How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Whats The Difference Between Salvage Titles And Rebuilt Titles

Salvage titles and rebuilt titles are two different things. Sometimes youll see rebuilt titles written as rebuilt salvage titles, but its not entirely accurate.

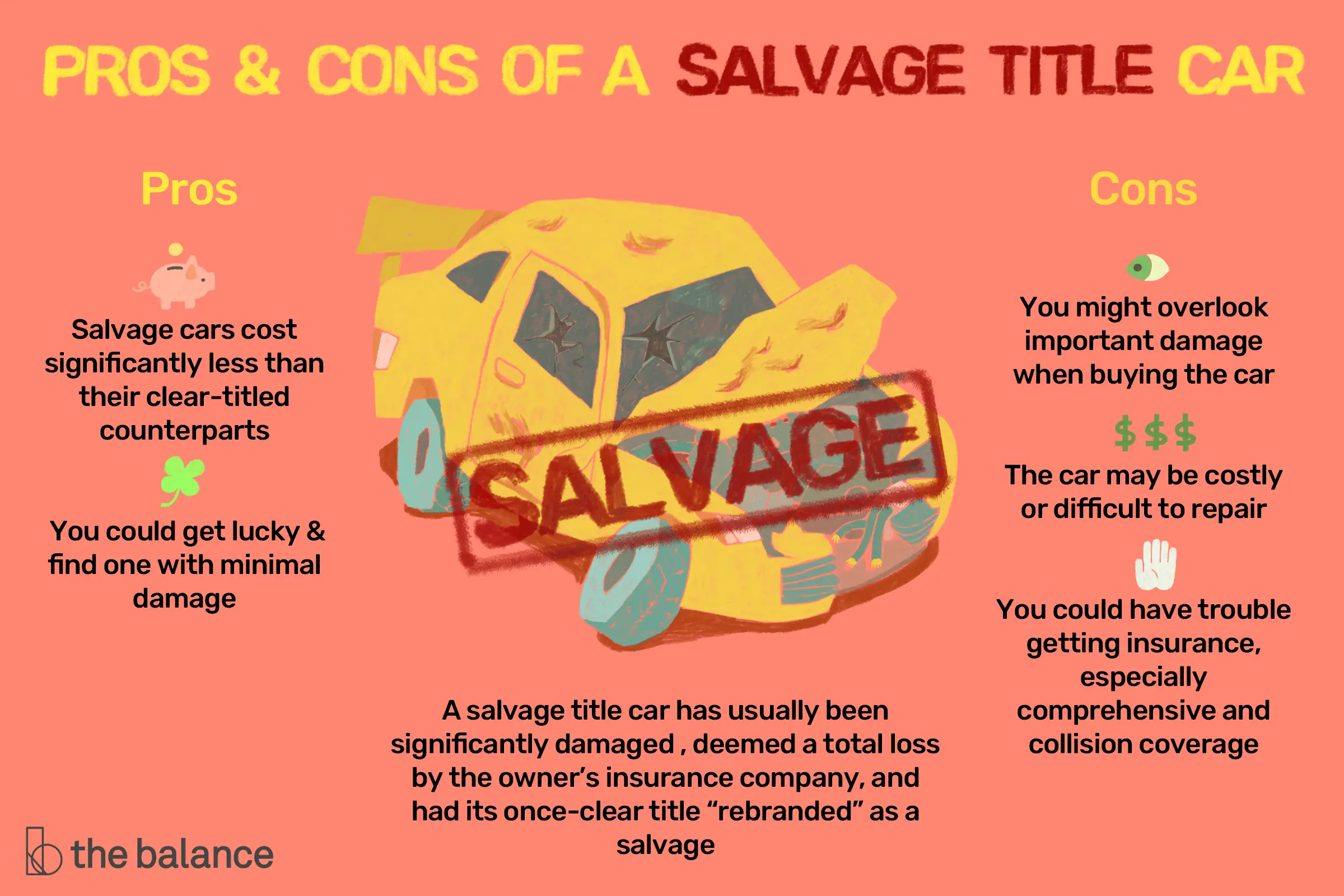

Salvage titles are car titles that acknowledge a vehicles total loss status by the auto insurance company and the local DMV.

Rebuilt titles are given to drivers who fix salvage vehicles. However, the salvage title brand is still listed on the cars history.

Insurance Companies That Will Insure Cars After A Salvage Title

Finally, it’s important to note that the amount of insurance you can get for a salvaged car varies from company to company. Often, insurance companies are willing to provide liability coverage – insurance that covers any damage that you cause with your car. Some companies also offer collision coverage for salvaged cars, though they might not cover the full value of the vehicle.

Why are salvage titles bad?

Ad Disclosure:

Also Check: How To Wire A Car Radio To A House Outlet

How To Get Car Insurance For Salvage Title

The first step to getting car insurance for salvage title vehicles is to do research on the vehicle you are looking to purchase. By utilizing the vehicle identification numbers, as well as the resources listed above, buyers can make an educated decision on their purchase.

A number of automobile insurance companies do not provide insurance for salvaged vehicles at all. Travelers is one example of the many. In fact, some estimates state that up to 33% of car insurance companies will not write policies for salvaged vehicles.

If you are specifically seeking out a salvage title car to save money, it may be a good plan to look for cars that are being sold by insurers. The insurer is aware of the specific situation the car was in when it was declared a total loss. It is also likely to have more documentation, such as photographs and written reports of the damage, that other people do not have. Asking the insurance company that you are looking to purchase from if they will cover the car can be a great way to get insurance on your vehicle.

Certain types of accidents are easier to get insurance for when it comes to salvaged vehicles. If the car was totaled due to natural disasters, getting coverage may become a lot more difficult. After natural disasters, some car dealers look to clean up the car so that it seems nice but do not invest the money in repairing what is needed.

What Insurance Companies Cover Rebuilt Titles

Some major car insurance companies that may write policies for rebuilt title cars are GEICO, Progressive and Allstate â but the coverage may vary state-to-state. To know for sure whether or not your rebuilt title car will be offered coverage, you should contact an insurance agent to confirm.

More about

Read Also: Is Autoslash Legit

Salvage Title Insurance: Limited And Scarce But Available

If you are hoping to fully insure a salvage-titled car, you may be in for a surprise. You may not be able to buy all types of car insurance. Few auto insurance companies are willing to write collision and comprehensive coverage on a salvage-title car. On the other hand, buying liability only will make for cheap car insurance.

“Insuring a salvage-title vehicle can be a real challenge. Most insurers are reluctant to write comprehensive and collision policies because it is so difficult to put a value on these vehicles,” says Kyle Mediger, an independent agent and owner of The Insurance Advisors, based in the Denver, Colorado area.

And, not all insurance companies provide coverage for salvage title vehicles.

If you buy back a car from an insurer that has totaled it, you may have more luck getting them to issue you a policy, says Penny Gusner, consumer analyst for CarInsurance.com. The insurer knows exactly why the car was declared a total loss and will typically have photographs and other details of the damage.

How Do I Get Rebuilt Salvage Title Car Insurance

The process of getting auto insurance for salvage vehicles after they have been rebuilt is similar to the process for any other car. You will want to shop around and compare your coverage options. You can talk to insurance agents and insurance companies or use comparison tools like our quote box. Comparing prices and coverage is crucial to getting the best deal.

Just keep in mind that it is much harder to get comprehensive coverage or collision coverage for a rebuilt title than for a normal car. Many companies will only offer liability insurance, as this is the minimum coverage required in most states.

That said, if the extent of the damage to the rebuilt vehicle was not too severe, some companies may offer comprehensive or collision coverage. This will vary case-by-case and company-by-company, but you should not expect it from vehicles with significant damage.

Before buying a rebuilt car, you should also keep in mind that insurance is more expensive for a rebuilt vehicle than one with a clean title.

Read Also: What Year Is My Club Car Golf Cart

Which Insurers Offer Rebuilt Title Insurance

Several car insurance companies offer rebuilt title insurance. Some only offer liability insurance coverage for rebuilt title insurance. Insurers like Geico and Progressive offer full coverage on rebuilt title insurance.

Here is a list of other insurance providers offering rebuilt title insurance:

- 21st Century

- Root Insurance

- Insurance Navy

And there are some insurance companies that dont offer rebuilt title insurance. They include Direct General, Esurance and Travelers.

How Do You Value A Car With A Rebuilt Title

A salvaged, reconstructed or otherwise clouded title has a permanent negative effect on the value of a vehicle. The industry rule of thumb is to deduct 20% to 40% of the Blue Book® Value, but salvage title vehicles really should be privately appraised on a case-by-case basis in order to determine their market value.

Don’t Miss: Add Refrigerant To Car

What Are The Procedures Involved In A Rebuilt Vehicle Inspection

Each state also has its own requirements when it comes to allowing a rebuilt car to be driven on public roads. Physical inspections are a requirement but the location and inspectors vary from state to state.

All states require applications and physical inspections, but some states go even further.

These are just a few examples:

- Nevada If the vehicle is five model years old or newer, the vehicle must be inspected before any repairs are made. After the repairs are complete, an application is needed, along with a certificate of another inspection.

- Tennessee In order to receive a rebuilt title, the owner must show the salvage certificate, color photos of the vehicle before repairs, and receipts for all replacement parts, plus complete inspection and pay fees.

- Texas To insure a vehicle with a rebuilt title for insurance in Texas, the rebuilt vehicle must pass safety and anti-theft inspection tests. Also, it must pass other state-mandated standards if you want to drive the vehicle on the road.

- Georgia You must have an original salvage title, photos of the damaged vehicle before repairs, applications, receipts for parts used, pass an inspection, and the work must be done by a licensed rebuilder.

Since there can be many rules involved, you will want to check your states requirements to ensure your title can change from salvage to rebuilt. You would not want to complete repairs only to find out you missed something at the beginning of the process.

Insurance Limitations For Salvage Titles In California

Keep in mind that some insurers will only sell liability insurance for revived cars, meaning that they wont pay for any physical damage to the vehicle. Even if you are able to get collision and comprehensive insurance, your policy may not cover the full value of the car if its totaled again.

What does it mean when your car is a total loss?

When your car is a total loss, it means the cost to repair the car exceeds the value of the car. If your car is declared a total loss your insurer may replace your totaled car with an equivalent one or issue payment for the actual cash value of the totaled vehicle.read full answer

Once you file a claim, the insurance company will determine whether the car is a total loss. Depending on your states laws, your car may be totaled if the cost of repairs exceeds a certain percentage of the cars value, such as 75%. If your state does not have a specific total loss threshold, your vehicle will be considered a total loss if the cost of repairs plus the salvage value is greater than the cars actual cash value .

You May Like: What Stores Can I Use My Synchrony Credit Card

Does Westlake Financial Finance Salvage Title

FOR IMMEDIATE RELEASE : Los Angeles, CA Westlake Financial Services announces it now finances vehicles with brands in 47 states. Vehicles labeled as salvage, junk, rebuilt, water damage, storm damage, flood, hail damage, lemon or crash test vehicle are all eligible for the branded vehicle program.

Where Can Salvage Title Vehicle Owners Find Affordable Policies

First off, is insurance more expensive for salvage cars? The simple answer is yes. Whether or not its officially rebuilt, a salvage car is a minefield in an insurers eyes. Basic questions about the safety and reliability of a car as well as repairs after even a minor incident are key concerns.

When it comes to a salvage title, car insurance companies can be hesitant, especially for comprehensive coverage. The best way to find competitive rates and coverage is by getting multiple quotes and comparing them side by side.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Don’t Miss: California Car Registration Price

Why Do I Need To Know What Qualifies As A Salvage Vehicle

It is important that you understand what a salvage vehicle is so that you arent confused if an insurance company refuses to insure your vehicle because it is a salvage vehicle.

What an insurer pays out for a salvaged vehicle and charges to insure it depends on the damage sustained and the car itself.

It is also important that you know that you are buying a salvage vehicle because the overall value is far less than buying a vehicle of the same type and condition that has never been in an auto accident.

You dont want to pay market value for a vehicle that doesnt have any real market value.

What Is A Salvage Title Vehicle

A salvage title indicates that a vehicle has been previously damaged and declared a total loss by an insurance company. This usually happens when a car is damaged to the point that the cost of repairs exceeds the cars value. The insurance company will therefore find it more cost-effective to issue the owner a payout for the value of the vehicle versus investing in costly repairs.

Since insurance companies want to recoup the loss of that insurance claim, the companies will sell the totaled car to an auto repair company to be rebuilt. The vehicle may then be sold again, but most state laws stipulate that the sellers have to sell the car as a salvage title rather than a clean title so that future buyers have all the facts and can make an informed decision when purchasing the vehicle.

If you see the words salvage title, you know that the car has experienced serious damage, such as:

- A major collision

- Hail or weather damage

- Vandalism

If youre planning to do some of the repair work yourself, salvaged vehicles may help you save money. Otherwise, buying a salvage car may simply not be worth the headache. You may be better off buying a used or new car instead of dealing with any hassle related to a salvage vehicle.

Also Check: Damaged Clear Coat On Car

The Differences Between A Salvage And Rebuilt Title

The state gives a salvage title to a car that has been deemed a total loss by a car insurance provider. If a vehicle with a salvage title is repaired and passes inspection, its eligible to receive a rebuilt title. However, keep in mind that not all salvage title cars can be restored. In these cases, a vehicle is declared non-repairable, meaning you can only use it for its parts.

An easy way to determine the type of car you have is by looking at the titles color:

- Green Clean Title

- Orange Rebuilt Title

How To Get Car Insurance For A Salvage Title

Salvage titles are sometimes difficult to find insurance coverage for

- Your current insurance company may not cover a salvage title, so be sure to check with them before you make any decisions

- If you are looking for insurance coverage, you may only find liability for your salvage car

- In some cases, your car may be considered a restored classic rather than a salvage title

While you can obtain car insurance for a salvage car title, you need to know the risks and understand who is willing to cover them.

A salvage car is a car that has been deemed by an insurance professional to be so damaged from an accident or vandalism that the market value is 30 percent or less of the blue book value of the same vehicle in prime condition.

You can find your particular salvage title insurance value by contacting your car insurance company.

Most people, when an accident occurs, will allow the towing company to take their vehicle to a local mechanic, or in some cases an appraisal center, for the insurance company to appraise the damage.

Enter your zip code above to receive car insurance quotes from multiple providers!

If the vehicle is considered totaled which makes it a salvage vehicle the majority of people take their belongings and allow the company that is storing the vehicle do with it what they will.

Others choose to take the vehicle with them in hopes of repairing it themselves.

Read Also: What Commision Does A Car Salesman Make

What Do Salvage Title Cars Look For

Some of the things you’ll want to consider when looking at a salvage car are insurance, warranty, financing, registration, claims and resale. Insurance: Insuring a salvage car varies by state and by insurer, but you should expect to get at least liability insurance in most states from most companies.

How To Insure A Salvage Title Vehicle

The process of insuring a salvage title vehicle is much different than insuring a new or used car. First, youll need to find an insurance company that will actually sell you insurance. After that, your car will undergo a thorough inspection.

If your car passes inspection, and the insurance company will sell you a policy, be prepared to pay for it. Insurance on salvage title vehicles can be expensive because they are riskier to insure. However, you can still take advantage of discounts the company offers to lower your rate.

Don’t Miss: How To Measure Car Speakers Size

The Problem With Getting Insurance For A Salvage Title Car

To be clear in most states, you cant drive a car with a salvage title. When people ask how to get insurance with a salvage title, what they really mean is how to get insurance with a rebuilt title.

If you try to get insurance with a salvage title, youll be denied. The exception to that is if the state youre in does not issue rebuilt titles, and instead considers a salvage title to be a road worthy title.

Again, check your local salvage title/rebuilt title laws to confirm if this is the case.

As we previously described, a rebuilt/rebuilt salvage title is a vehicle thats been declared a total loss by the insurance company or by the owner, and has been completely rebuilt in order to get back on the road.

But, to get on the road in most states, you need insurance.

Getting insurance with a rebuilt title is possible but well be honest with you, its not going to be easy.

Insurance companies love profit, and rebuilt vehicles generally are not profit centers. There are more things that can go wrong on rebuilt vehicles, so some insurance companies dont cover them.

If you need insurance for your rebuilt title car, you should also be prepared to pay more for your premium. Again, this is because the risk of insuring a rebuilt car is much greater than one with a clean title at least overall.

Yes, your particular rebuilt car may not have any issues, but the insurance company doesnt know that.

However, all is not lost.

Is It Worth It To Insure A Salvage Title

Even if a state clears a rebuilt salvage car for use on public roads, the owner must find insurance before registering and driving the car on those roads.

If you cant find insurance with your current carrier, you may have to investigate your states market of last resort, also known as an assigned risk plan, Boggs said. This might be the owners only option.

Don’t Miss: Replace Title Florida

Can I Drive A Car With A Salvage Title

A car with a salvage title cannot be driven on the road legally even if it still runs.

However, depending on the severity of the damage, some of these cars can be repaired and rebuilt.

Many states will require that you have the vehicle inspected to make sure that it is roadworthy. If the car has been salvaged, or rebuilt, it then receives a “branded” or rebuilt title.