

The cost of car insurance also varies by city, even within the same state. Average rates in one city can be hundreds or even thousands of dollars more expensive than another city in the same state, so you should be sure to compare quotes and estimate your costs before buying coverage.

The city with the most expensive car insurance prices is Detroit, where coverage costs $446 per month, or $5,357 per year thats $3,705 more each year than the national average rate. New York City, Miami, Philadelphia follow Detroit as the most expensive cities for car insurance.

|

City |

|---|

Cities sorted from most to least expensive.

How Much Is Car Insurance In Your City

Car insurance premiums dont just vary between states they also change within one. For example, drivers who live in Tucson pay an average of $1,167 per year. It is 9.1% lower than the average cost of car insurance in Arizona, which is $1,284.

Meanwhile, the average car insurance rate in Phoenix is $1,430 per year, 11.4% higher than the state average. Typically, factors such as the number of road accidents, occurrences of natural disasters and population density contribute to higher car insurance rates.

Average Costs of Full Coverage Car Insurance in Arizona – By City

Scroll for more

Read Also: How Big Is A 2 Car Garage

Cheap Car Insurance Az

Arizona is one of the great western states, featuring the Grand Canyon and a lingering Wild West attitude that makes it a popular destination for tourists and residents alike. But at Freedom National, we dont think there should be anything wild about your car insurance experience or the car insurance company you choose. Thats why we not only offer the cheap car insurance AZ residents are looking for, but also a 100% online buying experience, instant proof of insurance, and affordable coverage even for high-risk drivers with a past DUI, an at-fault accident, or a few minor tickets.

At Freedom National, we take our responsibility as your provider of cheap car insurance rates seriously. Thats why we dont just want to cover you and your vehicle, we want to help you stay informed on the most important factors to consider when choosing cheap car insurance in AZincluding state laws and how they affect you.