Can I Lower My Car Payment Without Refinancing

Yes, you can lower your car payment without refinancing. However, this treat arrives with the financial consequence it exposes you to pay higher interest rates. Nonetheless, it allows you the benefit of having money to spend and invest for returns.

Several borrowers consider refinancing as a good option for a car payment. It does not deny the fact that refinancing requires complex processes and the extension of a loan term.

Recommended Reading: How To Transfer A Car Loan To Someone Else

Refinance Your Auto Loan

Refinancing your existing loan might reduce your monthly payments. If interest rates have dropped since you got your original loan, your credit has improved, or you just arent confident you got the best possible rate to begin with, you may be able to get a new loan with a lower rate and better terms. Keep in mind that refinancing involves opening up a new loan with new terms that means the potential for brand-new loan fees on top of interest youd pay. And if you end up extending your loan term and are able to lower your monthly payments, youll be paying interest for longer.

Read Also: Usaa Auto Loan Payment Calculator

The Kia Sonet Gtx+ Automatics Launched In India At A Price Point Of Rs1289 Lakh

The Kia Sonet was launched recently in India. However, the price tags of the top-variant models of the car were not revealed at the time of the launch. The automakers have recently revealed the prices of the petrol and diesel variants of the top-spec model.

The Kia Sonet GTX+ will be available in both petrol and diesel variants and will come with automatic transmission setups. Both the cars have been priced at Rs.12.89 lakh . As per the latest revelations of the prices, the petrol range of the car now starts at Rs.6.71 lakh and goes up to Rs.12.89 lakh and the diesel variant starts at Rs.8.05 lakh and goes up to Rs.12.89 lakh. There is a total of 17 different trims of the car on the basis of the engine, trim, and so on. The two petrol unit variants of the car churns out 83 hp and 120 hp respectively. The diesel unit is a 1.5-litre setup which churns out 100 to 115 hp of max power and 240 Nm to 250 Nm of peak torque.

30 September 2020

Read Also: How Do I Get New Plates For My Car

Ways To Make Your Car Work For You

If you want to keep your car but need help affording it, use your car to make money. These solutions wont lower your payment instead, they increase your income so you can more easily make your payments. You might make more than enough to cover the car payment, so some extra cash goes in your pocket.

Each of these three options come with risks make sure you consider them carefully and have the right insurance.

Features And Benefits Of Car Loan

When it comes to car loans in India, in general, the following features and benefits are offered. Note that, the following is a generalized look at the advantages offered by car loans. Individually, car loan lenders may have highly customized and specialized offerings for their customer base.

- It helps you purchase a car even if you dont have all the money for it right now.

- Most car loans will finance the on-road price of the car.

- Some car loans will even finance 100% of the on-road price. This means no down payments.

- With some banks offering financing in the crores, you are not limited in your choice of cars

- Most car loan offerings in India are secured loans. This implies that the car serves as the security/collateral for the loan.

- Procuring a car loan is usually simple when compared to other loan products. Individuals with slightly unsavoury credit scores can also hope to procure one. However, this option differs from bank to bank.

- Car loans in India often offer fixed interest rate options. This means, you are always assured of a fixed amount that needs to be repaid monthly.

- Many lenders will offer interest rates based on your credit score so a high score to get you a cheaper loan.

- Car loans are not meant for just new cars. A used car loan can help you buy a pre-owned car.

Also Check: Does Uber Offer Car Seats

Where Can You Get The Best Auto Loan Interest Rates

Lenders dont all offer the same auto loan interest rates by credit score. Youll likely find a range of rates available to you if you compare auto loan offers. Thats why its good to shop around. There are a number of places you can find auto loans. Some may have better loan options than others, depending on your circumstances.

Refinancing Auto Loans For A Better Interest Rate

According to NerdWallet, with car loans, the interest rate you get is influenced by several factors. If you can consistently make on-time payments on your car loan, refinancing can be a great way to get a lower interest rate and decrease your monthly payment. Here are just a few examples of times when refinancing a car loan can be beneficial:

Says NerdWallet, by refinancing your car loan, you are replacing your current auto loan with a new one. Usually, the amount of the new loan is just the balance left unpaid on your current loan. However, some lenders offer the option to take cash out on your loan when you refinance. Because there typically isn’t much equity in an auto loan, this often results in an increased likelihood of owing more money on your car than it’s worth, per U.S. News. Therefore, unless you need emergency cash and you put down a large down payment when purchasing the vehicle, taking cash out is usually inadvisable.

Information and research in this article verified by ASE-certified Master Technician Duane Sayaloune of YourMechanic.com. For any feedback or correction requests please contact us at .

Also Check: How To Insure A Car

Can You Refinance A Car Loan

Yes, many lenders offer auto loan refinance opportunities, and several promise to make the process quick and easy. It can pay to refinance your loan in several different circumstances. For example, you might be able to improve your rate and monthly payment, shorten the term of your loan repayment, or extend the term if youre having trouble making payments.

Send In Extra Principle In Your Monthly Car Payment

Sending in extra principle has the effect of lowering your interest over the life of the loan.

When I bought my first car, I was a very savvy buyer looking to save money on my financing in every nook and cranny I could squeeze a few incremental dollars out of. I sent in extra principal with my car loan payments, which accelerated the payoff on my car from 42 months down to 36 months.

How do we do that? Its all in the way mortgages and car loans work. In the early months of the loan you are paying almost no principle back and each monthly payment goes almost all to interest. But lucky for you folks, you can control this formula by forcing more principle down their throat with your monthly payments, which means you are paying the loan off sooner. Since you pay it off early, they dont get to charge you all that interest anymore.

When I first bought my house, I sent in $300 to $500 extra principle each month. Then, before you know it, I knocked over 10 years off the life of my loan and saved tens of thousands of dollars.

There you have it, I bet you never thought you had so much control over the interest you will pay on your car loan. So remember, be patient and calm. If it takes a few more months, let it happen. Pay off all credit card balances if possible, finance online directly with lenders, refinance your existing car loans to lower rates, choose a shorter term auto loan and allow the lender to deduct your monthly payment directly from your bank.

Don’t Miss: How Much Does Rental Car Insurance Cost

When Is A Personal Loan The Right Choice

A personal loan is the right choice for you if you are not seeking the funds for educational related items and are simply trying to fill gaps in your expenses. Personal loans allow you to have more freedom with the funds in terms of what they are used on. Keep in mind, however, that personal loans will often come with a higher interest rate, so be sure you can meet all necessary payments.

Income Tax Benefits On Car Loans Taken To Purchase Electric Vehicles

If you have taken a car loan to purchase an Electric Vehicle , you can now enjoy a tax rebate of Rs.1.5 lakh on the interest paid. This was announced in the latest Union Budget by Finance Minister Nirmala Sitharaman and is a part of the governments efforts to stimulate the adoption of environment-friendly mobility solutions. If you have purchased an electric vehicle, you will be able to avail a benefit of about Rs.2.5 lakh during the entire term of the loan. The government has also slashed the tax rates on electric vehicles to 5% from the earlier 12%.

Also Check: How Much Oil Should I Put In My Car

Check Top Car Dealers In India

Car dealerships in India are committed to providing quality services across all areas of car servicing and maintenance. Majority of the car dealers in India have tie-ups with the automakers to impart training to their technicians in maintenance, diagnostics, system check, etc. Staff training and expanding the facilities is a continuous process taken up by dealers to ensure that customers receive the best value for the money they pay. Right from the sale of brand-new cars and used cars to periodic maintenance and customer support, the dealership outlets offer a wide variety of services. Nowadays, most dealers list out their services online to ensure a seamless customer experience without requiring face-to-face interactions.

Compare Current Car Loan Rates In Canada From A Range Of Lenders

If you need financing to buy a new or used car, the interest rate youre offered will affect how much your loan will cost you and ultimately how much your car will cost you. You need to be in a strong place financially to qualify for the most competitive car loan rates that lenders advertise and thats not the only factor to consider when shopping around for the best deal on car loan interest rates in Canada.

Recommended Reading: What Car Company Makes Acura

What Is An Interest Rate

An interest rate is an amount a lender charges you for borrowing money. Its shown as a percentage of the principal or the amount loaned. The interest rate can affect the amount you end up paying for a vehicle significantly. It can add thousands of dollars to your repayment amount.

Lenders base the interest rate they charge on a few factors. Your credit history is one of them, along with the price of the car and the amount of your down payment.

Average Car Loan Interest Rates By Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

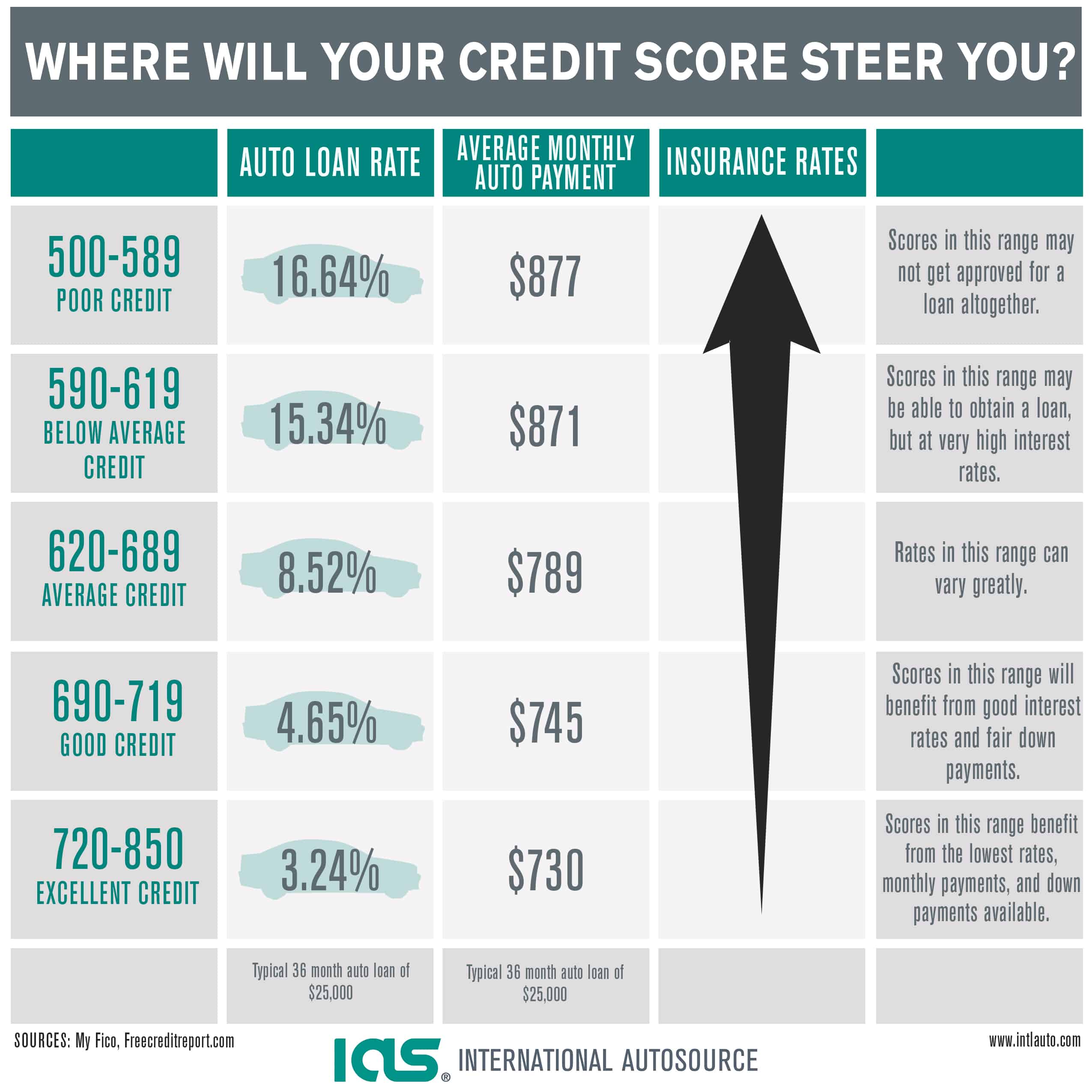

If youre in the market for a new or new-to-you vehicle, average car loan interest rates by credit score may give you an idea of what rate to expect from a lender.

Auto loan rates are provided as an annual percentage rate, or APR, and are based on several factors, such as your income and debt, as well as your credit score.

But your is likely the biggest factor in determining which rate youll get. The higher your credit score, the lower your car loan interest rate will probably be, because lenders perceive you as less likely to default on the loan.

Don’t Miss: Does Personal Car Insurance Cover Rental Cars

How To Use Average Car Loan Interest Rates

Once you know your credit score and the average car loan interest rate you might qualify for, you can use our car payment calculator to estimate the monthly payment for various loan terms.

You wont know your actual rate until you apply for a car loan and receive lender offers, but you’ll have a general idea of the rate. You can expect to pay higher interest rates for longer-term loans than short ones. To ensure you get the best deal possible, get rates from multiple lenders and compare.

If youve already financed a car and your rate is higher than the average rate listed for your credit score, you may be able to refinance for a lower rate and a lower payment. Apply to refinance your auto loan with several lenders to see the rates you’re offered.

About the author:Shannon Bradley covers auto loans for NerdWallet. She spent more than 30 years in banking as a writer of financial education content.Read more

What Factors Contribute To Auto Loan Interest Rates

While it is true that the interest rate you will receive varies depending on the lender and is somewhat out of your control, there are still choices you can make to increase approval. Consider these aspects and how they will affect loan approval and rates.

- Your credit history. Lenders use credit scores to measure the risk that borrowers carry. Very simply, the lower your credit score is, the higher your interest rate will be.

- Vehicle down payment. Putting down a large down payment will not only bode well with lenders but will decrease the amount you are borrowing saving you more money down the line.

- Loan term. Typically, a longer-term loan will equate to higher interest rates and more interest paid over the life of the loan. But a longer-term loan will decrease your monthly payment.

- Education and work history. Many lenders are expanding underwriting criteria outside of the sole measure of your credit score. This means you can still benefit from a competitive rate if you have a strong profession or educational background with or without a perfect credit score.

- Vehicle age. An older vehicle can carry additional risk of issues for both you and your lender. So, you can expect an older car to carry higher rates.

Recommended Reading: What Is Esp In A Car

How To Calculate Auto Loan Interest

Its smart to determine your expected auto loan interest rates prior to signing off on your next loan. Not only will it put you in control of your finances, but it can ensure that you dont end up paying more interest than you should. Here are a few ways that you can calculate your car loan interest rate.

- Calculate on your own. You will need the interest rate, term and loan amount, just as you would for any other method. Divide your interest rate by the number of payments in a year, then multiply it by your loan balance. The resulting number will be how much your interest payment for the month is.

- Use an auto loan calculator. If you are looking for a simpler route to avoid any mental math, an auto loan calculator will handle all the calculations. Bankrates auto loan calculator will present you with your estimated monthly payment, total interest paid and a full amortization schedule.

- Speak directly to a loan officer. Finally, connecting directly with a loan officer will provide you with a more tailored experience. This way they can tell you expected rates with your credit history in mind. Speaking directly to a loan officer is also a great way to gather and compare a few options.

Car Loan Interest Rates Explained

Borrowers with credit scores of 660 and lower are typically considered bad credit borrowers. If your credit score is in this range, you may fall into one of three categories: nonprime, subprime, or deep subprime.

People in these three groups usually need to find auto financing through a subprime lender that can work with credit-challenged situations. However, theres a price to pay for being financed with less than perfect credit higher interest rates.

Interest is the cost of borrowing money, and the rate you qualify for is mainly influenced by your credit score. Generally, the higher your credit score, the lower the interest rate. There are other factors that contribute to interest rates, of course, including the federal funds rate, the lender youre working with, and the length of your loan.

Also Check: How To Get A Dealer License For Car Auctions

Whats Considered A Low Interest Rate On A Car Loan

Generally, the lowest interest rates you can find on a car loan are around 2% or 3%. However, any car loan with a rate under 5% is considered low-interest and youll need good or excellent credit to qualify.

However, if you have less-than-stellar credit, the lowest rate you might be eligible could be upwards of 10%. Since car loans are usually secured, they typically come with lower rates than an unsecured personal loan.

Who actually qualifies for the lowest Rate?

Just because you see a low-interest rate advertised for a car loan with one particular lender, dont automatically think thats how much youll end up paying. Those ultra-cheap interest rates may only be available to you if you have excellent credit or if you are buying a certain type of car.

Recommended Reading: When To Refinance Fha Mortgage