Find The Cheapest Insurers After An Accident In Each State

| State |

|---|

Rates increase even more when an accident involves property damage of $2,000 or more. Car insurance premiums increased 56% with that sort of accident on a driving record, based on a four-state study. Rates only increased 47% in those four states with an accident where a bodily injury claim was made.

Not All Accidents Make Your Insurance Rates Go Up

Not all car accidents are chargeable. Here are typical examples of non-chargeable accidents:

- Your car was legally parked when it was damaged.

- Your car was struck in the rear by another vehicle and you were not convicted of a moving traffic violation in relation to the accident.

- Your car was struck in a hit-and-run accident.

- The driver of another car was convicted of a moving traffic violation associated with the accident, but you were not convicted of a moving traffic violation.

- The accident was caused by a collision with an animal or fowl.

- The damage was caused by falling objects or flying gravel or missile-like objects.

- The accident happened when you were responding to an emergency and you are a volunteer or paid member of the fire department, first aid squad or law enforcement agency.

- Your car insurance company was able to recover 80% or more of your collision insurance claim through subrogation .

- You were reimbursed by the person who caused the damage.

- There is a court judgment for the accident against the person who caused the damage.

- Accidents in which claim payments are made under the personal injury protection coverage and no payments are made under liability or collision insurance.

How Long Does An Accident Stay On Your Insurance

Car insurance companies consider multiple factors when determining your rates, including your driving record. Your history as a driver holds a lot of weight, as it helps insurers assess risk and better understand how likely you are to file a future claim. If you have a recent auto accident on your driving record, it’s something that could translate to higher ratesespecially if it’s accompanied by moving violations, such as speeding tickets.

The silver lining is that an accident’s impact on your premiums isn’t permanent. Many insurance companies only consider the last three to five years of your driving record when calculating your rates, although the exact length of time can vary by state and insurance company.

To be clear, that doesn’t necessarily mean that a previous accident will be removed from your driving record after a period of timeit’s just to say that insurers typically won’t factor it into your rates. In other words, an accident from six years ago might still be on your driving record, but it might not have a huge impact on your car insurance ratesassuming you’ve continued to demonstrate responsible driving since then.

Wondering how long an accident will stay on your insurance? Let’s first unpack how it affects your insurance rates in the short term.

Also Check: What Kind Of Commission Do Car Salesmen Make

What If I Have Accident Forgiveness

In general, you may qualify for accident forgiveness if:

- You and all other drivers of the car have a clean driving record

Then you may qualify to have your first at-fault accident forgiven. That means your auto insurance premiums may not go up because of an at-fault or partially at-fault accident*.It is important to know that insurance companies will only forgive one accident. If you have a second accident, expect to have your premium increase.

Your Insurance Company Can Help You With The Repairs

It can take awhile for insurance companies to settle. By reporting an accident with another vehicle to your insurance company , your coverage will allow you to seek immediate repairs to your vehicle rather than waiting until the dispute is settled. In addition, your insurance company and advisor will advocate for a fair claims settlement.

You May Like: Can I Use My Synchrony Credit Card Anywhere

When Not To File A Claim

Gusner and most industry experts agree that filing a claim is probably a mistake if the vehicle repair costs are under or just above your deductible. Instead, it’s smarter to pay out-of-pocket and avoid any surcharges generated by the claim.

“Keeping small claims to yourself, and away from your insurer and claims history, can help you keep future rates down,” Gusner says.

But, she adds: “One caveat is that your policy may require you to report any accidents. This may be noted in your file somewhere – be sure to ask if it will be so it’s clear you are not yet making a claim but are prepared to pay for repair costs at this juncture.”

How To Prove Youre Not At Fault

An auto insurance company might require proof from you that an accident was not your fault and therefore not chargeable. Satisfactory proof can vary among companies but often includes:

- A police report that says who was at fault.

- A statement from the other drivers insurance company accepting fault.

- A legal document showing that you were reimbursed for damage.

- A drivers written statement, under penalty of perjury, attesting to their fault.

Don’t Miss: Florida Dmv Replacement Title

Which Companies Offer The Best Insurance Rates After An Accident

After an accident, your insurer will have an impact on how much your rates go up. Different insurers boast different offerings when it comes to how they treat accidents.

Many companies offer some level of “accident forgiveness “, meaning they allow for the first accident to be ignored in terms of raising rates. Usually, accident forgiveness is either an add-on that costs more or a perk offered after multiple years often five or more with a clean driving record. For example, State Farm’s accident forgiveness goes into effect after nine years without an accident.

Across five of the largest insurers, State Farm had the smallest rate increase, 24%, after an accident that led to a bodily injury claim. Allstate, Progressive and Geico rates for full-coverage auto insurance went up at least 50% on average.

| Company | |

|---|---|

| $3,194 | 58% |

Insurers also put certain thresholds on what is considered an accident when it comes to raising rates. For example, in order to say an accident occured, State Farm requires a claim to be over $750 between liability and collision coverages. In addition, the driver needs to be at least 50% at fault. Geico is similar, with a $500 threshold in most cases.

Pay Attention On The Road

In other words, be a safe driver. This should go without saying, but in todays age of increasing in-car distractions, this bears mentioning as much as possible. The more mindful you are, the more accidents or moving violations youll be able to avoidevents that raise your insurance rates. Travelers offers safe driver discounts of between 10% and 23%, depending on your driving record.

For those unaware, points are typically assessed to a driver for moving violations, and more points can lead to higher insurance premiums .

Read Also: Who Invented Golf Carts

Car Insurance After Marriage

If you decide to tie the knot, the cost of your car insurance after marriage will likely drop. Insurers love statistics, and data shows that married drivers get in fewer accidents. Married people also tend to buckle up more often and obey the rules of the road.

Some savings come as you combine policies and get multi-car insurance. However, even you marry a spouse who doesnt drive, your rates can still drop dramatically about 10% on average.

Why Does Insurance Go Up After A Car Accident

Insurance goes up because insurance companies do not want to lose money. Money is often the driving force behind many decisions made by insurance companies. Drivers that cause accidents are more likely to cost an insurance company money over time. Insurance companies increase their rates for risky drivers to offset actual or potential payouts they might need to make because of that driver.

Insurance companies might use several tools when deciding whether to raise your rates. After an accident, the insurance company can examine the details of the crash to decide whether to raise your insurance. They can also use your driving record. Drivers with a history of accidents or unsafe driving are more likely to see their rates go up. At the end of the day, the insurance company will weigh the drivers propensity for risk against the cost of insurance. A riskier driver will be charged more.

Also Check: How To Make Freshies Car Scents

What If My Insurance Goes Up After An Accident And I Cannot Afford It

Many people wonder what they will do if they can no longer afford their insurance after an accident. If your insurance becomes too expensive, you might have to cancel it. Unfortunately, no insurance means no driving. Your license may still be valid, but you cannot drive your car without insurance.

You can speak with an attorney about your accident, and they might be able to help you communicate with your insurance company. Insurance companies are often looking for someone to blame for an accident, and your attorney can help you prove that the blame does not lie with you.

For example, crashes must be reported to the police, and the police write accident reports. These reports often contain information about who likely caused the accident if the police can determine that detail. An accident report that shows you likely did not cause the accident can be crucial to keeping your insurance rates down.

How Long Does It Take For Car Insurance To Go Down

That depends on your previous driving record and whether you have any at-fault incidents to your name. In general, car insurance companies only consider the past three to five years of your driving history. So, while accidents wont necessarily be removed from your record, they probably wont factor into your rate after that length of time.

Recommended Reading: Add Bluetooth To Factory Car Stereo

How Do I Keep My Rates Low After An Accident

If youve had a car accident, there are some things you may be able to do to keep your car insurance rates from rising.

First, explore discounts that you may have overlooked. Check with your insurer to make sure youre receiving discounts youre eligible for.

If you havent already signed up for paperless billing, now might be a good time to take advantage of the discount you may receive with this option.

The number of miles you drive annually is one factor that goes into calculating your insurance rate. Check with your insurer to make sure your rate correctly reflects your annual mileage.

Consider a usage-based insurance that tracks different elements of your driving habits and sets your rate accordingly. Better driving habits equate to lower rates.

Ask about multi-policy discounts if you have all your policies with one insurer.

Check into military and government employee discounts.

Another tactic that might be worth pursuing if youve had an accident but are looking for ways to decrease your car insurance rate is to increase your deductible. The higher your deductible, the lower your premium.

Look into how much insurance youre carrying on the car. Its worth your time to determine how much coverage you need. If your car is worth less than the deductible plus your annual total for car insurance, it could be time to rethink your coverage.

And another thing to scrutinize is what kind of car you drive. Some cars are cheaper to insure than others.

What Else Causes An Insurance Increase

Rate increases can vary by insurance company and state laws, but here are some common factors insurance companies consider:

- Severity of the accident. The overall severity of an accident and cost of a claim can impact rates. A minor fender bender typically doesnt have the same impact as a major accident.

- Your driving history. Car insurance companies like safe drivers. If youve gone several years with no accidents or moving violations, your insurance company may not raise your rates for a minor accident.

- Policy details. Your car insurance policy might include accident forgiveness, which generally means your insurer wont raise your rates after an accident.

Don’t Miss: How To Car Salesmen Get Paid

How To Find Cheap Car Insurance After An Accident

Car insurance rates vary among insurers. If you see an increase in your auto insurance rates after a car accident, there may be other companies that could offer lower rates for the same coverage. You can start looking for a new insurance company but make sure you compare quotes from at least 3 insurers to get the best deal.

Timing Of Insurance Increase

As mentioned above, most insurance companies will remove the accident surcharge within five years of the collision if you have no further accidents during that time. The Zebra notes that the farther the incident occurs to your policy renewal date, the longer you can expect to pay more money for auto coverage.

While three years is the average duration of an auto insurance increase after an accident, you may have to pay a higher premium for more than 36 months after a bodily injury claim, accident involving driving under the influence, reckless driving ticket or accident, accident causing serious bodily injury or death to another person, or several violations within a short time period.

In any of these cases, the state may require you to get high-risk, or SR-22, insurance. You might be unable to get coverage from a traditional auto insurer at an affordable rate. You might also have to serve a license suspension before you can qualify to get car insurance again. You have to prove that you have liability insurance to obtain driving privileges with an SR-22.

Don’t Miss: What Is An Equus

How Long Does An Accident Stay On Your Record

On average, car accidents stay on your driving record for three to five years. However, the exact length of time depends on your state and the severity of the incident. For example, in New York State, an accident or traffic violation will stay on your record until the end of the year when the incident occurred, plus three years after. In Oregon, an accident or violation will remain on your record for five years.

If youre involved in a DUI or reckless driving crash, expect the incident to stay on your record for up to 10 years. You can check your states Department of Motor Vehicle website for information about driving record requirements where you live.

Factors That Are More Likely To Cause Insurance To Increase After A Car Accident

No two car accidents are exactly the same, and the various details of your accident might play a role in how your insurance rates change. First and foremost, your insurance rates will almost undoubtedly go up if it is determined that you are at fault for the accident. Insurance companies do not like high-risk drivers, and being deemed at-fault for a crash is like a red flag for insurance companies.

Other factors include how serious injuries and damages were after an accident. Was anybody injured? Were their injuries severe or mild? Was there property damage? Was the property damage extensive? All these questions are considered by your insurance company when they adjust your rates after an accident. A more serious accident with severe injuries or damages will likely raise your insurance rates considerably. This is especially the case if you are also at fault for the crash.

Some insurance companies also forgive first-time or low-dollar accidents if you otherwise have a history of safe driving, so check your policys terms and conditions.

Read Also: Getting Hail Dents Out Of Car

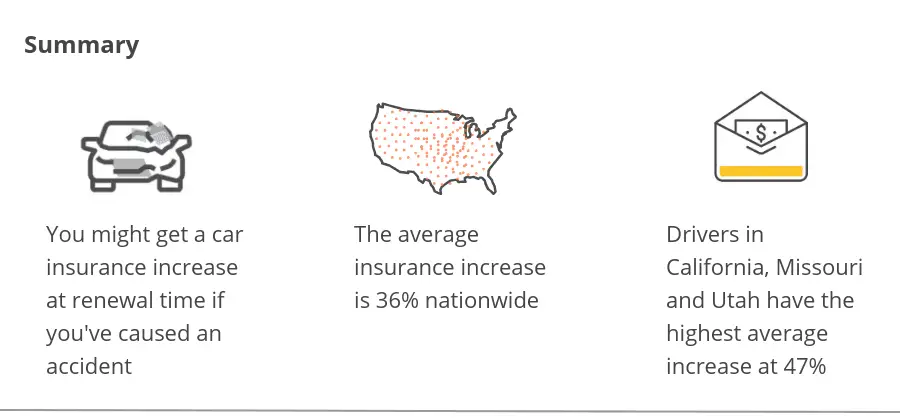

How Much Does Car Insurance Go Up After An Accident

Repair costs and medical bills arent the only financial blows that can come after you are involved in an accident. You may find that your car insurance rates increase as well, as much as 32%, even if you werent found at fault. This could add hundreds of dollars to your expenses each year, leaving you with less money to put towards your financial goals.

Since individual car insurance rates vary, based on factors like driving history and age, it is hard to say exactly how much more you can expect to pay. If you have been involved in other accidents, you can almost bet that your insurance will go up more than someone who has never had an accident before.

I recommend following up with your insurance agent after any kind of accident, no matter how small, to see how it will affect your premium. This eliminates the stress of getting an unexpectedly high bill in the mail and gives you, and your budget, time to adjust.

Take Advantage Of Multi

If you obtain a quote from an auto insurance company to insure a single vehicle, you might end up with a higher quote per vehicle than if you inquired about insuring several drivers or vehicles with that company. Insurance companies will offer what amounts to a bulk rate because they want your business. Under some circumstances they are willing to give you a deal if it means youll bring in more of it.

Ask your insurance agent to see if you qualify. Generally speaking, multiple drivers must live at the same residence and be related by blood or by marriage. Two unrelated people may also be able to obtain a discount however, they usually must jointly own the vehicle.

If one of your drivers is a teen, you can expect to pay more to insure them. However, if your childs grades are a B average or above or if they rank in the top 20% of the class, you may be able to get a good student discount on the coverage, which generally lasts until your child turns 25. These discounts can range from as little as 1% to as much as 39%, so be sure to show proof to your insurance agent that your teen is a good student.

Incidentally, some companies may also provide an auto insurance discount if you maintain other policies with the firm, such as homeowners insurance. Allstate, for example, offers a 10% car insurance discount and a 25% homeowners insurance discount when you bundle them together, so check to see if such discounts are available and applicable.

Don’t Miss: Car Rental Deals For Aarp Members