Get Discounts For Installing Anti

Individuals have the potential to lower their annual premiums if they install anti-theft devices. GEICO, for example, offers a potential savings of 25% if you have an anti-theft system in your car.

Your insurance company should be able to tell you specifically which devices, when installed, can lower premiums. Car alarms and LoJacks are two types of devices you might want to inquire about.

If your primary motivation for installing an anti-theft device is to lower your insurance premium, consider whether the cost of adding the device will result in a significant enough savings to be worth the trouble and expense.

Find Out How Much You Can Expect To Pay For Insurance Based On A Variety Of Factors

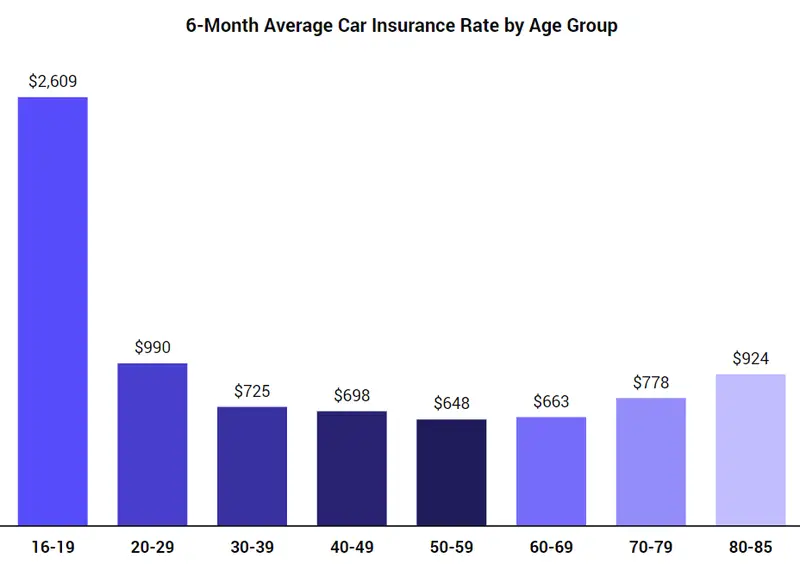

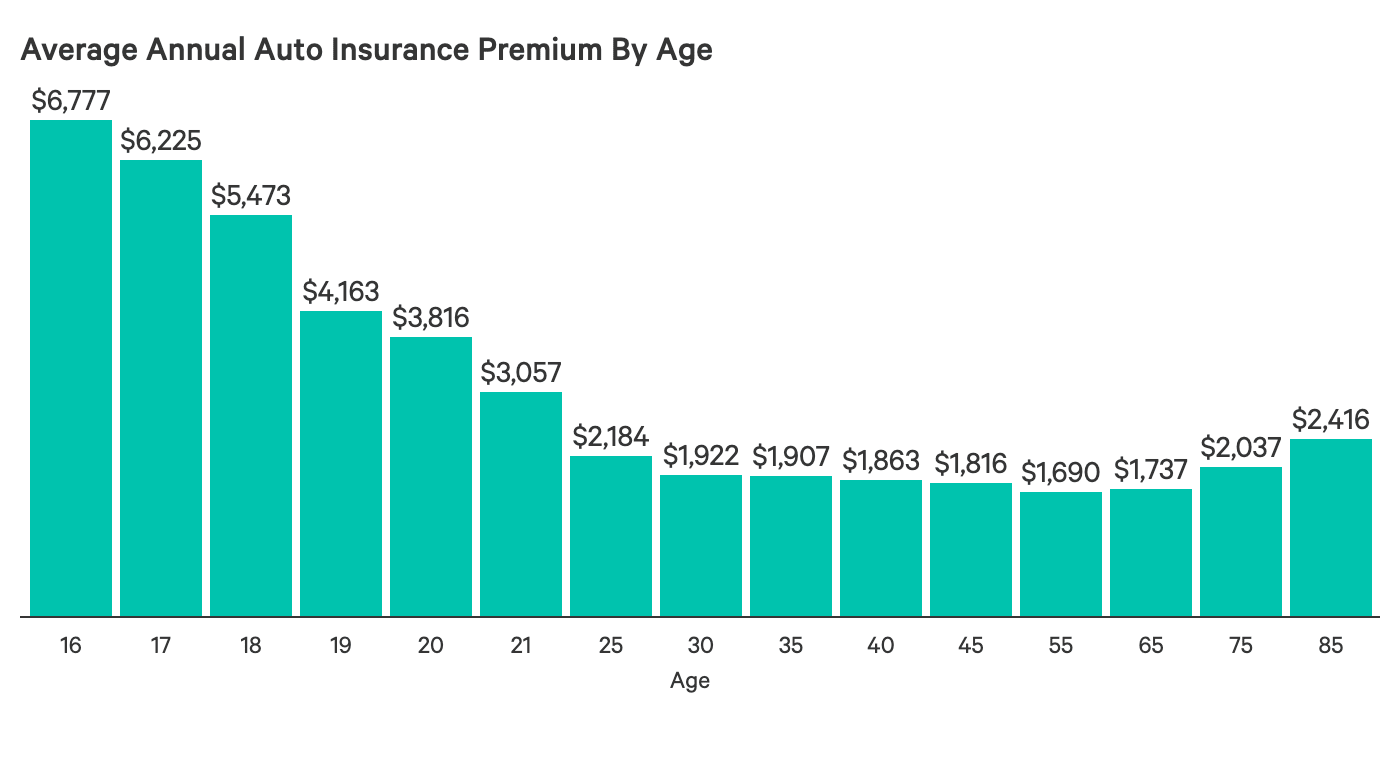

Whether you are just getting your license or are a well-established driver, you may be asking yourself, “How much is car insurance in 2021?” There is a multitude of factors that go into determining an insurance premium, so to pull back the curtain, we looked into average car insurance payments based on driver age, gender, level of coverage, driving record, and more.

Whenever you shop for car insurance, we recommend getting quotes from multiple providers so you can compare coverage and rates. In addition to the insurance company you choose, factors such as your age, vehicle make and model, and driving history can affect your premium, so whats best for your neighbor might not be best for you.

You can either use the tool below to start comparing personalized car insurance quotes.

Average Cost Of Car Insurance By Gender

Although insurance companies using gender as a factor in determining car insurance rates is an ongoing controversial issue, only seven states have banned it.

In all other states, gender is a determining factor for car insurance rates. Statistics support the theory that men are a higher risk to insure and are involved in more accidents, speeding and DUI convictions than women.

As age increases, the gender insurance gap decreases for several decades. In quotes collected by Insure.com and Quadrant Information Services in 2018, a 20-year-old man was quoted at $523 higher than a 20-year-old woman. By age 55, there was only a $36 difference, but the gap started to widen again after age 55.

| Gender |

|---|

| $1,148 |

You May Like: Ca Car Registration Cost

How Much Is Car Insurance Each Month

The cost of car insurance per month generally ranges between $110 and $130, depending on various factors including geographic location, car make and model, driving history, and more. However, auto insurance costs also depend on factors like gender, marital status, and age. Some insurance companies also offer optional coverages that can increase the price youll pay.

How Much Does My Commute Matter

Your cars annual mileage is a rating factor for many car insurance companies. The less you drive, the less risk you have of being in an accident. Also, how far you drive for your commute lets the insurer know what kind of risk you are at during the congested, high-risk hours.

Your insurer can also use the length of your commute to determine if you head into a metro area from your rural or suburban home. If you live outside of Los Angeles, but your commute is 30 miles, your insurer can predict that although your local area is low-risk, your commute into the heart of a very populated metropolitan area pushes your risk factor much higher.

Those who commute less than 15 miles each way daily pay 8% less, on average, compared to drivers with longer commutes, a CarInsurance.com analysis found.

Read Also: Can Onstar Find A Stolen Car If Not Activated

Average Car Insurance Rates By Company

Here’s a full-coverage car insurance annual premium ranking by company, according to Value Penguin:

- Erie: $1521

- Allstate: $3545

- Farmers: $4280

USAA is not ranked, as it’s limited to current and former military members and their families, but its coverage costs $1307.

For a full-coverage insurance policy, Erie is the cheapest in the rankings. For a minimum-coverage policy, Farm Bureau is the cheapest in the rankings.

How Much A Dui Raises Average Car Insurance Costs

|

Type of policy |

|

|---|---|

|

$565 |

$1,152 |

Our analysis found an average increase of at least $500 a year for full coverage car insurance after a DUI in every state, and in California and Michigan, the average increase is more than $3,000 a year.

Shopping around for the cheapest car insurance after a DUI can lessen the blow. Among the largest companies in our analysis, average annual rates for full coverage car insurance after a DUI ranged from $809 at American National to $8,589 at Encompass, a difference of more than $7,780 a year between companies.

Switching to your states minimum required insurance coverage is another way to lower the cost. For minimum coverage, we found average annual rates ranging from $292 at American National to $4,248 at Auto Club Group, a AAA insurance carrier. However, if you have a loan on your car, or its leased, you may be required to keep collision and comprehensive coverage.

Recommended Reading: How Many Cans Of Freon Does My Car Need

How Can Comparison Shopping Lead To Low Insurance Rates

You can check all the boxes of being a low-risk driver, but it is still essential to find an insurer with competitive pricing. Monthly car insurance costs can vary greatly, even for the most low-risk drivers.

If you know you have the advantage of being a low-risk driver, you know you deserve a great price, and you can likely find it by getting quotes from multiple insurance companies.

On the contrary, are your traits as a driver preventing you from getting the lowest rates? Here are some other ways to save money on car insurance.

Average Car Insurance Costs Uk By Car Insurance Group

Each car in the UK has an ‘insurance group rating’ which is used by underwriters to calculate car insurance premiums. There are 50 insurance groups, with the lower-numbered groups being cheaper to insure. The insurance group number depends on factors that determine how costly a car is to insure from the insurance company’s point of view, such as the value of the vehicle, cost of parts, security features, odds of theft and more.

When trying to save money on car insurance, it can really help to choose a car in a lower insurance group. In fact, the average cost of a car for insurance group 1 is more than 50% lower than prices for insurance group 50 cars.

Another way to look at this is the £ savings you can achieve with a lower insurance group car. A 20-year-old would save around £1,000 a year by choosing an insurance group 1 car instead of an insurance group 50 car a 50-year-old would save less in £ terms since the figures are lower overall, but could still save close to £500 a year with a group 1 car. To compare average car insurance prices by insurance group, see the data estimates in the following table:

| Insurance Costs by Car Insurance Group | 20 years |

|---|---|

| Get Quotes |

If you’re concerned with the cost of car insurance and are considering buying a cheaper-to-insure car, looks for cars in lower insurance groups . As shown in the table above, this can save you loads on car insurance premiums.

Don’t Miss: How To Make A Car Freshie

Your Driving Experience In A Relevant Country

While we touched on the importance of driving experience earlier, that last part is important. Unfortunately, many insurance companies do not count driving experience if it was earned in a country not among a select few.

If you fall under this scenario, youd be considered a new driver and pay the higher premiums associated with that.

How Accidents Affect Your Insurance Rates In Ontario

An accident wont necessarily impact your insurance premiums. For example, if another driver is involved and determined to be at fault, your rates will remain unaffected by the incident.

Your rate can still rise for other reasons but it wont be because of the accident itself.

If youre at fault, however, your rates may be affected and the accident will remain on your record for as long as 10 years in Ontario. The exception would be if its your first accident and your insurance policy includes forgiveness.

If your premiums do rise, they may do so by more than 30% depending on the circumstances. This may place you considerably higher than the average cost of car insurance in Ontario.

Also Check: Knocking Sound In Car When Driving

The Most Expensive States For Car Insurance

Florida, Louisiana, Michigan, New Jersey, and New York are the states with the most expensive average car insurance rates.

Just because you live in one of the most expensive states for auto insurance doesnât mean youâll automatically have to pay super high rates â comparing quotes from multiple insurance companies through Policygenius can help you choose the coverage thatâs best for your budget.

How Much Is Car Insurance For A 25

Hitting 25 years of age helps bring down the cost of auto insurance. The annual average nationwide for a 25-year-old is $737. That is for a standard liability policy that includes $50,000 for bodily injury per person, $100,000 max for all injuries and $50,000 of property damage . A bare-bones state minimum policy cost is a bit less at $657. You need a full-coverage policy for sure if your car is leased or financed has an average annual rate of $1,957.

Recommended Reading: Best Way To Protect Car From Hail

How Much Should I Pay For Car Insurance Per Month

You’re going to hear this answer a lot when it comes to insurance: it depends! There are many factors that determine how much you will pay each month. Things like where you live, your insurance history, your driving record, and age all have an impact on your monthly rate.

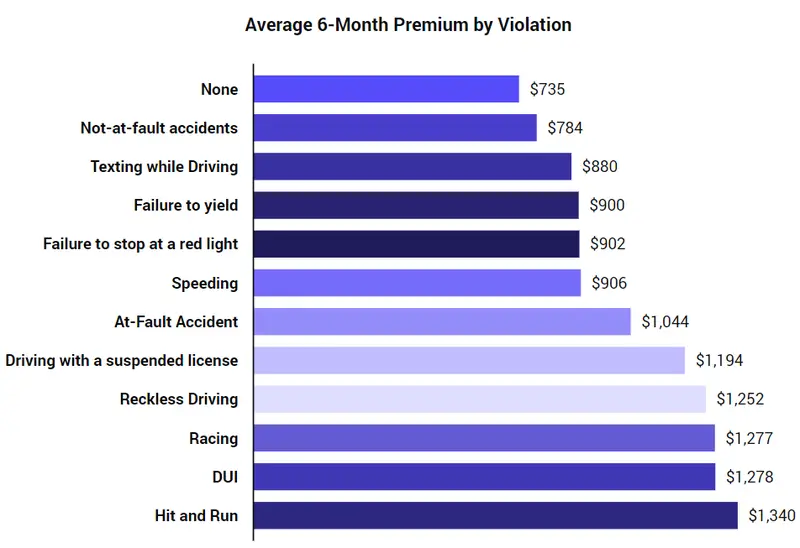

How Much Does My Driving Record Impact My Car Insurance Rate

If you have enough violations or accidents, you can become uninsurable according to some car insurance companies underwriting rules. For example, some insurers reject anyone with four or more chargeable accidents in three years, or more than three DUIs in seven years, or more than 15 points on the drivers motor vehicle record.

In general, a minor violation such as a speeding ticket can boost your rates, on average, by 20% to 43%. If you have a major violation like a DUI, your rates can go up 80% or more. The more risk you appear to be to your auto insurer, the more you will pay. Thats why its important to how to check your driving record and fix any errors.

Also Check: How Much Can I Make Selling Cars

Average Auto Insurance Cost For Young Drivers

The early twenties can be a special time in many peoples lives. For many, its their first time living away from home, launching a career, or attending college. Young adulthood also marks a time of change for car insurance premiums. As drivers gain more maturity and experience on the road, their rates decrease on average, though male drivers continue to pay higher premiums than female drivers.

Theres one interesting factor you might not expect in insuring young adults you might not expect: their educational status. Because college students are less risky drivers in general, college students sometimes pay lower insurance premiums than non-students of the same age and gender.Some insurance companies even offer special discounts for students who maintain a high grade-point average. Insurifys data on car insurance quotes for young adults revealsthat students pay a monthly average of around $433, while non-students pay about $376.

Why does the data suggest that college students pay more on average per month? There are a few reasons: students tend to be younger than non-students, and often remain on their family insurance policies. Students are also more likely to go to school in cities, where the cost to insure a car is often higher than in rural areas.

Average Car Insurance Cost By Coverage Type

As a general rule, the more a policy covers, the more car insurance costs.

You’ll often see quotes listed with numbers and slashes a 50/100/50 policy would cover up to $50,000 of injury protection for each person involved in an accident, up to $100,000 worth of injuries per incident, and up to $50,000 of property damages per incident.

As these coverage limits go up, your premium will increase. Every state has a different minimum requirement, making auto insurance coverage more expensive in some states than others.

Some policies go beyond the minimum coverage in a state, offering additional protection. Collision coverage can help repair your car if it’s damaged in an accident, and comprehensive policies can protect it in events like storms and disasters. However, these additional coverage types will increase your costs. According to Nerdwallet, additional coverage could raise your premium by about $1,000 per year.

Read Also: Car Care Credit Locations

Improve Your Credit Rating

A drivers record is obviously a big factor in determining auto insurance costs. After all, it makes sense that a driver who has been in a lot of accidents could cost the insurance company a lot of money. However, folks are sometimes surprised to find that insurance companies may also consider when determining insurance premiums.

Why is your credit rating considered? Michael Barry, senior vice president and head of media relations of the Insurance Information Institute, puts it this way:

Many insurers use credit-based insurance scores. Its a contentious issue in certain statehouses… insurers will say their studies show that if youre responsible in your personal life, youre less likely to file claims.

Regardless of whether thats true, be aware that your credit rating can be a factor in figuring insurance premiums, and do your utmost to keep it high.

Top 5 Most And Least Expensive States For Full Coverage Auto Insurance

One of the factors insurers use to determine rates is location. People who live in areas with higher theft rates, accidents, and natural disasters typically pay more for insurance. And since insurance laws and minimum coverage requirements vary from state to state, states with higher minimum requirements typically have higher average insurance costs. So, someone with the same risk profile as you may pay more or less than you for the same coverage if they live in a different state.

Here are the states with the highest and lowest average car insurance rates, according to Insurify.com.

Also Check: Best Paint For Car Interior

How Does Mileage Affect Car Insurance Rates

If you qualify as a low-mileage driver, you generally pay lower rates. So, what’s considered low mileage? If you drive 12,000 miles a year, or less, your insurance company will typically consider that to be lower than average, and you’ll likely pay a lower rate than those who drive more than that. Some insurers, however, make the low-mileage cut-off at 10,000 miles yearly and wait to hand out bigger discounts if youre under that number of annual miles. To get the best low-mileage discounts, which are about 8% on average, you typically must drive under 7,000 or 5,000 miles annually.

Based on a Los Angeles driver with a full coverage policy, the cost of a policy when the driver logged 20,000 or more miles was 36% more expensive than if just 5,000 miles were driven a year. In our example, the driver with less than 5,000 miles would save around $750 compare to the driver that was on the road for 20,000 miles or more.

Why Insurers Do Not Offer Month

Month-to-month car insurance is not available from any reputable insurer because of the potential losses that come with it. Drivers who need short-term insurance are considered to be high-risk, meaning theyre more likely to file a claim than those with standard insurance.

In addition, drivers in this demographic likely wont become long-term customers, and insurance companies wont be able to recoup the cost of a claim from a one-month premium.

Read Also: Who Takes Car Care Credit Card

Dont Pay More Than You Have To

Looking Fly on a Dime

Car insurance is necessary to protect you financially when behind the wheel. Whether you just have basic liability insurance or you have full auto coverage, it’s important to ensure that you’re getting the best deal possible. Wondering how to lower car insurance? Here are 15 strategies for saving on car insurance costs.

What Is The Average Car Insurance Cost

There are a wide variety of factors that influence how much car insurance costs, which makes it difficult to get an accurate idea of what the average person pays for car insurance. According to the American Auto Association , the average cost to insure a sedan in 2016 was $1222 a year, or approximately $102 per month. Keep in mind that this is a ballpark figure based on nationally collected data depending on your situation, it could be more or less.

Nationwide not only offers competitive rates, but also a range of discounts to help our members save even more.

Recommended Reading: How Much Is It To Change Interior Color Of Car

Poll: What Are The Most Important Factors When Buying Car Insurance

Participate in our poll so we can see what people really care about when buying car insurance. While price is clearly important to the thousands of readers who have found their way to this page, is it the most important factor?

Tell us the five most important factors for you from the list below . Once you enter your answer the results will show so you can compare to what other people have said they find most important.