Get Discount Louisiana Auto Insurance

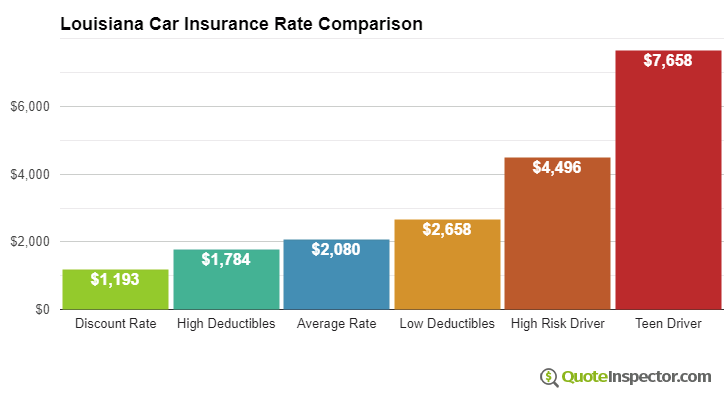

Auto insurance companies that sell policies for unemployed drivers may provide discounts that could lower prices by as much as 35% or more if you can meet the requirements. Larger auto insurance companies and some of the premium reductions they offer are detailed below.

- American Family may offer discounts for early bird, TimeAway discount, accident-free, Steer into Savings, air bags, and defensive driver.

- State Farm offers premium reductions for passive restraint, student away at school, accident-free, Drive Safe & Save, multiple autos, and defensive driving training.

- 21st Century offers discounts including teen driver, good student, defensive driver, automatic seat belts, and early bird.

- Travelers may have discounts that include hybrid/electric vehicle, early quote, driver training, payment discounts, and good student.

- GEICO policyholders can earn discounts including federal employee, military active duty, daytime running lights, defensive driver, five-year accident-free, and multi-policy.

How We Chose The Cheapest Companies In Louisiana

NerdWallets editorial team analyzed car insurance rates from 11 auto insurers in Louisiana and found the five cheapest options for drivers in several age brackets and with different histories, all driving a 2019 Toyota Camry L. For minimum coverage, we looked at rates that reflect the minimum requirements in Louisiana. For full coverage, we used the below coverage limits:

-

$100,000 bodily injury liability per person.

-

$300,000 bodily injury liability per accident.

-

$50,000 property damage liability per accident.

-

$100,000 uninsured motorist coverage per person.

-

$300,000 uninsured motorist coverage per accident.

-

Collision coverage with a $1,000 deductible.

-

Comprehensive coverage with a $1,000 deductible.

What Is The Required Coverage For Car Insurance In Louisiana

The following coverage is required by the state of Louisiana to legally operate a motor vehicle:

- Bodily injury liability coverage:The minimum legal requirement is $15,000 per person and $30,000 per accident

- Property damage liability coverage: The minimum legal requirement is $25,000

- Medical payments: The minimum legal requirement is $1,000*

- Uninsured motorist bodily injury: The minimum legal requirement is $15,000 per person and $30,000 per accident*

*These coverages can be rejected.

Recommended Reading: How To Track Car Location

What Does General Liability Insurance Cost

No matter what the policy limits are, Insureon’s customers pay on average $42 extra per month for general liability insurance. By excluding outliers such as extremely high rates or very low rates, the median cost of business insurance provides a more accurate estimate of what your business will pay.

How Much Auto Insurance Is Right For You

Our team of insurance professionals understands the Louisiana car insurance needs of our customers.

Auto insurance requirements vary by state. In some states, to drive you must carry:

- Liability coverage to pay for losses you cause others

- No-fault coverage to pay you and your passengers for medical and related expenses caused by injuries from a car accident, regardless of who is at fault

- Both liability and no-fault coverage.

We write insurance in Louisiana and would be happy to help you ensure you have the right car insurance coverage.

Even in states where coverage isnât required, by law drivers must be able to pay for losses they cause others. Having insurance is the simplest way for most people to comply. To finance a car, it is usually necessary to have insurance which covers damage to your vehicle. This includes:

Every person is unique â talk to us today to find out how to get the best price and value on Louisiana auto insurance. Call today for your free, no obligation auto insurance quote in Baton Rouge.

You May Like: How To Get Cigarette Burns Out Of Car

Car Insurance In Louisiana

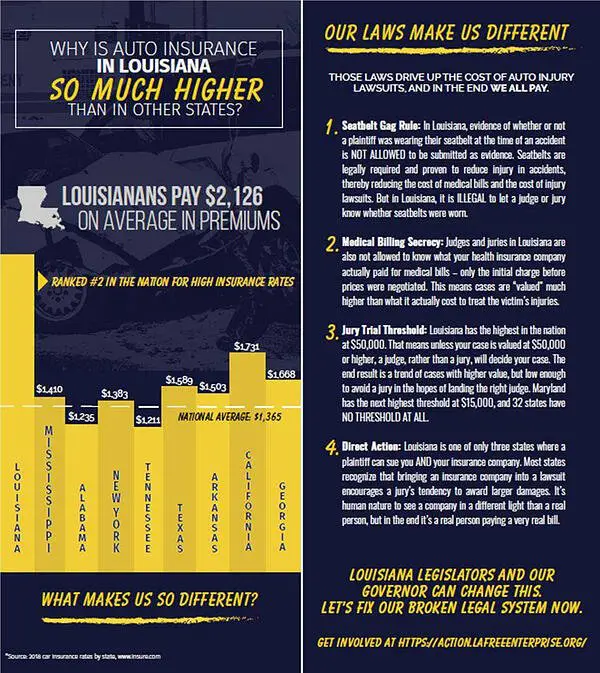

There are lots of things to love about living in Louisiana, from the rich culture to the great eats. However, car insurance premiums here are significantly higher than the national average. Check out our comprehensive guide to Louisiana auto insurance to make sure youre getting the lowest rates for the best coverage, and use Insurify to compare quotes and find your best rate!

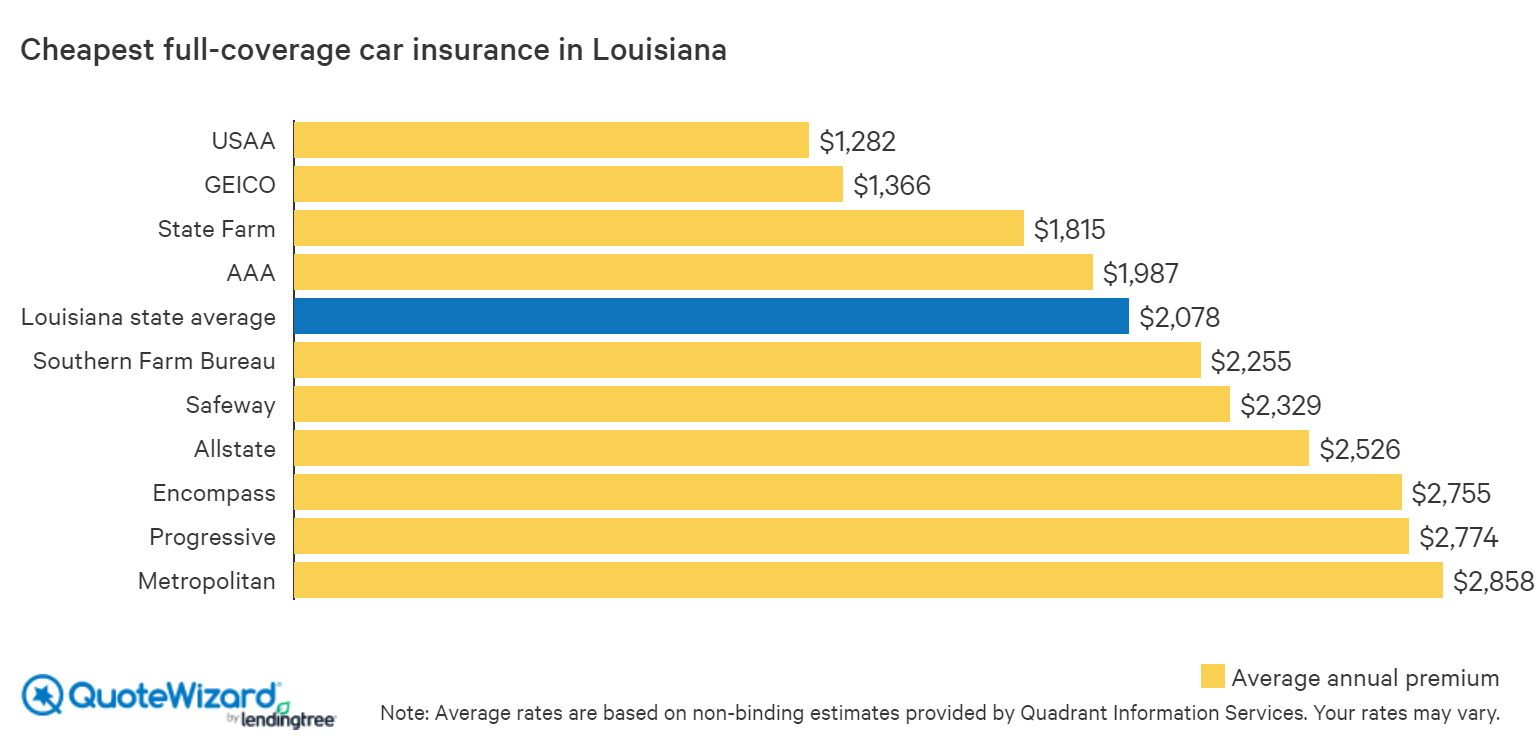

Cheapest Full Coverage Car Insurance In Louisiana For 40

Drivers in Louisiana with clean driving records may want to think about the following companies, which had the lowest average rates:

Southern Farm Bureau Casualty: $1,718 per year, or about $143 per month.

Louisiana Farm Bureau: $2,243 per year, or about $187 per month.

Safeway: $2,477 per year, or about $206 per month.

Geico: $2,487 per year, or about $207 per month.

State Farm: $2,672 per year, or about $223 per month.

You May Like: How To Keep Car Doors From Freezing Shut In Winter

Get Louisiana Commercial Auto Insurance With Progressive

Were the #1 commercial auto insurer* in the country, insuring over 1.5 million commercial vehicles. Heres a few of the many reasons small business owners trust us:

24/7 policy service by phone or online

We understand you might need help outside of regular business hours whether you need to adjust your coverages, request an insurance certificate or pay a bill.

Specialized commercial claims adjusters

Our in-house adjusters are specialized in handling commercial auto claims to help you get back on the road fast after an accident.

Discounts

Save up to 15% by paying your policy in full and take advantage of our other commercial discounts to get the best rate for your Louisiana policy.

Business insurance options

In addition to commercial auto insurance, we can help you find other business coverages including general liability, professional liability, workers compensation and more.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and reviewed by subject matter experts, who ensure everything we publish is objective, accurate and worthy of your trust.

Our insurance team is composed of agents, data analysts, and customers like you. They focus on the points consumers care about most price, customer service, policy features and savings opportunities so you can feel confident about which provider is right for you.

- We guide you throughout your search and help you understand your coverage options.

- We provide up-to-date, reliable market information to help you make confident decisions.

- We reduce industry jargon so you get the clearest form of information possible.

All providers discussed on our site are vetted based on the value they provide. And we constantly review our criteria to ensure were putting accuracy first.

You May Like: Can I Use My Synchrony Credit Card Anywhere

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Best Cheap Car Insurance In Louisiana

Home MediaCompare car insurance quotes

As the most expensive state for car insurance on average, Louisiana can be a challenging place to find affordable coverage. According to rate estimates from the Home Media reviews team, the best car insurance in Louisiana can be found for as low as $124 per month. The providers with the lowest average rates for full coverage car insurance in the state can be found below:

| Cheapest Car Insurance in Louisiana | Estimated Monthly Cost |

|---|---|

| $279 | $3,344 |

Louisiana drivers can look to Southern Farm Bureau, USAA, State Farm and Progressive when searching for cheap car insurance. While your rates will vary based on personal factors, these providers tend to offer the most affordable average annual rates in the state.

Also Check: Who Takes Car Care One Credit Card

Who Has The Cheapest Car Insurance In Louisiana

Getting the cheapest car insurance in Louisiana may sound great, but that cheap rate can come at a cost when you need it most. You want auto insurance thats affordable, but even more importantly reliable, in case you have an accident.

A Liberty Mutual auto insurance policy can cost less than you think4

- Loading…

Louisiana Car Insurance Rates By Company

Based on our findings, some of Louisianas cheapest car insurance companies are Geico and Southern Farm Bureau. Rates from Geico are $575 for minimum coverage and $2,211 for full, while Southern Farm Bureaus average premiums are $607 and $1,871, respectively. Make it a habit to get quotes from a handful of top insurance providers annually. You may find it worth your while to switch car insurance companies to take advantage of lower rates.

| Car insurance company |

|---|

*16 year old calculated on parents policy disclosure

Don’t Miss: Places That Accept Car Care One Credit Card

How Many Uninsured Drivers Are In Louisiana

About 12% of Louisiana drivers have no car insurance, according to the Insurance Research Council. If they crash into you, you could sue them to get payment. But if you have a good level of auto insurance youll have other options to deal with the situation.

- You can use your uninsured motorist coverage or medical payments coverage for injuries.

- Your car damage can be covered by either uninsured motorist coverage or your collision insurance.

Louisiana Car Insurance Rates By Driving And Accident History

Your driving history, including any accidents youve caused, is a major cause of insurance premium hikes. Insurance companies want to issue policies to safe drivers because theyre less likely to cause accidents. Your rates can vary quite a bit depending on what your driving record looks like.

See More:High-Risk Car Insurance Louisiana

Recommended Reading: Program Chamberlain Garage Door Opener To Car

Cheapest Cities For Car Insurance In Louisiana

Some cities in Louisiana have cheaper car insurance premiums than others because insurance companies take a driver’s ZIP code into account when calculating their premium, alongside other factors. For example, drivers who live in dense urban areas typically pay more for coverage than drivers in rural areas because they’re more likely to get into an accident. And if an area has a particularly high theft rate, car insurance may be more expensive due to the risk of vehicles being stolen.

You can get car insurance discounts in Louisiana based on how you drive, the car you own, and your relationship with your insurance company. In Louisiana, car insurance companies are allowed to consider factors like employment, residential, and marital status when setting premiums. That means there are also discounts available for being married, owning a home, or being affiliated with certain employers or educational institutions.

Almost anyone can get a discount on car insurance in Louisiana because most insurance companies make it easy to qualify for a variety of savings. Louisiana insurers typically offer discounts that fall into one of three categoriespolicy discounts, driver discounts, and vehicle discounts.

What Is The Best Car Insurance In Louisiana

NerdWallet named Liberty Mutual one of the best car insurance companies in 2020.3 Thats because we understand that everyone has individual needs when it comes to their Louisiana auto insurance. Some might want the cheapest Louisiana car insurance, while others want more coverage and an auto insurance company they know they can trust. Let us help you customize your Louisiana car insurance, so you only pay for what you need.

Also Check: Transfer Car Title Arizona

How Many Car Accidents Happen In Louisiana

While there is no way to know the exact number of motor vehicle accidents in Louisiana in a given year, the state does track fatal collisions carefully. Out of the 4.6 million residents within the state, there were 681 traffic fatalities in 2019 alone. The number of accidents involving severe injuries or property damage is substantially higher.

Types Of Car Insurance

There are several different types of auto insurance that you can choose from to meet your budget. Your friendly local ABC Insurance agent can help you understand each type of car insurance coverage to help prepare the right policy for you. The following types of car insurance coverage are available for you to choose from:

Read Also: Request Car Title Florida

What To Know About Driving In Louisiana

As mentioned, Louisiana has a very high rate of uninsured drivers on the road, so motorists are advised to have strong un/underinsured motorist coverage.

Its important to note that Louisiana is not a no-fault state. This means that if youre in an accident, the court will attempt to determine who was at fault in the accident. The offending party is then responsible for damages.

Motorists in Louisiana also have the option of providing alternative proof of financial responsibility, which will waive insurance requirements. These include:

- Surety bonds: A surety bond thats valid for $55,000 in payments is sufficient proof of financial responsibility.

- Real estate bonds: If you get a real estate bond approved by a county judge and two other guarantors, you can skip out on the minimum requirements for car insurance in Louisiana.

- Cash or security deposits: If you deposit $30,000 with the Louisiana State Treasurer, your car insurance requirements will be waived.

- Self-insurance: You can pay a $1,000 fee for each vehicle youd like to insure and skip the state car insurance requirements if you have:

- 26 or more vehicles registered under your name

- Property that you own in Louisiana

- Assets worth $100,000 or more

- No previously canceled self-insurance certificates within the last five years

Cheapest Full Coverage Car Insurance In Louisiana For 50

Drivers in Louisiana with clean driving records may want to get quotes from these insurers, which had the lowest average rates:

Southern Farm Bureau Casualty: $1,672 per year, or about $139 per month.

Louisiana Farm Bureau: $2,017 per year, or about $168 per month.

Safeway: $2,173 per year, or about $181 per month.

Geico: $2,442 per year, or about $204 per month.

State Farm: $2,623 per year, or about $219 per month.

Read Also: Used Car Salesman Commission

Recommended Car Insurance Coverage

The cheapest car insurance may not provide sufficient protection, so how much insurance should you buy? Bare-bones coverage may be a good choice if you have few assets or have an old car and dont drive much. But if you have a home and investments, consider buying more insurance. If you dont, youre at risk for having your money and house taken to cover the cost of an accident. If you financed your car you will be required to get additional comprehensive and collision coverage.

Use our How Much Car Insurance Do You Need? tool to get a recommendation.

Cheapest Minimum Coverage Car Insurance In Louisiana For 40

Drivers in Louisiana who want just the minimum coverage may want to check prices from these companies, which had the lowest average rates:

Geico: $443 per year, or about $37 per month.

Southern Farm Bureau Casualty: $450 per year, or about $38 per month.

State Farm: $597 per year, or about $50 per month.

Louisiana Farm Bureau: $649 per year, or about $54 per month.

Auto Club of SoCal: $938 per year, or about $78 per month.

Don’t Miss: Who Accepts Car Care Credit

Cost Of Louisiana Car Insurance By City

While the cost of auto insurance in Louisiana is high statewide, drivers pay significantly different rates depending on where they live. For instance, those who live in rural areas tend to pay much less for coverage than those who live around the New Orleans area.

| City in Louisiana |

|---|

BBB rating: A+

If youre looking for quality coverage from a local provider, Safeway Insurance can be a good choice for car insurance in Louisiana. While the providers rates arent quite as cheap as some of its competitors rates, Safeway still tends to offer some of the most affordable rates on average in the state, especially for those with poor credit scores.

How Much Does It Cost To Add A Teen To Your Policy In Louisiana

No matter where you live, adding a new driver to your family policy will hike your rate significantly. In Louisiana, you can expect your rate to go up by an average of 214 percent when adding a driver age 16 to your coverage, according to CarInsurance.com rate data. You’ll see in the table below how much it costs, on average, to add a teen driver in Louisiana, and how major insurers compare on price. GEICO Cas had the lowest auto insurance cost for adding a driver age 16 to a full coverage family policy, among insurers surveyed.

| Company |

|---|

| $5,263 |

Also Check: How To Get Off Enterprise Dnr List

Cheap Car Insurance In Louisiana

- Personalized quotes in 5 minutes or less

- No signup required

Compare Car Insurance Quotes Instantly

Quick Facts

- The average cost of car insurance in Louisiana is $333 per month, or $3,996 annually.

- National General is the cheapest provider we found in Louisiana, with average premiums of $205 per month.

- Your rates are determined by factors outside of your location, such as your age and driving record but by comparing car insurance quotes, you can ensure you find the best rate for your circumstances.