Fca Pricing Rules Cause Wind Of Change For Car Insurance Premiums Consumer Intelligence

Different pricing strategies at play will bode for an interesting few months for the UK motor insurance market, says pricing expert

Following the FCAs new pricing rules coming into effect from 1 January 2022, the direction of travel for the cost of car insurance may be about to change after premiums plummeted due to stricter Covid-19 restrictions, according to market research firm Consumer Intelligence.

Its latest data, published today showed that the average annual motor premium in the UK is now £782, following a decrease of 0.6% between August and November 2021.

Some UK regions are beginning to see premiums increase for the first time in over a year, however. For example, Scotland , the east midlands , the Eastern region and Wales all saw the cost of car insurance rise between August and November last year.

London drivers continue to be the most expensive to insure thanks to an annual average premium of £1,261. The north west ranks as the second most expensive region for motor premiums . The south west remains the cheapest UK region .

Telematics firms, meanwhile, provide 28% of the five cheapest insurance quotes the highest figure ever recorded by Consumer Intelligence.

Pay Your Premium In Full

As mentioned, paying the annual cost of your premium in full can help you get a lower rate, if you can afford the upfront cost. Most insurance companies offer this discount, even if it is not advertised. The exact savings vary by insurance company, but it is typically somewhere between 5-15%. If your insurance rate is very expensive, even a discount of 5% could be worth it.

How To Get The Lowest Insurance Premium

The trick to getting the lowest insurance premium is finding the insurance company that is most interested in insuring you.

When an insurance company’s rates go too high all of a sudden, it is always worth asking your representative if there is anything that can be done to reduce the premium.

If the insurance company is unwilling to change the premium they are charging you, then shopping around may find you a better price. Shopping around will also give you a better understanding of the average cost of insurance for your risk.

Asking your insurance representative or an insurance professional to explain the reasons why your premium increases or if there are any opportunities for getting discounts or reducing insurance premium costs will also help you understand if you are in a position to get a better price and how to do so.

You May Like: Best Way To Protect Car From Hail

Number Of Car Insurance Claims

From the perspective of a car insurer, drivers who previously filed a car insurance claim would be more likely to file a claim in the future.

On average, drivers with a previous claim can see their rates increase by 42%. Changing providers wont help you avoid this rate hike because insurers search the industry-wide Claim Loss Underwriting Exchange to identify past claims.

Many companies only look for claims made in the past three years. However, some look back five years, and others can look at 10 years worth of your driving history. If you do have a previous car insurance claim, compare insurance rates and other companies to see how previous claims affect your premium costs.

Auto Insurance Premium Comparisons

The tool produces examples of insurance premiums based on one of seven common profiles with varying levels of coverage levels and driving experience. The premiums listed are specific to each policy example and demonstrate the range of prices you can expect to find when you actually shop around. Your actual premium may differ significantly from these premiums based on your specific driving record, discount eligibility, and choice of coverage.

Also Check: Synchrony Car Care App

Personal Accident Cover For Owner Driver And Others

This particular component of your vehicle insurance premium goes a step above and protects you. The policy offers compensation against accidents, death, and disability to owner drive up to a sum Insured of INR 15 lakh.

You can also choose to opt for personal accident covers with variable sum insured as allowed in India Motor Tariff to include passengers that may be travelling in your vehicle. The premium thus goes higher as the sum assured increases.

Examples Of Insurance Premium Adjustments And Rate Increases

Have you ever spoken to a friend insured with one insurance company and heard them say what great rates they have, then compared it with your own experience with the prices for the same company, and had it be completely different?

This could happen based on various personal factors, discounts, or location factors, as well as competition or loss experience of the insurance company.

For example, if the insurance company actuaries review a certain area one year and determine it has a low risk factor and only charges very minimal premiums that year, but then by the end of the year they see a rise in crime, a major disaster, high losses, or claims payouts, it will cause them to review their results and change the premium they charge for that area in the new year.

That area will then see rate increases as a result. The insurance company has to do this to be able to stay in business. People in that area may then shop around and go somewhere else.

Fewer claims and proper premium charges for the risks allow the insurance company to maintain reasonable costs for their target client.

Read Also: Tip For Car Wash Attendants

Does Car Insurance Cover Theft

Not all auto insurance policies cover car theft. Itâs actually an optional coverage that drivers add on, so if you simply opt for the basic, mandatory car insurance in your province, you wonât have protection against a stolen vehicle.

To ensure youâll be financially compensated in the event your vehicle is stolen, youâll need one of the following three coverages:

- Comprehensive â Typically the most popular option among the three, comprehensive insurance protects you against risks that arenât collision-related. So if your car is stolen, vandalized, or damaged from harsh weather, it has you covered.

- All perils â You can think of all perils coverage as a bundled package of both comprehensive and collision insurance. Plus, youâll also be protected in the event a household member, repair technician, or employee steals your car .

- Specified perils â Coverage for specified perils is exactly what it sounds like â protection against risks that are specified on your car insurance policy. Typically, this includes most risks except for vandalism and falling options, but you should double-check to make sure theft is covered by your policy.

How Often And How Far You Drive

People who use their car for business and long-distance commuting normally pay more than those who drive less. The more miles you drive in a year, the higher the chances of a collision regardless of how safe a driver you are.

- To help offset how much you drive, consider joining a car or van pool, riding your bike or taking public transportation to work. Insurance rates may be lower with a shorter commute to work, so reducing your total annual driving mileage may lower your premiums.

- Check with your insurance company about a discount for driving less. Usage based car insurance like Drive Safe and Save by State Farm® might save you money when you drive less by using your cars telematics information.

Recommended Reading: Selling Leased Car To Carvana

How Much Is Car Insurance

If youre in the market for car insurance, you likely have a lot of questions. Among them is probably how much does auto insurance cost? The answer, of course, depends on several factors. Understanding how insurance providers calculate car insurance rates can help you not only estimate your budget, but also save money by knowing what to avoid in the future.

Average Car Insurance Costs If You Have A Dui

If you have a DUI on your driving record, that can significantly increase your rates, as insurance companies take it as a sign that the driver is high-risk.

- The average annual cost of car insurance across the board was $1,424.

- The cost for someone with a DUI was $2,879. Thats more than double the average.

A DUI can stay on your driving record for years, and the exact length of time will depend on the state in which you live. For many reasons, not only insurance rates, you need to avoid a DUI.

Car Insurance Premiums With a DUI

- Payment Cycle

- $2,879

Also Check: How To Fix Peeling Clear Coat On Car

How Often Do I Have To Pay My Premium

Different insurance companies will ask you to pay your auto insurance premium at different intervals. The most common options are monthly, twice a year and annually.

Many insurance companies will let you choose how often you’d like to payâand you’ll typically get a “paid in full” discount when you pay pay more upfront.

> > LEARN MORE: Car Insurance Discounts You May Be Eligible For

However, in some cases, you may be required to pay your entire term upfront. This is particularly common if you’re deemed an at-risk driverâfor example, if you previously let your insurance lapse or you require an SR-22. This is one way insurance companies reduce the risk of insuring at-risk drivers.

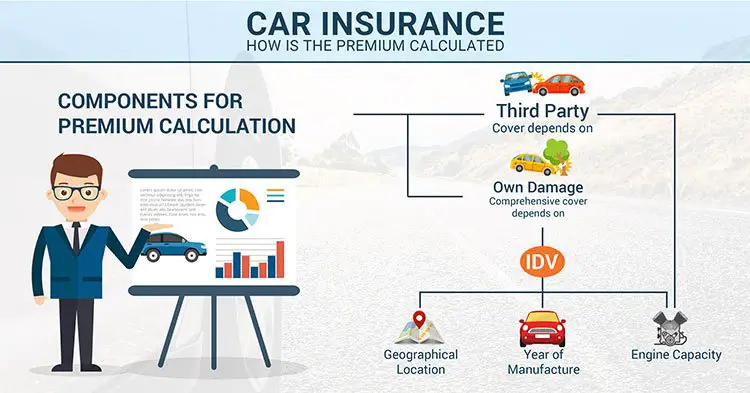

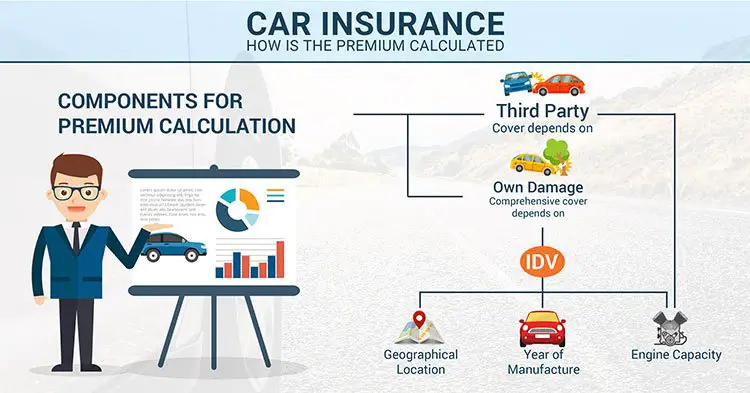

How Is Your Car Insurance Premium Calculated

There are a lot of things in the fine print of our insurance policies- the Terms and Conditions, the Exclusions, the Special Cases but premium is always told to us up front. More often than not, however, we tend to hear just a number, never really understanding how that number was arrived at, or what the process of calculation truly entailed.

The premium of car insurance depends on the following factors:

IDV of the vehicleType and age of the vehicleCubic Capacity of the engineGeographical zone

You May Like: Toyota Synchrony

Competition In The Insurance Industry And Target Area

If an insurance company decides they want to aggressively pursue a market segment, they may deviate rates to attract new business. This is an interesting facet of insurance premium because it may drastically alter rates on a temporary basis, or more permanent basis if the insurance company is having success and getting good results in the market.

Average Cost Of Auto Insurance Summary

The average costs of car insurance depend, in part, on how you pay: annually or monthly. The figures below are based on the average annual premium, but be aware that drivers may pay more if they opt for monthly payments. This is because theres usually a discount for paying in full. Thats why its essential to compare car insurance rates to understand your options fully.

Average Car Insurance Rates

- $1,633

Also Check: Squirrels In Car Engine

How Is Car Insurance Premium Calculated

You can easily calculate car insurance premium with the help of the InsuranceDekho car insurance premium calculator. The premium of a car insurance plan depends on the coverage of the plan and other factors such as cars make, model, variant, fuel type, RTO location, etc. The premium for third party car insurance plans is fixed by the IRDAI and it depends only on the cars engine capacity, whereas the premium for standalone own-damage& comprehensive car insurance plans is determined by the insurance companies and varies from the policyholder to policyholder.

Lets understand the premium price calculation for vehicle/car insurance better with an example.

For example, Mr. A wants to purchase a car insurance policy for his Hyundai i10 Asta which has the following details:

At InsuranceDekho, Mr. A can find the following premium quotes for his car/vehicle bearing the above-mentioned details:

|

Car Insurance Plan |

Average Car Insurance Cost By Age

| Age |

|---|

| $734 |

Note: Premiums are representative only individual premiums will be different

Your age can affect your car insurance rates because younger drivers with less experience on the road tend to have more accidents than older, mature drivers. As a result, they also pay more for car insurance.

Premiums usually drop by 12% to 20% when a driver turns 25 years old. After that, the average drivers rate will gradually decrease over time until they reach their seventies. At that point, costs rise once again due to the increased risk posed by senior drivers.

You May Like: Do Car Dealerships Rent Cars

What Decreases Your Premiums

Gaining more experience on the road will mean a decrease in your premiums if youâve shown that youâre a safe driver. While car insurance premiums start out very high when youâre a teenager, after about 10 years of driving your rates will start to go down.

You may also be able to apply for discounts that you werenât able to get when you purchased the policy. If you added new safety features, like a forward-collision warning system, blind spot detection, adaptive headlights, or security measures like an anti-theft system, then you should let the insurer know, and theyâll likely lower your premiums.

If your credit score or your grades have improved over the last policy period, you should be able to get further discounts.

Youâre under no obligation to stick with the same auto insurance company when you renew your policy. In fact, shopping around and getting quotes from many different car insurance companies can help you fine-tune the coverage you need at an amount you can afford.

Average Car Insurance Cost By Gender

| Gender |

|---|

| $3,058 |

Note: Premiums are representative only individual premiums will be different

The most expensive type of car to insure is a sports car, followed by a truck. In general, the faster a car can go or the more expensive it is to repair or replace, the more its insurance will cost.

Drivers tend to assume that if a car is more expensive, it automatically costs more to insure than a cheaper car. However, this is not always the case. WalletHubs analysis found that only 22% of the difference in insurance premiums for cars in the same category can be attributed to the cost of the car. The remaining 78% depends on other factors such as the cars body type, make, and age, which affect how much damage a car can cause and how much it costs to repair.

Don’t Miss: How To Repair Cigarette Burn In Leather Car Seat

Dont Pay More Than You Have To

Looking Fly on a Dime

Car insurance is necessary to protect you financially when behind the wheel. Whether you just have basic liability insurance or you have full auto coverage, it’s important to ensure that you’re getting the best deal possible. Wondering how to lower car insurance? Here are 15 strategies for saving on car insurance costs.

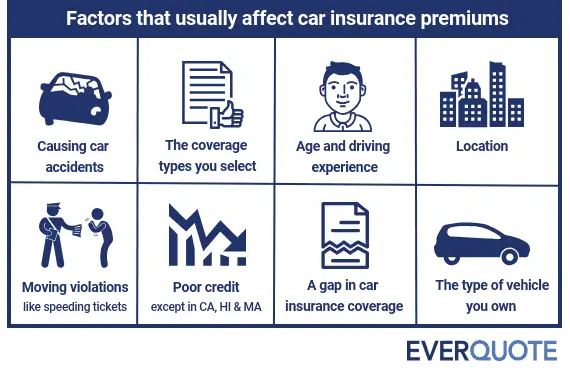

What Increases Your Premium

During the policy period, if you file multiple claims or have a claim against you, youâll likely see a rate increase at your next renewal. Being liable for even one car accident will definitely increase your rates, especially if you cause serious damages or injuries. Any traffic violations youâve accrued on your driving record, like speeding, will also cause an increase in your rates.

Youâll also see a slight uptick in rates as you approach your mid-60s, and by your late 60s and early 70s your rates could increase dramatically.

If your policy lapses, you arenât legally allowed to drive, unless youâre insured by someone elseâs coverage. But if you have no coverage, then by the time you purchase car insurance again, your rates may be higher than someone who has had continuous coverage.

Your rates may also be affected by factors completely beyond your control. Even if you were a perfect driver, your premiums may go up because of changes in the insurance industry, more cars on the road or higher repair costs in your area.

Don’t Miss: How Long Do Car Batteries Last In Texas

How Premiums Are Calculated

Insurance premiums may increase after the policy period ends. The insurer may increase the premium for claims made during the previous period if the risk associated with offering a particular type of insurance increases, or if the cost of providing coverage increases.

Insurance companies generally employ actuaries to determine risk levels and premium prices for a given insurance policy. The emergence of sophisticated algorithms and artificial intelligence is fundamentally changing how insurance is priced and sold. There is an active debate between those who say algorithms will replace human actuaries in the future and those who contend the increasing use of algorithms will require greater participation of human actuaries and send the profession to a “next level.”

Insurers use the premiums paid to them by their customers and policyholders to cover liabilities associated with the policies they underwrite. They may also invest in the premium to generate higher returns. This can offset some costs of providing insurance coverage and help an insurer keep its prices competitive.

While insurance companies may invest in assets with varying levels of liquidity and returns, they are required to maintain a certain level of liquidity at all times. State insurance regulators set the number of liquid assets necessary to ensure insurers can pay claims.

If Youre Buying Car Insurance For The First Time You May Be Curious How Insurance Companies Determine Your Premium Which Is The Amount You Pay In Order To Have Insurance Coverage For Your Vehicle

The cost of your car insurance premium may vary since its based on a number of different factors, including your driving record, how much you drive, the types of insurance coverage you choose and even your age.

Lets take a look at how a car insurance premium works, the average insurance costs and the factors that can affect your insurance rates.

Read Also: Car Ac Making Noise When Turned On