Buying A Separate Teen Policy

Some parents prefer to have their teen driver buy a separate policy. While this strategy will double the cost of auto insurance for your young motorist, it can also shield your family’s net worth if they are at fault in a serious accident. Also, if your teen graduates from high school and moves away, they can no longer remain on your policy unless they are a dependent college student.

Depending on your state, your teen driver might not be able to appear on the title of a car and obtain independent insurance unless he or she is older than 18. Younger drivers are also ineligible to sign a legal contract, which is necessary to obtain auto insurance coverage.

You might want to take this step if your teen has a history of accidents or tickets, although you may have to wait until he or she turns 18. Even if you have a clean driving record, these items can increase your cost by up to 20 percent if you share a policy with your adolescent.

When To Buy Auto Insurance For Your Teen

While permitted drivers carry less risk to the insurance company compared to fully licensed teen drivers because of adult supervision requirements, WalletHub suggests that you check state and insurer guidelines before you start gathering quotes. In most states, you have to add your teen to your auto insurance policy as soon as they have their learner’s permit. Some states, such as Maryland, Indiana, and Illinois, also allow insurance companies to make this make this a requirement as well. In other cases, your teen will be covered under your policy until they turn 18 or have a full license.

Add Teens To An Existing Policy

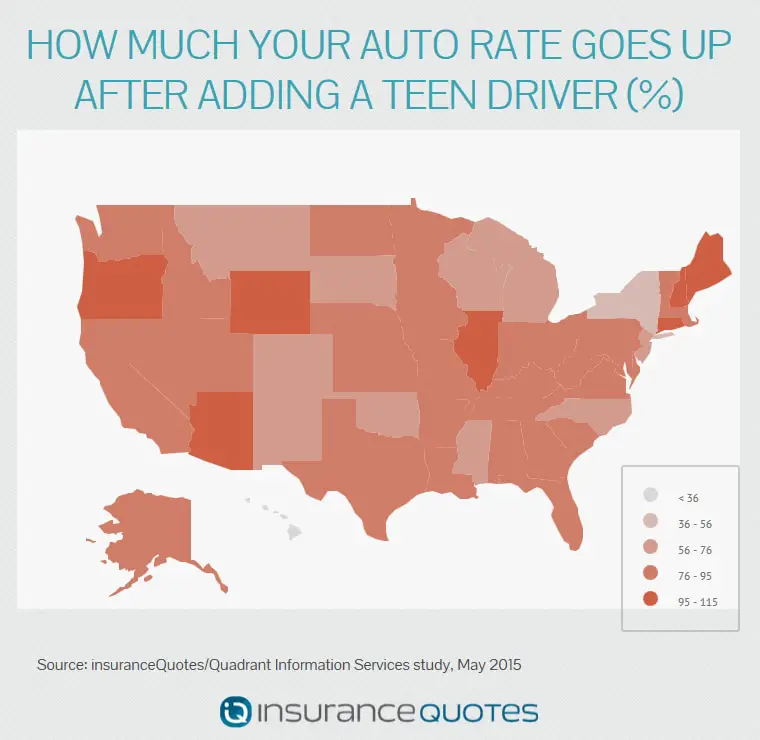

Adding a teenager to an existing car insurance policy can be significantly cheaper than having a teen get their own policy. For example, the average annual cost of car insurance for a 16-year-old in California is $2,845, while adding a teen added to a parent’s existing policy only increases the cost by about $1,461 per year.

Don’t Miss: How To Get Car Out Of Impound With Suspended License

Lay Some Ground Rules

- Discuss when, where, how and with whom your teen can drive

- Limit the number of passengers in the car

- Establish a curfew

- Insist your driver wear seatbelts at all times

- Limit teen driving during high-risk times, like Friday or Saturday nights

- Set driving-area limits

- Prohibit driving under the influenceor riding with friends who are

Adding A Teen Driver Cheat Sheet

You May Like: How To Connect Phone To Car Without Bluetooth

Best On A Budget: Erie

- Average Price for a 17-Year-Old: $2,248 per year

- Purchasing Options: Online, phone, local agent

- Available Discounts: 8

Although Erie has a relatively small service area, young drivers in those states can find some of the most affordable rates for car insurance on the market.

-

Good variety of coverage options

-

Website is easy to navigate

-

No online claims

Erie has made a name for itself by offering affordable insurance to teens and young drivers, a group that can face much higher rates for car insurance. Founded in 1925, Erie is now a Fortune 500 company that services a very select market on the East Coast. Its insurance products are only available in Washington, D.C., and 12 states: Illinois, Indiana, Kentucky, Maryland, New York, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and Wisconsin.

Erie car insurance is available in several forms:

- Uninsured or underinsured motorist coverage

- Roadside assistance

- Rideshare insurance

Erie also offers two exclusive programs: Rate Lock and Auto Plus. While Rate Lock helps guarantee your rate, the Auto Plus bundle includes several popular benefits, such as a waived or diminishing deductible, increased policy limits, and transportation expense reimbursement.

With 24/7 customer service, Erie wins top honors in J.D. Powers North Central rankings. It also receives high scores from AM Best, signifying strong financial stability and reliability.

Read our full Erie car insurance review.

Insure Under Your Policy

It could make sense financially to add your teen to your insurance policy. If you compared the increase in premiums that adding a teen driver would cause to a parents policy with the cost of an independent policy for that same teen driver, you would see that its cheaper to get on the parents policy, says Musson.

According to Carinsurance.com, adding a 16-year-old female driver adds $1,593 a year to a parents full coverage policy on average. Its about $651 a year to add minimum coverage for the same teen.

Adding a male is a bit more expensive. The average bill for adding a 16-year-old male costs $1,934 a year on a parents full coverage policy, and adds about $769 for minimum coverage.

Teen male drivers are on average 129% more expensive than compared to a female teen, which was 107% more expensive. Still, adding a teen to a parents policy is significantly cheaper than having the teen get their own policy.

You May Like: Are Car Batteries Covered Under Warranty

Do Teens Need Their Own Insurance Policy

Generally, teens do not have to worry about getting their own car insurance policy. More often than not, parents add their teen drivers to their own policies because its usually the cheaper option.

NOTE: Some teens own their own cars in these cases, usually they have their own car insurance policies. However, most states have strict rules on teens owning property , meaning parents have to at least co-sign for the property. If this is your case, talk with your states motor vehicle agency about state policies for teens to own vehicles outright.

How Much Does Car Insurance For Young Drivers Cost

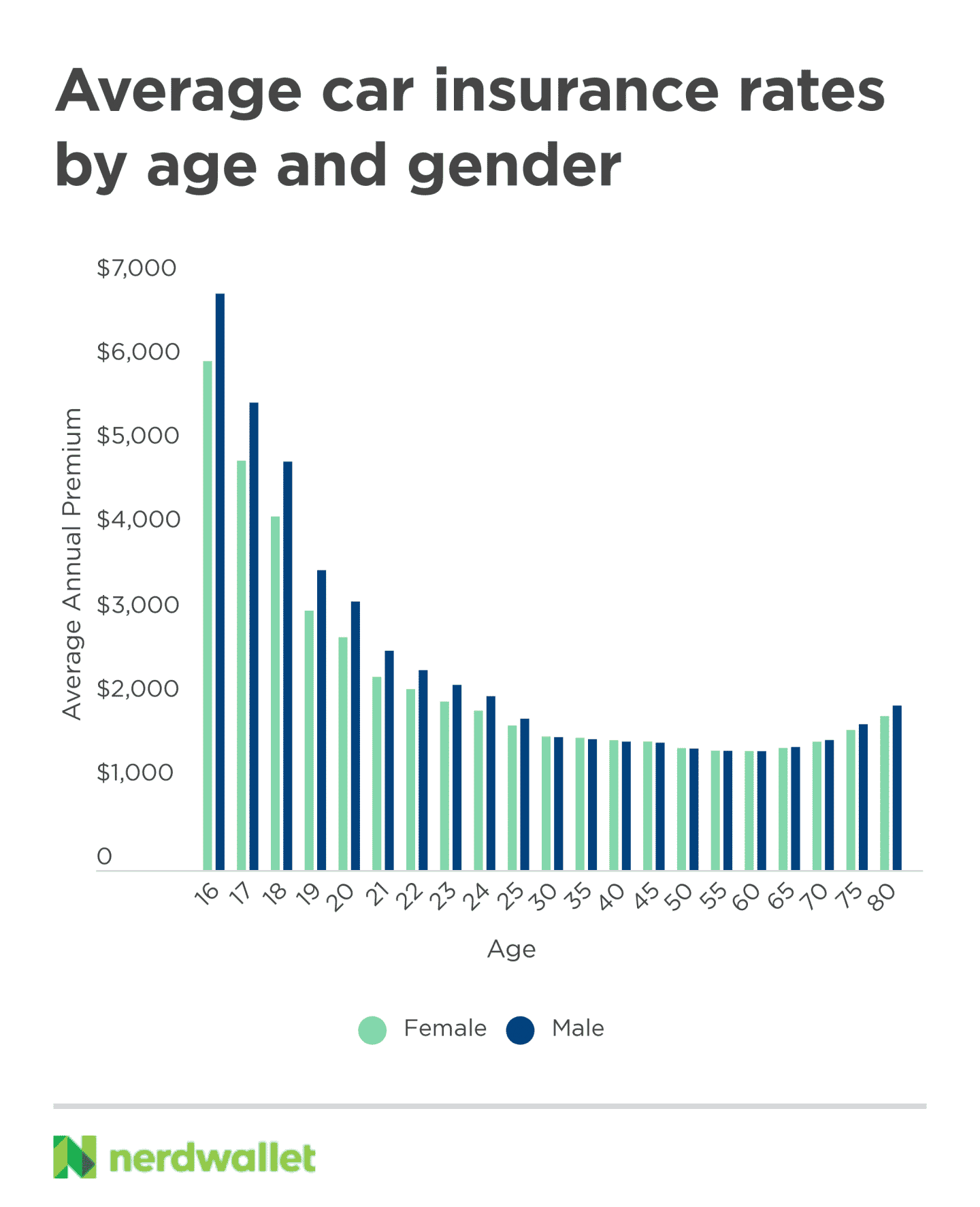

The cost of car insurance is different for everyone and depends on a set of specific factors, such as your age, gender, driving history, and credit score. Young drivers generally have less experience behind the wheel, so they are more susceptible to incidents of all kinds on the road. To compensate for this lack of experience, teens are generally charged more.

Our research into a selection of the top auto insurance companies found the average annual price for 17-year-olds to be $5,095, compared to $1,810 for 42-year-olds and $1,497 for 67-year-olds. That means 17-year-olds are paying an average of 181% more than 42-year-olds.

Also Check: How To Install Subwoofer In Car

Drive An Older Safer Car

Older cars are less expensive to buy and insure, significantly so if you drop comprehensive and collision coverage coverage. There are many safe older cars on the market today. When you choose a car with safety features, you often get a discount for each one. Many companies offer discounts for antilock breaks, automatic seat belts, and even airbags.

Best Teen Car Insurance For Affordability: Allstate

Allstate stands out in the teen driver category because it is consistently among the cheapest insurers for all ages, and it also offers a wide array of money-saving options for policyholders with a teen driver on their family policy.

- Allstate has a program called Drivewise, which gives teen drivers feedback and can translate to savings for safe drivers.

- It also has other options for saving in the form of smart student discounts for good grades, which can help lower costs.

Recommended Reading: How Many Miles Should A Car Have

Save On Your Teen’s Insurance With Auto Policy Discounts

Whether they’re just starting out or a little more seasoned, teen drivers can earn discounts:

- If your teen gets teenSMART certified

- If your student driver younger than 25 meets Allstate grade requirements

- If your student driver under 21 keeps their car at school 100+ miles from home

Does Adding A Male Teen Driver Cost More Than A Female

Male teen drivers usually cost more to insure than females. Why? The average cost to add a teenager to your car insurance policy comes down to risk.

Katie Sopko, an insurance agent/agency manager with A Plus Insurance in Greenville, South Carolina, says statistics show male motorists cause approximately 6.1 million accidents per year versus 4.4 million per year caused by females.

“Women are, simply put, more careful drivers than men, on average,” Sopko says.

Don’t Miss: Where Was The First Car Made

Average Cost Of Car Insurance For Teen Drivers

The average cost of car insurance varies for male and female young drivers, with female teen drivers generally paying less than males. Keep in mind, however, that Hawaii and Massachusetts ban the use of age to calculate car insurance premiums. Additionally, California, Hawaii, Massachusetts, Michigan, North Carolina and Pennsylvania prohibit using gender as a rating factor.

Female drivers typically pay less than their male peers since male drivers are seen as riskier to insure. Studies show that males speed more and generally exhibit more risky behavior behind the wheel than female drivers. Teenage drivers and young adults also have the highest cell phone usage of all age groups, which may increase the risk of causing an accident or getting a ticket due to distracted driving.

Here is the average annual premium for full coverage car insurance for teen males and females added to their parents policy:

| Age |

|---|

| $280 |

*Rates reflect the total cost for two adult drivers, one teen and one vehicle

Car insurance rates generally decrease as drivers get older and gain more experience behind the wheel. By maintaining a clean driving record and taking advantage of discounts, teenage drivers can typically expect lower car insurance costs over time.

How To Save On Car Insurance For Teens

You can lower the cost of car insurance with discounts* for students and teen drivers. At Progressive, we offer a variety of discounts for teens including:

- Good student: B average or better? Your young driver can earn about a 10% discount in most states for good grades.

- Multi-car: If your teenager has their own vehicle, we’ll chip in another discount just for having more than one vehicle on your policy.

- Teen driver: If a driver on your policy is 18 years old or younger and you have been consistently insured for at least 12 months, we’ll add a discount.

- Snapshot®: Our Snapshot® program rewards good drivers based on how they drive. Plus, our mobile app can reveal if your teen was driving distracted. Learn more about distracted driving.

You May Like: What Is The Best Car Insurance For Seniors

Best Accident Forgiveness Policy: Amica

- Average Price for a 17-Year-Old: $6,156 per year

- Purchasing Options: Online, phone, live chat

- Available Discounts: 18

Amica doesnt skimp on the savings, offering a number of discounts that include a generous accident forgiveness policy for your teen or young driver.

-

Accident forgiveness for newer drivers

-

Top customer satisfaction scores

-

No rideshare insurance

Included in Amicas Platinum Choice Auto package, accident forgiveness is a coveted perk that provides some leeway for new and training drivers. The package combines thoughtful extras like deductible-free glass repair and replacement, new car replacement, credit monitoring, and rental car reimbursement without any daily limits. For teens and young drivers looking for the full package, this is an easy way to combine multiple services into one convenient bundle while still benefiting from an accident forgiveness program.

To help you cut the cost of car insurance, there are 18 total discounts you can apply to your policy, such as loyalty, safe driver, and bundling discounts for multiple vehicles or multiple insurance products, like renters and auto insurance.

There are many types of car insurance coverage available:

- Uninsured and underinsured motorist protection

- Roadside assistance

- Rental reimbursement

Keep A Clean Driving Record

One of the most impactful ways to lower car insurance costs for your teen is to require that they maintain a clean driving record. Insurance companies already see teens as inexperienced, high-risk drivers, and traffic violations or accidents will not help to change that perspective. Whether it is speeding, an accident, reckless driving or distracted driving, you will see an increase in insurance rates.

You May Like: What Car Brand Has 4 Circles

Best Car Insurance For Teen Drivers

We chose the best car insurance companies for teens by analyzing factors specific to teen drivers. First, we researched average auto insurance rates pulled from Quadrant Information Services. Price is far from the only factor to consider when insuring a teen, though, especially when you know teens are more likely than any other age group to get into accidents. To that end, we also looked into coverage options, teen-specific discounts, safe driving programs and third-party scores for each insurer.

We compiled these factors to create a Bankrate Score for each company, calculated on a scale of 0.0 to 5.0. The higher a company scored, the higher that carrier ranked in the individual categories. Our Bankrate Score can help you understand a companys overall profile when shopping for teen car insurance.

It is helpful to know that, while your age factors into your car insurance premium in most states, Hawaii and Massachusetts prohibit this practice. Similarly, in California, Hawaii, Massachusetts, Michigan, North Carolina and Pennsylvania, car insurance companies are prohibited from using gender as a rating factor.

| Car insurance company |

|---|

-

Geicos average rates for teens

Geico average car insurance premiums for teens added to their parents policy

Age Average annual premium for minimum coverage* Average annual premium for full coverage* 16 *Rates reflect the total cost of two adult drivers, one teen and one vehicle

Liability Insurance For Teenage Drivers

If youre buying coverage for a teen driver or helping a new driver purchase their own policy, its helpful to know the different types of insurance. Almost every state requires some form of liability car insurance, which covers damages for others when a driver is at fault. Here are the main parts of liability coverage:

- Bodily injury liability: This covers lost wages, medical bills and other expenses for someone whos injured when youre at fault for an accident.

- Property damage liability: This covers damage to someone elses property such as a vehicle when youre at fault for an accident.

The minimum level of liability coverage varies from state to state. For example, motorists in North Carolina are expected to carry 30/60/25 coverage, which means a policy would pay up to $30,000 per person for bodily injury, $60,000 per accident for bodily injury and $25,000 per accident for property damages.

You May Like: What Rims Fit My Car

Teenage Car Insurance Average Cost: Everything You Need To Know

You’re probably wondering about the teenage car insurance average cost if you have a child approaching driving age. You likely already know that adolescent auto insurance can be costly thanks to the high risk of accidents for this age group.

You’re probably wondering about the teenage car insurance average cost if you have a child approaching driving age. You likely already know that adolescent auto insurance can be costly thanks to the high risk of accidents for this age group. Review the average cost of auto insurance premiums for teens and explore strategies to save if you’ll soon have a new driver at home.

What Are The Best Cars For 17

Besides protecting your teen, your insurance company may show its appreciation for buying a top car for teens by trimming your rate.

The Insurance Institute for Highway Safety offers some basics when looking for a vehicle:

- Vehicles with more powerful engines can tempt to test the limits, according to the IIHS.

- Get Electronic Stability Control , which helps maintain control on curves and slippery roads.

- Consider cars with top safety reviews from the IIHS and National Highway Traffic Safety Administration.

You May Like: How To Refinance Car Loan

How Do You Get Car Insurance For A Teenager

It is possible for a teenager to get car insurance with a permit, but most insurance providers will include the permitted teen on their parentâs policy without any other formalities. Teenagers should get car insurance after they receive their driving permit to stay protected in the event of an accident.

How Much Does It Cost To Add A Teenager To Car Insurance

Teens crash at a much higher rate than older drivers. The risk is four times as much. According to the federal Centers for Disease Control and Prevention, the worst age for accidents is 16. They have a crash rate twice as high as drivers that are 18- and 19-year-olds.

Costs vary by insurance company, which is the reason we suggest shopping for teen driver insurance. It’s easy to switch car insurance companies.

The table shows the average cost of car insurance some insurers charge when adding a teenager to an existing car insurance policy, based on 2022 data.

Average Cost to Add a Teenager to Car Insurance| Company |

|---|

| $1,671 |

You May Like: Who Pays For Rental Car After Accident

What Factors Affect The Price Of Car Insurance

Each insurance provider has a unique pricing model, and there are numerous factors that can affect car insurance premiums. Driving history, claims history and vehicle type are major determinants, while some insurance companies use factors like your ZIP code, gender, age and credit score as additional rating factors. Because every driver has their own unique characteristics, auto insurance rates vary significantly from one person to another, and that includes insurance for teen drivers.