Premium Calculation For Used And New Cars:

Every car insurance company uses its own set of parameters to calculate the premium for a policy. However, the factors that are considered by most insurers are listed below:

- Premium calculator for used cars – The online car insurance calculator tool helps you in procuring the most appropriate auto insurance policy for your vehicle in a transparent and convenient manner. To calculate the premium for used cars, you will have to provide the following details:

- Type of car

- Details of the existing car insurance policy

- Registration number of the car

- Details regarding change in ownership

- Claims for previous years, if applicable

The used car insurance calculator tool will show you the premium required to insure the vehicle in a matter of seconds.

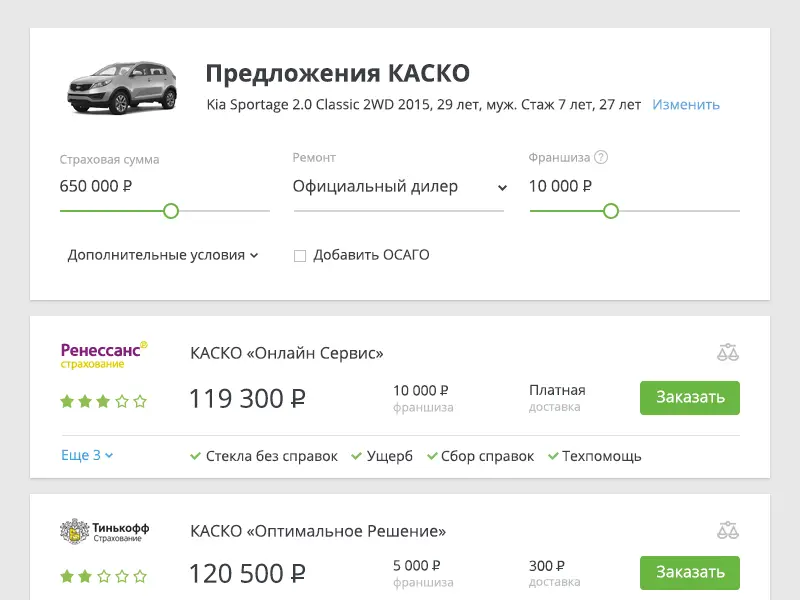

- Premium calculator for new cars – The new car insurance calculator tool provides a listing of top insurers and their car insurance products in a few simple steps. This offers a new car owner the much needed guidance in narrowing down on an appropriate auto insurance policy for his/her prized set of wheels. The details you would have to provide to calculate the premium for insuring a new car are:

- The name of the car manufacturer

- The model of the vehicle

- Year of manufacture

- Personal details of the owner-driver

- State of registration of the vehicle

How Does My Age Affect My Car Insurance Premiums

Young people between 17 and 25 have a hard time when it comes to insuring a car â sometimes the insurance is as expensive as the vehicle itself. There are ways of softening the blow, though. It might be worth considering a telematics car insurance policy or adding an experienced named driver to your policy â just be careful of âfrontingâ.

How Does My Car Affect My Car Insurance Premiums

As youd expect, the kind of car you drive could have a large bearing on how much you pay for your insurance.

There are different insurance rates by car. If its a brand new sports car, for example, the cost of repairs or replacement could be far higher than a bog-standard car.

There are a few things you need to keep in mind when looking at this:

Also Check: Powering Car Amp In House

How Are Car Insurance Prices Calculated

Your car model and driving history influence the amount you pay for car insurance and this is changing in 2021

Article

2020-10-25

Buying your first car is always a big milestone in your life. Your car keys act as your keys to the world. This is particularly true in Europe, where new experiences, different cultures, and memories that will last a lifetime are only a roadtrip with friends away. So, whats holding you back?

Well, money of course. Its not just the initial investment required to buy a car, but also regularly paying for petrol and insurance that make a dent in your finances. While the amount you spend on fuel relates to how much you consume, many drivers ask themselves: How is the price for my car insurance calculated? We want to shed light on this question.

Whether You’re Renewing Or Getting A New Quote Here Are Important Components That Go Into Calculating Your Premium That We Want To Help You Understand

Ever wonder how car insurance rates are calculated? Its time to open up the hood and find out!

While every car insurance company takes similar factors into account when calculating how much to charge, you will find that premiums can vary. Factors range from things you have control over, like your driving history, to things that are calculated based on demographic and statistical risks, like your age, postal code, and vehicle type.

Claims Costs

A number of factors have led to an increase in auto insurance premiums. The costs of claims have been going up in recent years as the price tag to repair cars equipped with the latest technologies has increased. The increase in severe weather has also played a role in cost increases, with more ice storms, floods, hailstorms, and other natural events damaging cars. Another key factor is the rise in people making fraudulent claims something which increases the cost of insurance for everyone.

Where you live

Many people dont realize that how much they pay may be affected by their postal code. Your insurer uses where you live to estimate risk based on things like how frequently cars are stolen in your area, how often people make claims, or how many accidents occur near you.

Vehicle type

Your vehicles make, model and year have a significant impact on your car insurance premiums. These factors are important for multiple reasons:

Vehicle use

Vehicle drivers

Coverage types

Deductible amount

Driving record

Drivers training

Discounts

Don’t Miss: How To Stop Geico Insurance

What Are The Benefits Of Using A Car Insurance Calculator

- Fill out your vehicle, personal, and claims information only once and you can calculate the rates from dozens of insurance companies.

- The online website will take up the information that you fill out and shop on your behalf. Compare and benefit from the variety of options so that you are under no pressure.

- They have many insurance companies on their board and negotiate your rates.

- You may save time, money, and a lot of effort while choosing your best insurance option. The seamless and convenient online process helps you to take a good decision.

- When you use the car insurance calculator you are aware of the factors that affect your rates and how to drive them down in the future.

- Most importantly it is a FREE car insurance calculator tool, you have nothing to lose.

If You Are Driving For Commercial Purposes

If you use your vehicle for work, you may need to get commercial car insurance coverage. Thats because your personal car insurance policy will not cover any accidents, damage or theft that occur on a work vehicle. Your business may also require a higher liability limit than is typically available through personal car insurance policies.

You May Like: What Gas Stations Can I Use My Synchrony Card At

What Are The Factors That Affect The Car Insurance Premium

A car insurance premium is affected by different factors like:

The Car itself

The insurance premium for some cars are more than others. The engine cubic capacity of your car decides the premium of the third party cover. Higher the cc of your car higher will be the premium of TPI. The make model details are considered if you are choosing other packages and add-ons.

Where you live

The location in which your car is registered plays an important role in the premium of your car insurance. If you live in a highly populated urban area or in a city then the premium will be higher. Because the chances of claims are higher due to heavy traffic, congestion, vandalism and other factors.

Age of the Vehicle

For a new vehicle, you would look for a greater extent of coverage. It is because if the new car gets damaged, the cost of repairs will be high. Instead, for an old vehicle, the cost of replacement of the parts and repairs can be affordable for you. Hence, the age of the vehicle governs the car insurance premium.

Fuel Type

Owning a CNG car will attract more insurance premium because the cost of maintenance is higher in comparison to that of petrol or diesel car. The damage repair costs are higher for the CNG kit installed car. Hence the premium is more.

Driving Efficiency

If you are a bad driver and has higher records of accidents, probability of own damage is more. Also, you wont get No claim bonus discount, hence you will end up paying a higher premium.

Insureds Declared Value

Average Settlement Amount For Pain And Suffering In Car Accidents

The average car accident settlement for pain and suffering ranges from a few thousand dollars to upwards of $250,000 or $500,000. The amount of compensation paid in a personal injury claim is based on several factors, like the severity of the injuries and the potential timeline for healing. More severe injuries typically incur higher settlement amounts.

For instance, an accident victim who suffered a traumatic brain injury and sustained permanent disability will likely receive a higher settlement than an accident victim who suffered a mild concussion that resolved in three weeks. Likewise, a victim involved in a head-on collision with a tractor-trailer will likely receive more than a victim who was barely side-swiped at an intersection.

There is no specific settlement amount for pain and suffering in car accidents, but previous compensation amounts can help provide an estimate of the settlement you may receive for your accident injuries. Take a look at a few examples for a better idea of what your unique case details may award in pain and suffering compensation.

You May Like: Does Carvana Take Leased Cars

The Rising Cost Of Claims

Millions of claims on car insurance policies are made every year.

As cars become more and more sophisticated, the costs of parts, labour and the expertise needed to repair them goes up. But the cost of a personal injury claim is even more expensive than ‘bent metal’.

Making sure someone injured in a car accident receives enough money to support them during their recovery is important. As most insurers pay out the majority of the premiums you pay in claims, prices have to go up to cover these costs.

At LV=, we want to make sure you’re getting the right level of cover for your needs at a price that’s affordable for you. Watch our video for everything you’ll need to get a quote and hit the road with LV= car insurance

View video transcript

At LV=, we want to make sure were giving you the right level of cover that meets your needs at a price that is affordable for you.

So, heres what well need to know from youA bit about you and your named drivers, like your name, address and date of birth.Well also need your driving license details and information on any endorsements you might have.

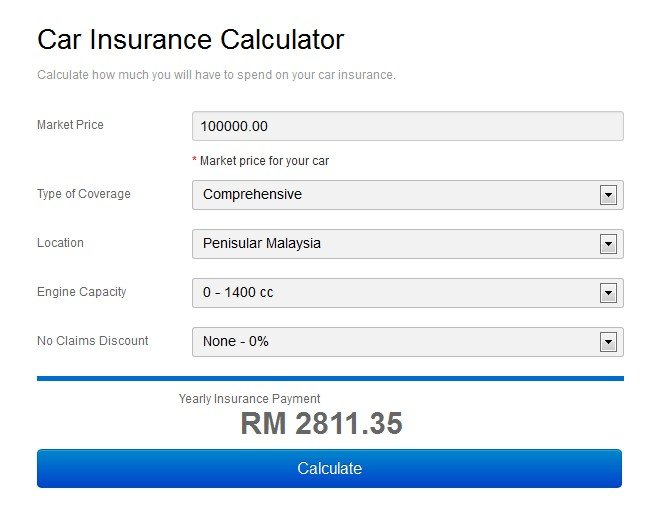

How To Use Car Insurance Premium Calculator Online

Every insurance provider has its own method of calculating the car insurance premium amount.

However, there are two major divisions namely, the premium calculation for used cars and the premium calculation for new cars. You will be required to enter certain essential details in order to calculate the premium for your car insurance.

Here are the steps to get the insurance premium through the vehicle/car insurance premium calculator:

- Select the brand, model, variant and fuel type of your car

- Select the registered location of your car correctly

- Select the year in which you purchased your car

- Select Yes or No to confirm if you made any claim in the previous year

- After this, you will have to enter your name and mobile number. You will get an OTP on the mobile number, entering which will get you the policy premium quotes for the car insurance.

Also Check: Repair Car Clear Coat

Optional Car Insurance Coverages

Comprehensive insurance

This type of auto insurance covers damages resulting from incidents other than car accidents or collisions. Comprehensive coverage includes protection from hazards like extreme weather, vandalism, falling objects, fire, theft, and flooding.

Collision insurance

Collision insurance covers damage to your car in the event of a vehicle rollover or a collision with another vehicle or object. If your car is totalled, collision insurance will pay the cost of replacing it.

Uninsured motorist coverage

Covers costs related to your injury or death after an accident caused by another driver who is either uninsured or unidentified, as in the case of a hit-and-run driver. Keep in mind that this coverage only pays for damage to your vehicle if the uninsured driver is also identified.

Alexandra Bosanac

About the Author

Alexandra Bosanac is the Core Content Manager for LowestRates.ca. Her reporting has appeared in Canadian Business, the Toronto Star, the National Post, and the CBC.

Use Online Car Insurance Calculator And Make A Prudent Purchase Decision:

A car insurance calculator, apart from enabling you to calculate the premium online, also helps you compare policies between different car insurance providers. This caters to the varying needs of customers, as it helps them evaluate the options available in the market and narrow down on a plan that suits their needs. You can also buy a car insurance policy online in a few simple steps following policy comparison.

Also Check: What Gas Stations Accept Synchrony Car Care

What Can’t Be Used To Calcuate A Car Insurance Premium

Car insurance companies may not legally consider the following, when deciding how much your car insurance premiums will be:

- Your credit history, including past bankruptcies. While some provinces have banned the use of credit scores, others say it helps evaluate a driver’s risk and could result in lower premiums.

- Your employment status

- How long youâve lived in your current home

- Whether you own or lease your vehicle

- Any period of time when you did not have car insurance

- Accidents for which you were not at fault

Examples Of Pain And Suffering Settlements

The examples below are not real life cases and are being used for illustrative purposes only. The figures used here are not representative of what your pain and suffering claim may be worth. Each case is different and past results do not predict future performance. The only way that you can discover the value of your claim is to speak with an attorney.

Example 1: Accident victim Mary was involved in a T-bone accident after a negligent driver drove through a red light and struck her vehicle. Her left arm was broken, and she received numerous cuts on her face and chest from broken glass. Mary was required to wear a plaster cast for eight weeks and received multiple stitches, some of which caused permanent scarring.

After weeks of physical therapy, Mary still experienced arm pain after the crash that prevented her from resuming her job full-time. She filed a personal injury case for her medical bills and lost wages, as well as a claim for pain and suffering for her left arm and her stitches. Mary was awarded $50,000 for her pain and suffering.

Example 2: Accident victim Joe was on his way to work when a speeding driver rear-ended him. The force of the impact shattered multiple ribs, which led to extensive stomach pain after the accident. Joe went to the hospital for x-rays, where doctors discovered one of his broken ribs punctured his right lung.

Recommended Reading: Getting Hail Dents Out Of Car

Tips For Saving With A Car Insurance Calculator

Getting the most out of a car insurance calculator is important. It ensures that your auto insurance quotes are as accurate as possible. Here are some actionable tips for the questions needed in the calculation :

- Gather your driving information : Gather your current policy, vehicle and driving details will help you save time and get a precise estimate. Dont forget about family members if they are on your policy as well.

- Know your coverage and policy limits : Know the deductible you are comfortable with and the type of coverage you want to be included . Make sure you have the same amounts each time to ensure you are comparing the same information.

- Discounts : There are many discounts offered by each company such as home and auto bundle, multi-vehicle, winter tires and many more. Make sure you select the ones that apply so you get a lower price.

Consider all the variables when choosing your car insurance to make sure you are getting good value and the best rates.

Average Car Insurance Rates Across Ontario

The average cost of car insurance in Ontario is $104 per month. Its $1,250 yearly.

| City | Average Car Insurance Rates in Ontario* |

|---|---|

| Clarington | |

| Brampton | $2,014 |

*Methodology: We used a sample profile for a male driver aged 30 years with his own vehicle having mandatory coverage. He drives a Honda Civic 2012 car. With an average mileage of 5000 8000 km per year to commute to work. He has a clean driving record history of 5 years with no accidents or collisions.

We surveyed the Ontario car insurance prices for the purpose of illustrating. The ranges in quotes based on driving record, location, and other criteria. To get a customized quote, enter your postal code above.

Read Also: How Much Does A Car Salesman Make On Commission

Your Policy And Deductibles

When you are choosing your car insurance deductible and coverages, the specifics play a role in your monthly payment.

- Generally, choosing a higher deductible means a lower monthly payment.

- Choosing a lower deductible means a higher monthly payment.

Any additional coverage you add typically gives you added insurance protection, depending on the claim, but will also add to your monthly cost.

One way to lower insurance costs is to review your policy with your insurance agent and eliminate any coverage you may not need, such as comprehensive coverage on an older vehicle, rental reimbursement or emergency roadside service.

How Is My Car Insurance Premium Calculated

When calculating your car insurance premium, insurance providers will look at various factors including your occupation, your annual mileage, your address, how much voluntary excess you are willing to pay, the make and model of your vehicle, where you park your car overnight, your age, how long you have been driving for, your driving history, any no claims discount as well as whether or not you have added any named driversonto your policy.

Ultimately, car insurance providers calculate your car insurance premium by assessing how big of a risk you pose to them. They do this with the help of facts and statistics related to all the above mentioned criteria.

You May Like: How To Make Vent Clip Freshies