Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

What You Need To Know Before You Renew

To renew your licence plate , you need:

- your licence plate number

- your insurance company name and policy number

- your odometer reading

Sign up for digital remindersNever forget to renew again!

Sign up to get free email, text message, or phone call reminders 60 and 30 days before its time to renew your licence plate.

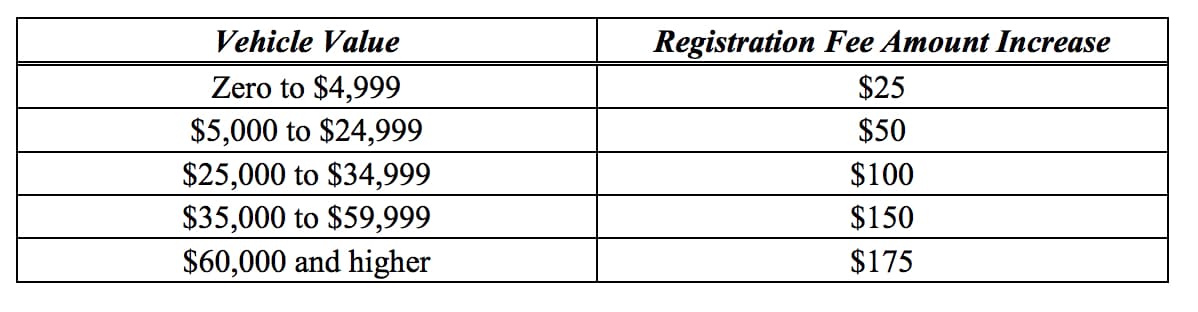

Determine The Fees And Taxes For Passenger Vehicles

Use the both the registration fee and county use tax charts to determine your registration fee and county use tax.

If this is the original registration of your vehicle, in addition to the registration fee and county use tax, you must pay

- the fees for your vehicle plates

- your title certificate fee of $50.00

- the sales tax – the amount of the sales tax depends on the purchase price and your locality. You can see the current sales tax rates by jurisdiction at the Department of Taxation and Finance web site.

There is a minimum 2-year fee of $32.50 for a vehicle that has 6 or more cylinders, or for an electric vehicle. Dealers, this minimum fee is not a surcharge or an additional fee. 1

Also Check: How Do I Find Out What My Car Is Worth

How To Estimate Registration Fees And Taxes

If this is the original registration , you must pay the

- registration fee

- title certificate fee of $50.00

- MCTD 1 fee for the following 12 counties only: Bronx, Kings , New York , Queens, Richmond , Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, and Westchester

If you transfer the registration and plates from another vehicle, you dont need to pay the plate fees or MCTD fee, and you may be able to transfer the registration fees to your new vehicle.

What Is Vehicle Registration

State governments use vehicle registration to determine who owns a car. Authorities often use this data to assess taxes or track criminal offenders. While all vehicles carry a unique vehicle identification number, cars registered with the state also have a registration plate and certificate. This registration is a separate requirement from licensing and street-legal certifications.

According to the American Automobile Association, owners must register any passenger or commercial vehicle driven on public roads. Tractors and other vehicles restricted to private property use are often exempt from registration requirements. Depending on your state’s guidelines, you may be able to register your car as an antique, commercial, or combination vehicle. Most states require any registered vehicle to carry a specified amount of liability insurance.

When you buy a new car, the dealership will usually take care of the title and registration for you. However, as points out, if you’re buying a vehicle from a private seller, you’re responsible for registration. If you move from one state to another, you will have to register your car after you move, unless you’re a full-time student or an active member of the military.

Also Check: What Is Car Insurance Premium

Sticker Refund For Individuals

We have eliminated licence plate stickers for passenger vehicles, light-duty trucks, motorcycles and mopeds.

If you paid renewal fees for your licence plate sticker for an individually-owned vehicle between March 1, 2020 and March 12, 2022, you will receive your refund cheque in the mail.

To get your refund, you must check the address on your drivers licence and update it if it’s incorrect and pay any defaulted fees, fines or tolls.

Summer 2022

If you updated your address or paid defaulted fines, fees or tolls after March 7, your refund cheque will arrive in the mail by the end of August.

If you havent received your cheque by the end of September, call us at

Registering A Vehicle To A Business

The first time you register a vehicle to a business or organization you must get a registrant identification number at a ServiceOntario centre. To get a RIN or change the company name and/or address on an existing RIN you will need to provide the following:

- A “Proof of Business Address Obtaining/Amending a Registrant Identification Number form available at ServiceOntario centresor a Notarized Letter of Authorization completed by someone with the authority to bind the organization, such as an owner or director

- One identification document for the business

- Two documents that show proof of business address . These can be hard copies or digital.

You May Like: Will Carvana Buy My Leased Car

County Use Taxes And Supplemental Fees

Residents of New York City and several counties in New York State must pay a vehicle use tax when they register a passenger vehicle or renew a passenger vehicle registration. 2

If you reside outside New York City and you are exempt from the vehicle use tax in the county where you reside or have a business, complete form UT-11C. 3

New York City Bronx, Kings , New York , Queens, Richmond

All passenger vehicle original registrations and renewals

- Vehicle use tax – $30 for two years

- Supplemental MCTD fee – $50 for two years

County use tax chart for counties outside of New York City

The chart shows the use taxes for all original registrations and renewals by the weight of the vehicle. Residents of the 12 counties in the Metropolitan Commuter Transportation District also pay a supplemental fee for each year the registration is in effect.

| County |

New Vehicle Calculator Faqs

Usually within 30-45 days of purchasing your vehicle.

The permit the dealer provides for display on the passenger side of the front window is valid until the plates and stickers are received by the customer, or for six months from the sale date, whichever comes first.

You must have liability insurance covering damage to the person or property of others. Comprehensive or collision coverage is for damage to your vehicle only, and does not meet the financial responsibility requirement. Check your policy or talk to your agent or broker to be sure that you have the correct liability insurance coverage. The minimum liability insurance coverage required for private passenger vehicles per accident is $35,000 and is defined by the following levels of coverage:

- $15,000 for injury/death to one person.

- $30,000 for injury/death to more than one person.

- $5,000 for damage to property.

Dealers may charge buyers a document preparation service fee not to exceed $65 program participant). This fee is not required or collected by DMV.

Recommended Reading: What Do I Need To Detail My Car

Tips For Calculating Vehicle Registration Fees

Even if you know every item that goes into determining registration fees, it can still get confusing.

For help, you can:

- Review your states car registration requirements. Often, registration fees or, at least, the factors that go into determining them are included.

- Look at the registration application form. Generally, these forms outline what you have to pay, and why.

- Contact your DMV or state motor vehicle registration agency. These folks are trained for this! Give them a call, and be prepared to answer specific questions about your vehicle.

For more on car buying, check out our section on buying and selling vehicles.

Penalties For Not Registering Your Car

The vehicle must be registered for you to legally drive it. If you are in an accident or stopped by law enforcement, youll be asked to show your license, proof of insurance, and registration certificate. If you dont have a current registration certificate with you, you may be fined or your vehicle may be impounded.

Fines may also apply for late registration renewal. Examples of penalties:

- Maine: If you live in Maine, fines range from $200 to $1,000. You can also be issued a traffic infraction.

- Vermont: Drivers in Vermont who fail to register their vehicles and present a current registration certificate when asked by law enforcement face penalties of $100 to $250 for a first offense. For a second violation, penalties range from $250 to $500.

Don’t Miss: Does Car Insurance Cover Flat Tires

Check Your Vehicle Identification Number Before You Renew

You will need to correct your vehicle identification number before you can renew your licence plate online.

If the vehicle identification number on your dashboard and vehicle permit does not match, you will need to visit ServiceOntario to correct it. You will need to bring the following documents:

- the vehicle permit the vehicle portion of the permit is required

- your Canada Inter-Province Motor Vehicle Liability Insurance Card

- one of the following documents:

- original vehicle manufacturers warranty

- copy of manufacturers invoice

- original or copy of the bill/certificate of sale from the original selling dealer

- letter from an authorized dealer for your make of vehicle verifying the correct vehicle identification number of the vehicle

- copy of certificate of title/certificate of origin

- copy of new vehicle information statement .

- original safety standards certificate, form SR-E-214, only if the last 6 characters of the vehicle identification number are correct

- sworn affidavit by the vehicle owner explaining the vehicle identification number error

If you do not have insurance, you must get it from an insurance provider licensed to do business in Ontario. Proof of insurance is required to renew your licence plate.

Renewal Fees For Basic Passenger Vehicles

Fees are different for every situation and are calculated many ways. Everyone starts with the basic fees of $43.25 and things like vehicle weight, location, and taxes determine your final amount.

Common vehicle fees| License and registration |

|

|

| Use a License eXpress account | Varies depending on vehicle, plate, and location |

| Plates – Issue an original license plate | $50 per plate |

| Varies depending on plate options | |

| Plates – Replace license plates | |

| Varies depending on plate design | |

| Plates – Veteran’s emblem packets |

All WAC and RCW links go to leg.wa.gov

| Make checks payable “Department of Licensing” | Yes |

| No | Yes at most offices** |

*Starting January 1, 2020 we will charge a 3% card payment fee for online transactions. You can also pay with your checking account information online for no added fee.

**We accept credit and debit cards at some of our offices. Our card payments vendor charges a fee.

Don’t Miss: How Long Do You Have To Register A Car

Lost Stolen Or Damaged Vehicle Permit

To replace a lost, stolen or damaged vehicle permit, visit a ServiceOntario centre.

Cost: $32

Bring the following with you:

- identification

- one of the following documents:

- the licence plate number

- the vehicle identification number

You must be the owner of the vehicle or have a Letter of Authorization from the vehicle owner.

Stay Current To Avoid Penalties

Vehicle registration needs to be renewed yearly or every few years, depending on the state you live in. And you may need to pay a fee each time you renew the registration.

If your registration isnt current and you get pulled over, you could get a ticket and have to pay a penalty. Your states DMV or transportation agency might also charge penalties for expired registration. Not keeping your registration could lead to problems down the line, and may even cause your car insurance rates to increase.

On top of fees, your car could be impounded. If this happens, the vehicle can be held until all fines and registration fees are paid. You may also have to pay towing and impound fees.

Read Also: How Do I Get My Title For My Car

Eliminating Licence Plate Stickers

We have eliminated licence plate stickers for passenger vehicles, light-duty trucks, motorcycles and mopeds.

If you paid renewal fees for your licence plate sticker for an individually-owned vehicle between the period of March 1, 2020 to March 12, 2022, you will receive a refund cheque in the mail if eligible.

If eligible for a refund, you must do the following by March 7, 2022:

- check the address on your drivers licence and update it if it’s incorrect

- pay defaulted any fees, fines or tolls

| Original drivers licence | $90 |

|---|---|

| Renew a drivers licence | $90 |

| Replace a driving instructors licence | $35.75 |

| Reinstate a suspended drivers licence | $281 |

Penalties For New Vehicles Or Vehicles Never Registered In California

Here are the penalties for new vehicles or vehicles that have never been registered in California.

| If payment is late: | |

|---|---|

| 40% of the vehicle license fee due for that year. 40% of the weight fee due for that year . | |

| More than one year two years | 80% of the vehicle license fee due for that year. 80% of the weight fee due for that year . |

| More than two years | 160% of the vehicle license fee due for that year. 160% of the weight fee due for that year . |

Don’t Miss: How To Get Rid Of Mold Smell In Car

Registration Fees By Vehicle Type

All vehicles must be registered to legally be driven in Iowa. The annual registration fees are determined by Iowa Code sections 321.109 and 321.115 through 321.124 and are to be paid to the county treasurers office in the county of residence.

A summary of registration fees by vehicle type has been provided below:

Ambulance – Motor vehicle equipped with life support systems used for transporting sick or injured persons needing medical care to medical facilities.$50

Antique Vehicles – Motor vehicle 25 years old or olderPurchased/Transferred on or after January 1, 2009:

- Standard minimum fee for the vehicle type applies

Grandfather Clause Titled/Registered prior to January 1, 2009

- Model Year 1970-1983 – $23

- Model Year 1969 & older – $16

Autocycle – An autocycle is a three-wheeled vehicle that has a steering wheel and seating that does not require the operator to straddle or sit astride. These vehicles typically have bucket seats, seat belts, a steering wheel, and gas and brake pedals similar to a car.

|

Model Years Old |

No Fee Plates Issued at State Level

Transit BusNo Fee Plates Issued at State Level

The formula to calculate the registration fee for electric vehicles is as follows: $0.40 per hundred pounds of vehicle weight, plus a percentage of the vehicle list price , plus the supplemental registration fee .

Registration Fee Based on List Price and Age of Vehicle

|

Model Years Old |

|

6 or older |

$10* |

| Vehicle Type |

$60 – Special Equipped

|

Model Years Old |

|

75% of original fee |

Registration And Title Fees

|

$84.00 |

NOTE: The fees for senior citizens 65 and older and person with a disability are $7 less than those stated in all PASSENGER vehicle categories if you own or lease the vehicle. This reduction does NOT apply to boat registrations.

- All passenger vehicles or non-commercial trucks registered to recipients of the following programs are eligible for discounted registration fees

- Pharmaceutical Assistance to the Aged and Disabled . ⢠Supplemental Security Income .

**A commuter van is defined as a motor vehicle with a seating capacity of at least eight passengers that transports them on a daily commute to and from work. It may also be operated for personal use.

*The weight class of the vehicle is determined by information contained in the manufacturer’s statement of origin :

- The application for renewal of registration.

- The Branham Reference Book.

- The MVC’s weight class manual.

If the manufacturer’s shipping weight is disputable or unavailable, the applicant may be required to have the car weighed on a certified scale under N.J.S.A. 39:3-8. This weight will be considered the manufacturer’s shipping weight.

If the weight class , color, number of doors and/or model needs to be corrected, visit a motor vehicle agency to complete a Vehicle Correction Application . Customers may also correct the weight on the title through the mail. Send the request to:

Transfer of the title is $60 .

Fees for duplicate or a replacement of original registration documentation

Don’t Miss: How Much Car Payment Can I Afford Calculator

Vlf For Tax Purposes Faqs

The Vehicle License Fee is the portion of your registration fee that is tax deductible. VLF for Tax Purposes may assist you in determining the VLF paid in a specified tax year.

For the purpose of this transaction, the calendar year 1/1/XX through 12/31/XX is the same as a tax year.

You may retrieve the current year plus the two prior years. The tax years available are displayed in the tax year drop down box on the VLF for Tax Purposes inquiry screen.

- Franchise Tax Board 1-800-338-0505 or www.ftb.ca.gov

- Internal Revenue Service 1-800-829-1040 or www.IRS.gov