Amortizing Your Prepaid Finance Charges

You pay your prepaid finance charges at the beginning of your loan, hence the term prepaid. Still, you pay back the principal on your loan with your monthly payments, so you can think of your prepaid finance charges as another type of interest charge. Because of how car loan interest works, you pay more interest at the beginning of your loan than near the end as your loan balance decreases, a process known as amortization. So, under APR you pay your prepaid finance charges via amortization as well.

In our example, the $200 of prepaid finance charges are paid down via amortization as the graph below depicts .

The orange portion of the lines depict the portion of the finance charge for each monthly payment that is made up of the prepaid finance charges. As you can see, both the blue interest charges and the orange prepaid finance charges decrease over the course of the loan as you pay down your loan balance. If you add up all the interest charges and prepaid finance charges, you will find that the total finance charge is $2,631, making the total of payments for this loan $17,631 .

Auto Loan Length Still Matters

Even with an identical APR, youll end up paying more in interest over the course of a longer term loan. For instance, a buyer who takes out a $25,000 loan with a 3 percent APR for 48 months will have a higher monthly payment by more than $100, but will end up paying nearly $400 less in additional interest versus the same loan at 60 months. Use an auto loan calculator to decide which is the better deal.

Why Should I Know My Daily And Monthly Apr

The balance on your credit card might change on a daily, weekly, and monthly basis. You can better understand how much of your money is going to interest you by calculating your daily and monthly APR. Understanding how much of your money goes to interest rather than your balance may drive you to pay off your debt or assist you in deciding which purchases are worthwhile to place on your credit card. You may learn more about the interest youre earning over time and utilize this information to make some financial decisions by breaking down your interest rates on a daily and monthly basis.

You May Like: What Year Is My Club Car Golf Cart

Time To Get A Car Loan

One final factor that can wreak havoc with your brain when trying to find a fair and reliable car loan with a good APR is that sometimes hidden fees and variable rates are sometimes written into the fine print so be careful who you decide to work with. It is always your choice to shop around and there are many honorable independent lenders, but you may pay more with a manufacturers lending arm but you at least know their first priority is to get you to buy another one of their new cars. And using that as leverage can sometimes lead to better service and a better purchasing experience.

The Difference Between An Interest Rate And The Annual Percentage Rate Apr On An Auto Loan

Most car loan contracts list two rates, your APR and your interest rate.

Interest rate or note rate is the lower of the two rates and represents the cost per year of borrowing money NOT including fees or interest accrued to the day of your first payment.

is the higher of the two rates and represents the total cost of financing your vehicle per year , including fees and interest accrued to the day of your first payment. APRs are useful for comparing loan offers from different lenders because they reflect the total cost of financing. The higher the APR, the more youll pay over the life of the loan.

Mathematically, these rates will give you the same monthly payments and will result in you paying the same amount for your car in the long run. However, the higher the APR, the more youll pay over the life of the loan. Lenders will give you both rates on your car loan paperwork so that you can better understand your loan.

The distinction between these rates is simple in many ways, but it is important that you understand how to interpret each.

You May Like: How Much Commission Does A Car Salesman Make

What Does Apr Mean For A Car Loan

When it comes time to finance a new or pre-owned car, several terms are important to understand. One such concept is the annual percentage rate, or APR. The APR expresses the total cost of borrowing and may differ among lenders based on how they set their rates, and the fees they charge. Your credit score and the amount you borrow will also affect the APR on your loan. Learn the APR meaning for car loans and how to use this information when purchasing your next auto.

What Is A Car Loans Apr

The of a car loan reflects the total cost of taking out a car loan. An APR provides you a broad overview of all the bells and whistles you may have rolled into the loan, such as the:

- Principal amount youre borrowing

- Interest youll pay on the principal

- Other fees and charges associated with taking out the loan and

- Anything else you rolled into the loan, such as sales tax, registration fees, and extended warranties.

As with interest rates, a higher APR means youll pay more money over the course of a loans term compared to taking out a loan with a lower APR.

The Federal Truth-in-Lending Act, or TILA, requires all lenders to provide consumers with a loans APR. This makes it easier for you to compare rates between lenders to find the best and most affordable loan for you.

Sample Truth-in-Lending Disclosure for a car refinance loanAuto Refinance Calculator

Recommended Reading: How To Read Club Car Serial Number

Is 29 Apr Good For A Car

Dealerships will often advertise very good interest rates on new cars: 2.9%, 1.9%, sometimes even 0%. What they leave in the fine print is that these rates are only available to car buyers with the best credit-that may mean a score of 750 or better.

Similarly, How do you calculate interest on 60 months? To calculate your monthly car loan payment by hand, divide the total loan and interest amount by the loan term . For example, the total interest on a $30,000, 60-month loan at 4% would be $3,150.

What is a good interest rate for a 60 month car loan? The average new car’s interest rate in 2021 is 4.09% and 8.66% for used, according to Experian. … Loans under 60 months have lower interest rates.

What Determines Your Interest Rate On A Car Loan

Interest rates are not the same for every person and are determined based on several factors. Here are some of the things that may affect your interest rate when financing your vehicle:

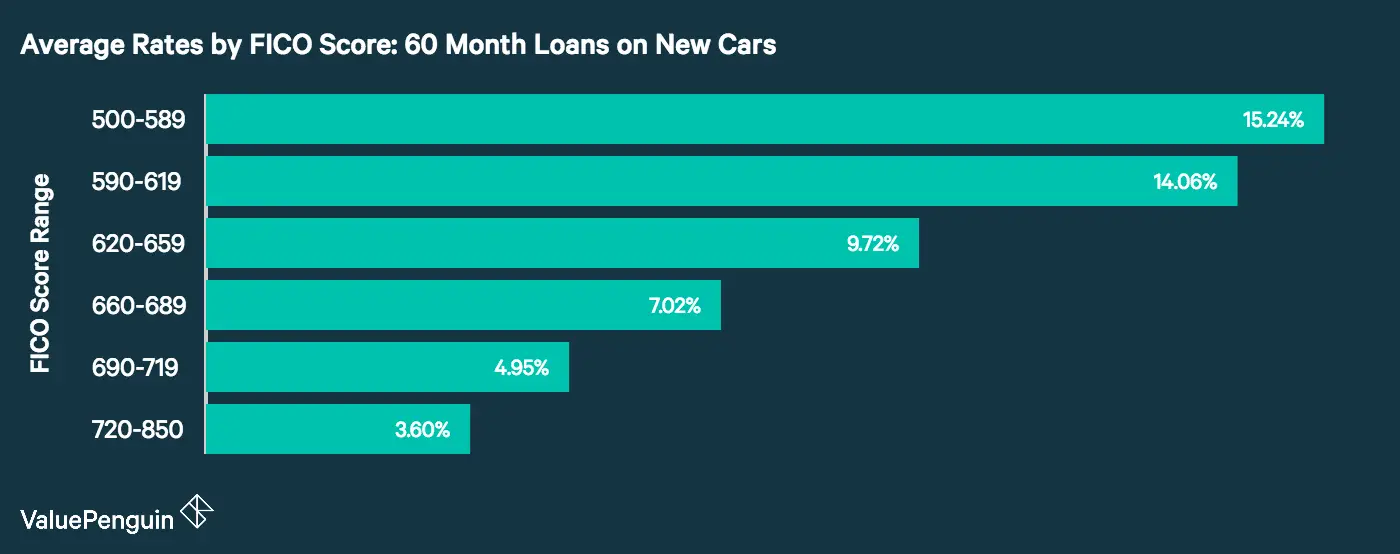

Typically, the higher your credit score, the lower your interest rate will be. Thats because a high credit score indicates that you have a good history of paying off your debts on time, so youre a less risky borrower. If youd like to check your credit score, you can use Chase Credit Journey to find your score for free without hurting your credit.

The vehicle

The vehicle you purchase may also affect your interest rate. New vehicles tend to have a lower interest rate, sometimes even as low as 0%, while used vehicles usually have a higher interest rate.

Loan term

Longer loan terms tend to have higher interest rates than short-term loans. So, while you will have to pay a higher amount each month on the principal, with a short-term loan , you may save a lot of money on interest.

Lender

Interest rates vary. You should compare interest rates from several lenders to see which ones offer the best prices. You can also finance your vehicle through the vehicle manufacturer whose rates may be different.

Don’t Miss: Symptoms Of Low Freon In Car

How To Calculate Credit Card Apr Charges

Its critical to understand how your credit cards Annual Percentage Rate is calculated and applied to your outstanding balances if you want to keep your overall credit card debt under control.

The Annual Percentage Rate on your credit card is the monthly interest rate you are charged on any unpaid credit card balances. You can better grasp how compound interest affects how much you pay back in interest by calculating the daily periodic rate on your credit cards. Your APR may be broken down yearly or monthly on your monthly bill, but you may do it yourself and break it down to a monthly APR.

This information could assist you in deciding which credit cards to apply for. This information could assist you in determining which credit cards you should pay down soon and how much it costs you to borrow from your credit card company each day. Monthly APR can also help you figure out how much it costs you to carry a loan each month if you dont pay it off completely.

Calculating Apr On A Car Loan

To calculate the estimated APR on a car loan, weve put together a method using computer spreadsheet software. To go that route, youll need the following information:

- Loan amount The total amount you plan to finance, typically the price of the vehicle, minus any down payment or trade-in

- Loan term The length of your auto loan

- The loans interest rate

- Certain fees, like origination fees

The first step in calculating APR yourself is in calculating your estimated monthly payment.

If you already know your estimated monthly loan payment, you can skip this step. If you dont, you can easily estimate your monthly car payment on a spreadsheet by typing the formula below into a cell.

=PMT

The result is your estimated monthly payment. It will be a negative number, but dont worry. You didnt make a mistake. Keep this number handy for calculating your APR.

Lets say you want to finance $13,000 with a loan term of 60 months and an interest rate of 4%. Heres what your formula would look like with those numbers plugged in.

Using this example, your spreadsheet would calculate your monthly payment to be $239.41.

RATE*12

Using the monthly payment you calculated , heres what youd enter into the cell for this loan example.

=RATE*12

Entering the formula above would calculate your estimated APR at approximately 5.6%.

Don’t Miss: Can I Pause My Car Insurance Geico

How Car Loans Are Financed

Financing a car loan is a little more complicated than telling a bank how much you need to borrow, receiving that money, handing it to a dealership, then paying a monthly bill at least at first.

In essence, there are multiple components that, added together, constitute what goes into your loan and how much debt youre on the hook to repay.

The first and biggest chunk of a car loan is the principal, the money you borrowed and agreed to pay back in order to purchase the vehicle. For example, purchasing a car for $28,000 means the loan principal balance is $28,000. You can reduce the principal by paying a down payment or trading in your existing vehicle .

Principal:Interest:

The interest is the amount of money youll pay on top of the principal in exchange for taking out the loan. Since youre effectively buying a product by taking out a loan, interest is how lenders earn a profit and stay in business.

Car loan interest is amortized, or front-loaded. As a result, the bulk of your early payments goes toward paying down your loans interest, with the remainder being applied to the principal. As you pay your loan over time, more of your payment will be shifted to pay down the principal until the loan is fully paid off.

Your car loan may also include certain fees and charges that stem from buying a car, such as:

- Prepaid finance charges

- Origination fees

- Guaranteed Asset Protection.

Is 2299 A High Interest Rate

High interest-rate cards like this are generally marketed to people who have less-than-stellar credit scores of around 650 or below, but even these customers should refrain from opting for a sky-high interest rate. Once you get above 22.99%, you’re better off getting a secured card, Harzog says.

What kind of APR should I expect? Good : 5.06 percent for new, 5.31 percent for used, 5.06 percent for refinancing. Fair : 11.30 percent for new, 11.55 percent for used, 7.82 percent for refinancing. Subprime : 17.93 percent for new, 18.18 percent for used, 16.27 percent for refinancing.

Is 11 percent interest good for a car?

In the US an 11% car loan interest rate would be considered a high average interest rate. Someone with good credit would get anywhere from 0% to 6% depending on the type and age of the car they are buying.

How can I lower my APR on my car? How to lower APR on a car loan

Also Check: Carvana Sell Leased Car

Example : An Alternative Way To Calculate Apr For A Car Loan

Another way to calculate your APR is to think about what your note rate and APR actually reflect.

Your note rate reflects the interest charges you pay per year for the amount you borrow whereas your APR reflects the portion of your finance charge you pay per year for the amount you finance . The equations below represent these concepts.

You cannot really use these equations directly to calculate your note rate and APR, because your loan amount falls during the course of your loan as you pay it down, and as you pay off your loan balance your interest charges fall in accordance with amortization .

However, you can estimate your note rate and APR using an average of your loan balance over a 12 month period.

You would pay $838.89 in interest charges under the note rate during the first year and $905.02 in interest charges + prepaid finance charges in your first year under the APR. To calculate an estimate of the note rate, you can divide the $838.89 by the average loan balance over the first year, which is $13,978. You will get a note rate of roughly 6% .

And if you want to estimate the APR, you can divide the $905.02 by the average balance of the amount financed over the first year, which is $13,888. Your estimated APR will be about 6.52% , which is very close to the 6.55% APR in this example.

Search Auto Trader For

Copyright © Auto Trader Limited 2022.Auto Trader Limited is authorised and regulated by the Financial Conduct Authority in relation to consumer credit and insurance mediation activities. Our FCA firm reference number is 735711.Auto Trader Limited is a credit broker and not a lender. Representative finance examples are for illustrative purposes only. Finance is subject to status. Terms and conditions apply. Available to 18s and over. UK residents only. Auto Trader receives a fee from retailers advertising finance and may receive a commission from commercial partners for introducing customers to finance products. These fees and commissions do not influence the amount a customer pays.

Read Also: Car Rental Discounts Aaa Aarp

How To Find A Car Loan With A Low Apr

The car itself shouldn’t be the only thing you’re shopping for: Shop for your car loan. Get pre-approvals from several lenders, and compare them to find the best offer for you.

Good places to start looking include banks or local where you already have a relationship. There are also a variety of other online lenders and banks making auto loans see Insider’s list of the best auto loans of 2021 to get started.

Start getting pre-approval offers up to a month before you want to buy. Depending on the lender, these approvals are generally valid for 30 to 60 days. Once you start submitting applications for pre-approvals, you have 14 days to submit as many as you’d like and have them appear as one inquiry on your credit report.

The best way to find a low interest rate on a car loan is to shop around, and compare pre-approval offers from several different lenders. If you’re still not impressed with your offers, improving your credit score could be a big help. You may also reduce the amount you’ll need to finance by saving up more money for a down payment, 0r shortening your loan term by paying more per month.

Why Do Average Interest Rates Vary For Loans For New And Used Vehicles

Usually, the interest rate for a loan for a used car is going to be a little more than one for a new car because used cars can be viewed as less reliable than new cars. Finder.com shows that certain banks won’t even approve a loan for a car that’s older than 10 years or has a very high amount of mileage. The lender sees such vehicles as a risk because they are more likely to breakdown, making it difficult or impossible for the borrower to continue paying back the loan.

For example, a bank might offer a 3.74 percent rate for a new model but up that rate to 4.24 percent for a 2008 model even if it’s the same price. Used cars are usually less expensive than brand new models, so you may face a higher interest rate, but still save money in the long run. Longer auto loan terms on older models are typically not allowed for fear that the car won’t make it to the end of the payment calendar.

Also Check: What Kind Of Car Did Columbo Drive In The Series