Collision And Comprehensive Coverage

Collision and comprehensive insurance are optional in every state, but may be required by your contract if you financed or leased a vehicle. These coverage types pay to either fix your car or reimburse you for its value if its stolen or damaged beyond repair.

Collision insurance pays for damage to your car after an accident, regardless of who was at fault. It will also pay for pothole damage.

Comprehensive insurance pays out if your car is stolen or damaged by anything other than a car accident. That includes damage from storms, floods, falling objects, explosions, earthquakes, vandalism or contact with an animal, such as hitting a deer.

Both comprehensive and collision coverage generally come with a deductible, which is the amount of the insurance claim youll have to cover before your insurer pays. The higher the deductible you choose, the lower your premium will be. However, since the payout is limited by your cars value, comprehensive and collision dont make sense for older cars with little cash value especially if you also have a high deductible.

» MORE:What is full coverage car insurance?

Collision Insurance Vs Comprehensive Coverage In Florida

When it comes to buying car insurance, too many options make things confusing for someone generally unfamiliar with insurance lingo. Buying the best insurance basically comes down to two main things: understanding how different types of insurance function and understanding how to personalize each type of insurance to your unique situation and needs.

Comprehensive and collision insurance are two different types of car insurance that are a great fit for many drivers on the road in Florida. They both can be very important to help repair any damages that your vehicle sustains after being involved in an accident.

However, comprehensive and collision insurance are typically two types of insurance that get confused with each other constantly. Many Floridians think that these two insurances are interchangeable, when in reality, they are not. While neither one is required to have in the state of Florida, they both could be a great asset to add to your existing insurance coverage.

What is Collision Insurance?How Do I Get Collision Insurance?

If you are interested in purchasing collision insurance, call the company that provides you with your regular auto insurance. They will talk to you about the different types of collision insurance policies you can choose from and help you to pick the right one for you.

How Much Does Collision Insurance Coverage Cost?What Does Collision Insurance Cover?What is Comprehensive Coverage?How Do I Get Comprehensive Insurance Coverage?

When Is Comprehensive Insurance Worth It

Comprehensive insurance is worth it for drivers who couldnt afford to replace their car themselves if it were totaled. Even if youre not leasing or financing your car with a loan, the cost of paying for comprehensive coverage is less than what youd pay to replace most cars.

But there are some drivers who can safely drop comprehensive coverage . You probably dont need comprehensive car insurance coverage if you own an old car that you could replace yourself if it were damaged, or that you wouldnt bother replacing at all.

If you have an old, beat-up car that you use for errands, or that your teenager drives to school, theres a good chance the cost of adding comprehensive coverage and paying a deductible if you need to make a claim isnt worth it.

Remember, you can have comprehensive coverage on one car and not another, even on the same policy.

Compare rates and shop affordable car insurance today

We don’t sell your information to third parties.

Recommended Reading: When To Switch Out Of Infant Car Seat

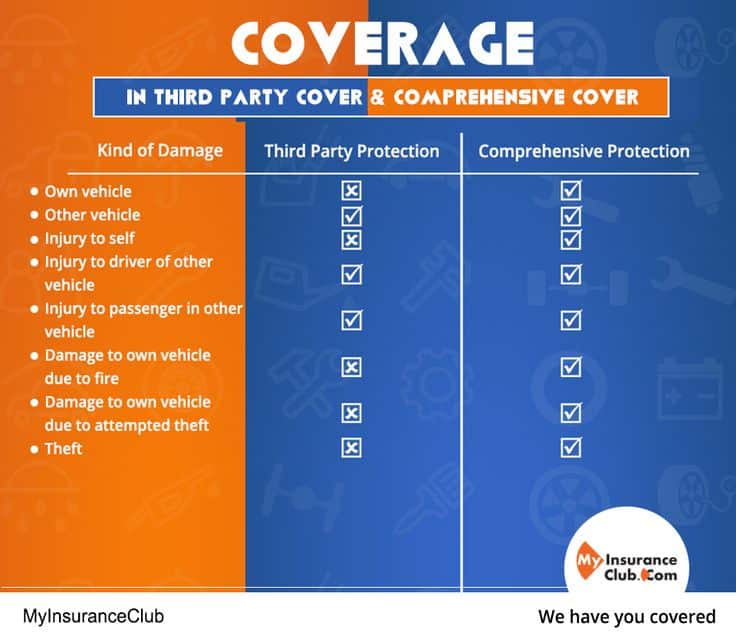

What Does Liability Insurance Cover

Liability car insurance covers you when you cause property damage or injuries to someone else. For example, if you cause an accident and the other driver breaks their arm, your liability insurance would pay for their medical bills and for damage to their vehicle. Liability insurance also covers your legal costs if you are sued because of a car accident.

When you buy liability car insurance, youll have the option to choose your policy limits. You will often see the limits written as a series of three numbers. For example, you might see it written as 20/40/10. That means:

- $20,000 of bodily injury/death coverage for one person per accident

- $40,000 of bodily injury/death coverage to more than one person per accident

- $10,000 of property damage coverage per accident

You are required to purchase liability car insurance in most states. Its a good idea to buy more than your states minimum requirement. Thats because you are still responsible for paying for any amount that exceeds your policy limits, and you could be sued for the balance. The best car insurance will include enough liability insurance to cover what you could lose in a big lawsuit.

How Can I Get The Best Rate With Geico

The Zebra recommends that you don’t pay for more insurance coverage than what you need. Find your vehicle’s value using Kelley Blue Book or the National Automobile Dealers Association to determine how much coverage you need. You might also choose to raise your deductible or move to a usage-based policy. Geico also offers many discounts, which can make your policy affordable.

A Geico comprehensive coverage policy can help you cover damages to your vehicle related to unexpected events. Always consider your insurance needs before choosing a policy to ensure that you have enough coverage.

You May Like: How Much Does It Cost To Get Car Windows Tinted

Am I Covered If Im Driving Someone Elses Car

Rental cars. Rental agencies offer damage waivers and liability policies. The damage waiver isnt insurance. Its an agreement that the rental agency wont charge you for damage to a car you rent.

You probably dont need the rental agencys liability policy. Your own auto policy will usually cover you while youre driving a rental car for personal use. It probably wont cover you if youre driving the rental car for work, however.

Before you rent a car, ask your agent whether you need the rental agencys liability policy and damage waiver.

Learn more: Do I need to buy insurance when I rent a car?

Borrowed cars. If you cause an accident while driving a borrowed car, the car owners insurance pays claims. If the owner doesnt have insurance, or doesnt have enough to pay for the damages and injuries you caused, your insurance will pay.

If you dont own a car, but borrow a car often, you can buy a nonowner liability policy that pays for damages and injuries you cause to other people while driving a borrowed car. It doesnt pay for your injuries or damage to the car youre driving.

If you borrow a car from a repair shop, your liability insurance will pay for damages to the car. It will also pay for other peoples injuries and damages if you’re at fault in an accident. Check your liability limits to make sure they’re enough to pay for the damages.

Does Comprehensive Insurance Coverage Include

This coverage includes support against situations such as the following:

- Theft of the car. You take care of the expenses when you are the victim of your car theft. Even if it suffered from partial theft or was damaged by criminals.

- Damage from natural disasters. The physical damage that the car can suffer from hail, storms, lightning, or more.

- Dents. People who are learning to drive often stand in their car when parking or backing up. Comprehensive insurance can take care of this type of damage, no matter how small.

- Broken glass and mirrors. Covers the cost of glass or mirrors that are broken after an accident. It doesnt matter if they are on the roof or the windows.

- Flood damage. If your city suffers from flooding and the car is exposed to this disaster, the insurance will cover your expenses.

You May Like: How To Wash A Car

What Is Comprehensive Car Insurance And What Does It Cover

Comprehensive car insurance is additional coverage that protects your car from loss or damage that’s not caused by collision-related incidents. That means this coverage can protect your car from things that are out of your control. Like what? Comprehensive coverage can protect your car against:

- Damage caused from falling trees or objects

- Damage caused by an animal

- Weather-related damage from lightning, windstorms, hail, rising water, earthquakes or fire

Although the list of hazards covered under Comprehensive coverage is generally offered by most insurers, you should still contact your insurance provider to get a better idea on what would be included in your specific policy.

Tip: If you already have Comprehensive coverage included in your car insurance but you’re not sure which hazards are covered, look for the “Specified Perils” section of your policy to find the types of damage your car is protected from.

What Do Collision And Comprehensive Insurance Cover

Collision and comprehensive coverage are important supplements to liability insurance:

- Collision coverage pays for your vehicles damage if you hit an object or another car.

- Comprehensive insurance pays for non-crash damage, such as weather and fire damage. It also reimburses you for car theft and damage from collisions with animals.

Collision and comprehensive car insurance are often sold together as a package by auto insurers. Heres how the coverage types compare.

| Collision insurance | |

|---|---|

|

Broken windshield |

Nationwide, 74% of drivers with auto insurance buy collision coverage, and 78% buy comprehensive coverage, according to the Insurance Information Institute.

Also Check: How To Calculate Finance Charge On Car Loan

Differences Between Comprehensive And Collision Insurance

Is There A Comprehensive Deductible If An Insurance Claim Is Filed

If your car got damaged during a natural disaster, or in any of the awful or unfortunate scenarios described above, the last thing you want to think about is whether you have the money to cover your comprehensive deductible.

If you are in a state that offers a zero dollar insurance deductible amount for comprehensive coverage, you wont have anything to worry about in the event of a so-called act of god. Your insurer will either fix your car, or offer you a payout for the value of your car, without any out-of-pocket expenses on your end.

Also Check: How Do You Sell A Car

Types Of Damages Covered By Comprehensive Auto Insurance

- Natural disasters, including storms, tornadoes, hurricanes, earthquakes and hailstorms

- Fire, civil commotions and explosions

- Damage from impacts with animals, such as a deer

- Broken or shattered windows or windshield

- Falling objects

- Acts of terrorism

Comprehensive insurance is usually subject to a deductible. This is the amount you have to pay before your coverage kicks in. For example, say you have a $500 deductible. If your car is damaged in a hailstorm and the damage costs $900 to repair, you would be responsible for $500 and your insurer would cover the remaining $400.

Who Needs Comprehensive Insurance

Drivers who lease or finance their vehicles typically need comprehensive covera ge because most lenders require it. If you fully own your vehicle, you can choose whether you want this coverage or not.

Even if comprehensive insurance isn’t required, it can be beneficial for many drivers. Without this protection, you have to pay for your vehicle’s repairs in the event of a claim. For example, if you don’t have comprehensive insurance, and your car was stolen, you would have to purchase a new car out-of-pocket.

Many people buy comprehensive insurance with collision insurance since both optional policies are included with full coverage insurance.

You May Like: What To Do After Replacing Car Battery

Not All Insurance Coverage Is The Same

Its important to note that different insurance companies have different policies when it comes to covering theft.

If you want confirmation that your insurance will cover your car in the event of catalytic converter theft, call them and ask directly.

Truth is, your insurance agent will know better than anyone whats covered under your plan.

The Bottom Line: Is Comprehensive Insurance Worth It

Not everyone has a choice about whether to get comprehensive car insurance. If youre leasing or financing your vehicle, its likely required. But if you could drop the coverage, consider the value of your car plus these pros and cons:

|

Pros |

|

|---|---|

|

Covers a variety of unexpected events. |

Costs more than minimum required coverage. |

|

Could save you a lot of money on repair or replacement costs if your car is newer and has a high value. |

Isn’t worth the price if your car is older and has little value. |

If you dont have a loan or lease on your car, comprehensive insurance likely isnt required. And if the vehicle isnt worth much, it may not make financial sense to keep the coverage. Compare the value of your car to your comprehensive deductible plus the amount you pay for the coverage. If theres not much difference, youre paying for coverage you dont need.

Yes, comprehensive coverage will pay to replace your car if its stolen. You’ll be paid the value of the vehicle at the time of the theft, minus your deductible.

Comprehensive insurance automatically covers you up to the value of your vehicle minus your deductible. That means all you need to decide is whether you need comprehensive insurance and how high your deductible should be.

If you dont have a loan or lease on your car, comprehensive insurance likely isnt required. And if the vehicle isnt worth much, it may not make financial sense to keep the coverage. Compare the

Read Also: How To Get Rid Of Dent In Car

How Your Comprehensive Coverage Works

Unlike liability coverage, comprehensive coverage covers damage to your car. There are no coverage limits to comprehensive insurance. Instead, youre covered up to your cars actual cash value.

Actual cash value is a term that means your cars value at the time of an accident, taking into account its age and any wear and tear. So, if the market value of your car was $20,000 when you bought it, its actual cash value might be closer to $15,000 after a few years.

When your car is damaged by something like a falling tree branch and you want to use your insurance to fix it, you can make a comprehensive claim and your insurance will cover the cost of repairs, or send you a payout for the value of your car.

Every company has its own process for filing a comprehensive claim, but generally you will have to:

Let your insurance company know about your cars damage

Document the damage to your car with pictures and notes

Work with your insurance company while it investigates the claim

Accept the claim settlement

Fortunately, comprehensive claims often take less time than claims involving another driver, since you dont have to wait while the insurance company figures out who was at fault.

What Is Comprehensive Coverage And What Does Comprehensive Insurance Cover

Key takeaway

- Comprehensive coverage directly pays for the damages your car bears from hail, storm, fire, and vandalism but does not cover damages caused by a collision.

- Although comprehensive coverage is an optional coverage option from your vehicle insurance but your lender may need it

- Comprehensive coverage is a good option for new model cars as old cars may require additional coverage and this will ultimately increase your overall cost.

Comprehensive coverage helps you pay for the replacement of your vehicle or repair the damage done to your car as a result of any reason other than collision. This is why comprehensive coverage is also referred to as other than collision coverage.

This simply means that it usually covers damages of falling objects like trees, damages as a result of vandalism, or fire. Although its an optional coverage option when it comes to vehicle insurance. Plus, when you lease or finance your vehicle, your financer or lender would likely need comprehensive coverage.

Learn how comprehensive coverage protects your vehicle, the limits, and deductibles applied on the coverage, and how it is different from the collision coverage.

Recommended Reading: What Year Is My Car

What Does Comprehensive Car Insurance Not Cover

Now comes an interesting section, we know what comprehensive insurance covers. But it is also important to know what it does not cover to avoid confusion in the future. Here are the things that comprehensive auto insurance does not cover:

- If your car gets into a collision with another car, object, or human being

- Expenses to repair another drivers vehicle from the collision

- Medical expenses of the driver and other passengers in the car after an accident

- Collision caused by a driver who was under influence at the time of the accident

- If the accident is caused by an unlicensed driver

- Repair cost of wear and tear in your car

What Is A Comprehensive Deductible And How Does It Work

Your comprehensive car insurance is one of the types of coverage that requires a deductible. A comprehensive deductible is the amount of money that you have to pay toward a claim.

You choose your comprehensive deductible amount when you buy insurance, but its usually set at $500 or $1,000. A higher deductible means lower rates, but it also means youre agreeing to pay more out of pocket if your car is damaged.

Lets say that you set your comprehensive deductible to $1,000. That means youll have to pay that amount out of pocket towards a comprehensive claim, so it wouldnt be worth it to file a claim on any damage that would cost less than $1,000 to fix.

If a tree falls on your car and causes $2,000 worth of damage, youd use your comprehensive coverage to pay for it youd just be responsible for paying $1,000 of the bill yourself in order to have the rest of the repairs covered by insurance.

Recommended Reading: How To Get Car Out Of Impound