Buy Or Sell A Used Vehicle In Ontario

Know the steps you need to take to buy or sell a used vehicle in Ontario.

Before you sell a used vehicle, you need to:

- buy a Used Vehicle Information Package

- make sure that the Vehicle Identification Number on your vehicle matches the number on your permit

- check to ensure the vehicle has no money owing on it

When you sell your vehicle, you need to give the buyer:

- the Used Vehicle Information Package

- a signed Bill of Sale with your name, the buyers name and address, the date and purchase price

- a completed and signed Application for Transfer this is found on the back of an ownership permit, under the vehicle portion

- a certificate that verifies the vehicle meets safety standards

- you will need to get this from a licensed mechanic

- look for a green and white sign with Ontario Motor Vehicle Inspection Station on it

You keep:

- your licence plates

- the plate portion of your permit

- you will need this if you want to register your plates on another vehicle

- you can also request a refund for any full months left on your plate stickers

Finding out if money is owed on a vehicle

A Used Vehicle Information Package will tell you if there is any debt/money owing on your vehicle.

If there is a lien on the vehicle, you can contact the Ministry of Government and Consumer Services, Personal Property Security Branch, for more information:

Toronto area:

Before buying a used vehicle you should:

When you buy a vehicle, ensure the seller gives you:

Quebec Will Give You A 000 Rebate On An Ev Even If Youre Buying It Used

If you buy through a private seller or if you acquire a car as a gift under a circumstance that requires you to pay tax, then all of those smaller lower-priced windows are lumped together for a total provincial tax rate of 12 per cent on the ICBCs valuation. The same value windows apply for the luxury tax rates of 15 and 20 per cent on higher-value vehicles.

Can I Tax My Car Without Insurance

No. When you tax your car, the DVLA checks official databases to make sure that the car has a valid MOT and insurance. Its a legal requirement to have all 3 for your car.

If youve just bought a new car, update your car insurance with the details of your new car before you tax it. That way, your insurance will be correct when the DVLA does its checks.

The only time when you dont need car insurance is if you register your car as off the road . In this case, you dont need to tax your car either.

Also Check: How Much Does It Cost To Get A Car Painted

How Car Road Tax Is Calculated

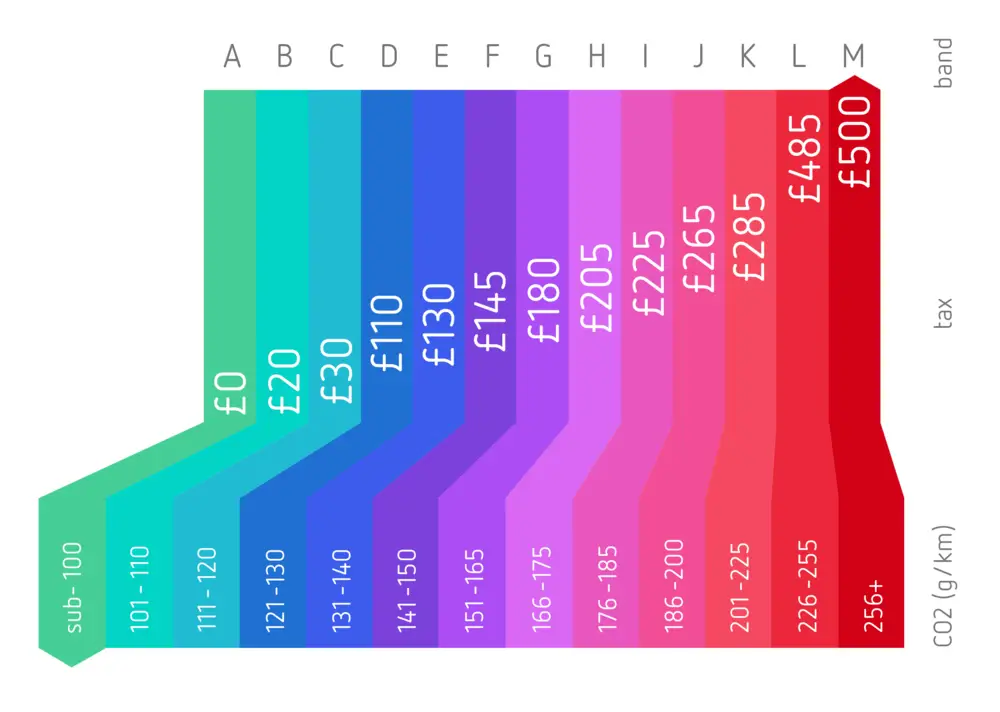

There’s a full guide to car tax on Parkers, as well as a car tax advice section, but in a nutshell, the current car road tax rates are calculated on CO2 emissions and price, those between 2001 and 2017 are CO2 emissions only, while those older than 2001 have rated based on their engine capacity alone.

For new cars, there are 13 CO2 tax bands which relate to different emissions levels and amounts of car tax payable. The list price cut-off is £40,000 or more. Cars registered from 1 April 2017 are liable for 12 months First Year Rate which is linked to a car’s CO2 emissions.

Pre-March 2001 cars are divided into two bands, based on engine capacity in cubic centimetres . The dividing point between upper and lower is 1549cc. If you’re not sure of your car’s engine capacity, you can check it using the Parkers car specs pages.

How To Calculate Florida Sales Tax On A Car

Find the sales tax percentage for your location, as this may increase the total sales tax fee to over the base amount of 6%. Then, youll multiply the cost of the vehicle by the sales tax percentage.

Lets say in your location the sales tax is at the base of 6%. Imagine you purchased a vehicle from a trade-in. The full price was $30,000, but you received a trade-in value of $5,000, a manufacturers rebate of $500, and a dealer incentive of $1,000. You would pay $23,500 for the vehicle.

In this case, Florida collects a 6% sales tax on $24,000. $24,000 is the advertised price minus the dealer incentive and trade-in allowance. This price does not factor in the manufacturers rebate. Based on this example, you would need to pay $1,440 in sales tax.

Remember that the total amount you pay for a car not only includes sales tax, but also registration, and dealership fees.

Also Check: How To Get Internet In Your Car

Car Tax Calculator: Your Questions Answered

Q: What is car tax and why is it so important? A: Car tax is something that all vehicle owners need to pay in order to allow them to park and drive their cars on roads in the United Kingdom.

Q: Why do I have to pay car tax? A: Drivers are required by law to purchase car tax every year. The revenue this raises is paid directly into the central government fund, which is used for projects to improve the roads for everyone these include new and upgraded roads and essential maintenance.

Q: What happens if I get caught with an untaxed car?A: If you are caught on the road in an untaxed vehicle, you could be fined up to £1,000. The DVLA can order untaxed vehicles on the street to be clamped and will impound them in some cases. When DVLA clamps an untaxed vehicle, the owner will be charged a £100 release fee. If you can’t show that the vehicle has been taxed at the time its released, you will have to pay a surety fee of £160 but you get it back if you can show the vehicle has been taxed within 15 days.

Q: Is my car taxed? How to check online A: You can check vehicle tax easily and online by going to the DVLA website and entering the vehicle registration number.

Q: How do I tax my new car? A: If you buy a brand-new car, the dealer will usually arrange for it to be registered, and will obtain a reference number from which you can get your car taxed.

Q: Do I still need a tax disc for my car? A: No, these were phased out in 2014.

Tax On Rebates & Dealer Incentives

Rebates and other dealer incentives are commonly offered to encourage buyers to purchase certain vehicles. For example, a $1,500 cash rebate may be offered on a $15,000 vehicle, dropping the out-of-pocket cost to $13,500.

In Florida, vehicle sales tax is applied before manufacturer incentives or rebates. In the example above, you would pay taxes on the $15,000 price of the vehicle, since this is the price before incentives.

However, the sales tax is applied minus dealer incentives. Imagine the incentive above is from the dealer, not the manufacturer. In that case, the car buyer would pay the sales tax on the car price of $13,500.

Don’t Miss: What Do I Need To Register My Car In California

How Much Will It Cost To Tax My Car

This depends on when a car is bought: with the exception of inflationary increases, changes to the road tax system are not retroactively applied, so the system that was in place when a new car was first purchased will stand for as long as it is on the road though annual rates are subject to inflationary increases.

If you’re buying a new car, then you will pay road tax based on the system that was introduced on 1 April 2017, but most recently adjusted for April 2021 onwards. If you are buying a used car that was registered before April 2017, then the rate you pay will be based on the system that applied at the time of registration, even if the car is still in production.

The first thing to know about the UKs current road tax system is that it is split into two main rates. There is one rate for a new cars first year on the road this varies depending on how much carbon dioxide it emits. After a new car has spent a year on the road, a second system applies this is not affected by CO2 emissions, but is determined by how much the car cost when it was new.

Note both the first and second year rates are affected by what powers the car – electricity, conventional fuel, or a combination of the two.

How To Use The Parkers Car Tax Calculator

Using the car Parkers tax calculator is easy! It’s also the perfect way to check the road tax on your own car, or any other vehicle you might be interested in.

Simply select your car make and model through the dropdown menus above, and on the third dropdown, you’ll be able to choose the bodystyle and year the car was manufactured. Don’t worry if the exact year isn’t there, as long as it falls within the range you’re presented with.

Finally, hit the blue ‘go to’ button and you’ll come to a new page, which will show you a list of all the tax rates for all the models that fall into the categories you’ve selected. If you’re not quite sure exactly what your car is, you can find out by using our Car Valuation Tool, which allows you to enter your registration number to tell you exactly what the make, range and exact model it is.

Recommended Reading: How To Get Sap Off Car

How Much Tax Do You Pay On A Used Car In Canadian Provinces

In most cases when anybody is buying anything, they want to know they how much the tax is going to be. It is no different when it comes to buying a used car. Throughout the different provinces in Canada, there are different rules and regulations. When it comes to the Provincial tax aspects, these apply to the provinces. Federal tax is Canada wide. Individuals want to know what their tax implications are going to be on their used car purchase. As it pertains to the province that they purchased it in.

Us Automobile Import Example

The following example shows a breakdown of the customs duties and taxes assessed on a U.S. manufactured 2005 model year automobile sold for export from the United States to a purchaser in Canada and imported in the 2005 calendar year.

Trade in example

While you may have only paid the total amount of $15,000, the gross price of the vehicle of $25,000 is the value for duty that must be declared to allow for the calculation of any applicable duties and taxes.

Don’t Miss: How To Connect A Car Amp To A Wall Plug

Repayments And Imputed Interest

When you lease a passenger vehicle, you may have a repayment owing to you, or you may have imputed interest. If so, you will not be able to use the chart.

Imputed interest is interest that would be owing to you if interest were paid on the money you deposited to lease a passenger vehicle. Calculate imputed interest for leasing costs on a passenger vehicle only if all of the following apply:

- one or more deposits were made for the leased passenger vehicle

- one or more deposits are refundable

- the total of the deposits is more than $1,000

What Happens To Your Road Tax When You Sell Your Car

Under the current system, any remaining road tax you have when you sell your car will not transfer to the new owner with the vehicle. Instead, the seller can get a road tax refund on any tax remaining on the vehicle, while the buyer has to pay to re-tax the car.

The tax refund on a sold car will be sent automatically when the DVLA receives notification that the car has been sold, scrapped, exported or taken off the road with a Statutory Off Road Notification .

Sellers are expected to inform the DVLA of any change of ownership straight away or face a £1,000 fine. If they dont, they could also still be liable for speeding or parking fines incurred by the new owner.

Information on whether or not a car is taxed is available online via the Government website. All you need is the make and model of the car plus the registration number.

You May Like: How To Clean Dirty Leather Car Seats

How To Record Motor Vehicle Expenses

You can deduct motor vehicle expenses only when they are reasonable and you have receipts to support them. To get the full benefit of your claim for each vehicle, keep a record of the total kilometres you drive and the kilometres you drive to earn business income.

For each trip, list the date, destination, purpose, and number of kilometres you drive. Record the odometer reading of each vehicle at the start and end of the fiscal period.

If you change motor vehicles during the fiscal period, record the dates of the changes and the odometer readings when you buy, sell, or trade the vehicles.

What Is A Vehicle Mileage Tax

A vehicle mileage tax, or vehicle miles traveled fee, would charge motorists a fee based on how many miles they drive. Simply put, if you drive a vehicle, you would pay money to the government for every mile you drive. The time period can vary, but is typically a vehicle miles travel fee is measured in a one year period. A vehicle mileage traveled fee can be used to raise revenue for transportation and infrastructure projects.

Recommended Reading: How Much Does A Car Salesman Make Per Car

How Big Is The Vehicle Miles Traveled Tax

The infrastructure bill includes $125 million to fund pilot programs to test a national vehicle miles traveled fee.

- National pilot program: This includes $10 million each year from 2022 to 2026 for a national vehicles miles traveled fee pilot program.

- State and local pilot program: This includes $75 million provided from the federal government to regional, state and local transportation agencies. The breakdown is $15 million provided each year from 2022 to 2026.

How Do I Get A Refund On Car Tax

Car tax doesnt get transferred when you buy or sell a car. If youre buying a used car, youll need to tax it afresh – even if the previous owners tax hasnt run out yet.

If youre selling a car, you can claim a refund for any full months of tax that are left. That means if you sell your car on the first day of the month, youll lose the tax for that whole month. But youll get a refund for any other months that are left.

You can also get a refund in other circumstances, like if your vehicle has been written off, scrapped or stolen.

To claim a refund, youll need to cancel your car tax by telling the DVLA that you no longer have the car or its off the road. Theyll then send you a cheque for the refund.

You can tell the DVLA that youve bought, sold or transferred a vehicle here: gov.uk/sold-bought-vehicle

Read Also: Car Amp To Wall Outlet

If I Want To Transfer My License Plate To A Replacement Vehicle What Do I Need To Do

Take the registration of your previous vehicle and the Bill of Sale for your replacement vehicle to the Department of Motor Vehicles and register your replacement vehicle and perform the transfer.

- You will not need to pay taxes on the replacement vehicle until the anniversary of the license plate/registration renewal month.

- Legislation was passed requiring the Department of Motor Vehicle to develop a system that would prevent customers from transferring a license plate to a vehicle after the first time without first paying the property taxes.

- This legislation was effective beginning January 1, 2006.

- See the current State Appropriations 2007-2008 DMV Proviso 36A.7 for more details.

How To Calculate Used Car Sales Tax

Join 1,972,984 Americans who searched DMV.orgfor car insurance rates:

Most people like to know how much something costs before they buy it, right?

So, when buying a used car, take note: The price tag might not reflect the full cost of your vehicle. Hidden costs like auto sales tax might catch you off guard you after your purchase.

Learn how you can calculate auto sales tax in advance so an unexpected cost won’t surprise you after you close the deal.

Don’t Miss: Club Car Years

First Tax Payment When You Register The Vehicle

Youll pay a rate based on a vehicles CO2 emissions the first time its registered.

This also applies to some motorhomes.

You have to pay a higher rate for diesel cars that do not meet the Real Driving Emissions 2 standard for nitrogen oxide emissions. You can ask your cars manufacturer if your car meets the RDE2 standard.

| CO2 emissions | Diesel cars that meet the RDE2 standard and petrol cars | All other diesel cars | Alternative fuel cars |

|---|

This payment covers your vehicle for 12 months.

Estimate The Number Of Personal And Business Miles Youll Drive

You can only deduct the cost of using your car for business, and your daily commute doesnt count as business mileage. Think about business trips, running business errands, and client visits when estimating the number of miles youll drive over the course of your lease.

Your financial forecasts can help you estimate your annual mileage. Say youre planning to open a new storefront in the next state over. Expecting to spend more time in your car over the three-year lease, you estimate the following.

| Year 1 |

|---|

Also Check: How To Add Bluetooth To Car