Amortized Loan Payment Formula

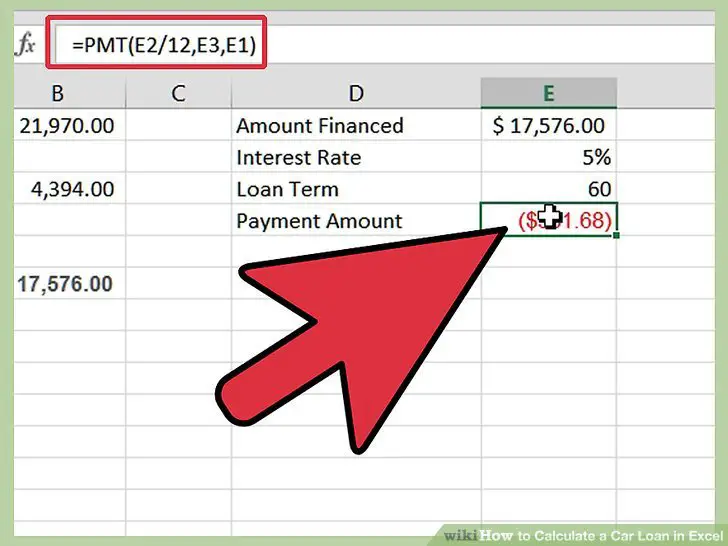

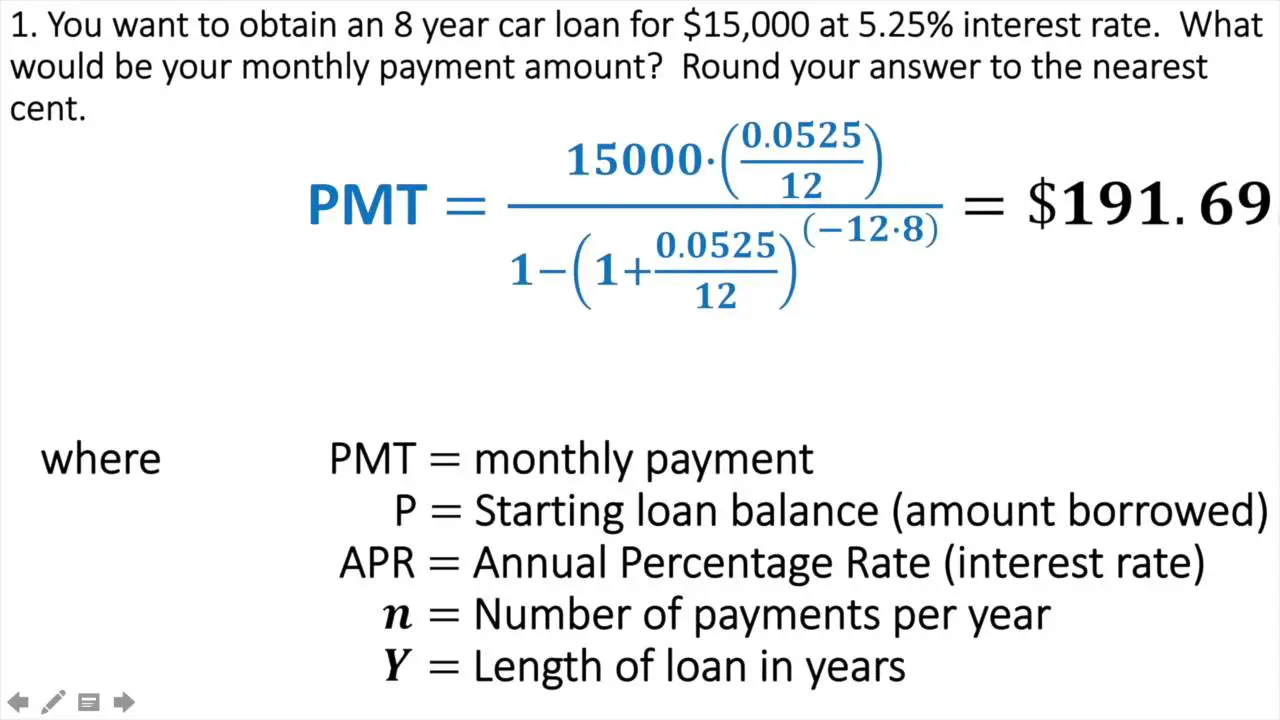

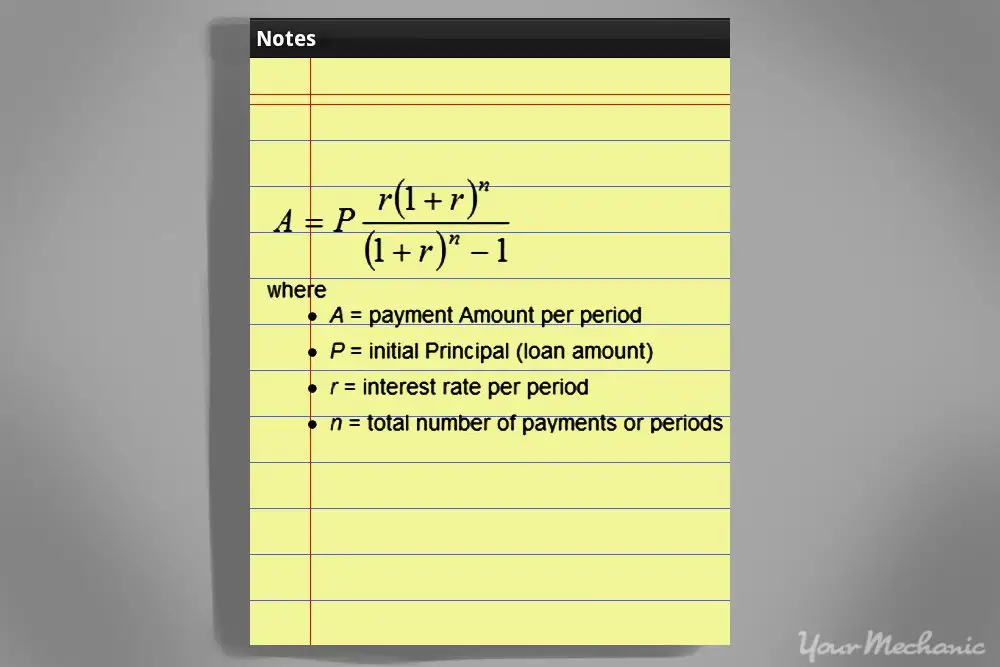

Calculate your monthly payment using your principal balance or total loan amount , periodic interest rate , which is your annual rate divided by the number of payment periods, and your total number of payment periods :

Assume you borrow $100,000 at 6% for 30 years to be repaid monthly. To calculate the monthly payment, convert percentages to decimal format, then follow the formula:

- a: 100,000, the amount of the loan

- r: 0.005

- n: 360

- Calculation: 100,000//=599.55, or 100,000/166.7916=599.55

The monthly payment is $599.55. Check your math with an online loan calculator.

Use Our Interest Rate Calculators

If all of that looks like way too much math to stomach, or if you donât have time to become a spreadsheet expert, you can use our handy financial calculators to do the work for you.

Our repayments calculators will tell you the repayment youâll make on a monthly, fortnightly or weekly basis, and give you the total amount of interest youâll wind up paying on your car, personal or home loan. And our credit card debt payment calculator will show you how long it will take you to pay off a credit card debt, plus how much youâll pay in interest and fees.

How To Calculate A Car Loan Payment

If youre using financing to buy a new or used vehicle, you should already know that youll have to pay back that loan over several months or years. But just how much will you owe each month, and what costs are included in those payments?

When purchasing a car, it is nice to know how to calculate your car loan payment. Calculating total and monthly costs allows you to budget accordingly and figure out the total price of the carnot just the sticker price.

The math involved can be overwhelming if you do not use math often, but finding a good car loan calculator and having the right information handy can save you a lot of time.

Read Also: What Is The Safest Car For Teenage Drivers

Whats The Average Interest Rate On A Car Loan

According to the Federal Reserve, in the first quarter of 2021, the average auto loan rate on a 48-month new-car loan was 5.21%, and the average rate on a 60-month new-car loan was 4.96%.

A range of factors can affect what interest rates you might be offered, including your credit scores, the size of your down payment and the length of your loan term. Your rate may be higher or lower than average depending on your financial situation.

How To Calculate Auto Loan Interest For Going Forward

After youve paid your first month, learn how to figure interest on a car loan from this point onward:

Also Check: How Long Will My Car Last

How To Calculate Auto Loan Interest For The First Payment

How to calculate interest rate on a car for the first payment is slightly different than the subsequent payments, so here is the formula for the initial bill:

How Can I Pay Less Interest On My Car Loan

Interest charges can add thousands of dollars to the amount you have to repay. But there are ways you may be able to minimize the impact on your wallet if you need to finance your car purchase.

- 0% APR financing If you have excellent credit and the auto manufacturers finance division offers special financing, you may be able to take advantage of 0% APR financing for a certain amount of time.

- Early repayment If you have a simple interest loan, you can reduce your interest charges by paying more than the minimum due each month or paying off the balance early.

- Shorter loan term Choosing a shorter repayment term will lower the total amount of interest you pay in the long run. But itll increase your monthly payments, so be sure you can afford it.

- Refinance down the road If interest rates drop or your credit improves after you get your car loan, you may be able to get a lower rate by refinancing.

You May Like: Freshies For Car

How To Calculate Total Interest Paid On A Car Loan

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin. This article has been viewed 339,242 times.

There are several components that are used to compute interest on your car loan. You need to know the principal amount owed, the term of the loan, and the interest rate. Most car loans use an amortization schedule to calculate interest. The formula to compute amortization is complicated, even with a calculator. Car buyers can find amortization calculators on the web. If your car loan uses simple interest, you can use the calculator to determine your monthly payment amount.

Do Not Forget About Car Insurance

Some people forget about the cost of car insurance while budgeting for a new car. It is essential to work that cost into your monthly budget. All 50 states require drivers to have some kind of auto insurance, so this step isn’t optional.

Insurance costs vary by the car you drive. If you’re considering a new car, get a new insurance quote. This quote will help you more accurately budget for your new car.

You May Like: How To Make Car Freshies

Calculating Interest On A Credit Card

Itâs a good idea to think of using a credit card as taking out a loan. Itâs money that is not yours, youâre paying to use it, and itâs best that you pay it back as soon as you can.

For the most part, working out how much you pay in interest on your credit card balance works much the same way as for any other loan. The main differences are:

- Your basic repayment is a minimum amount set by your credit card company. It might be a set dollar amount, similar to any other loan, or it might be a percentage of your balance. Itâs best to pay more than the minimum amount, because often, it doesnât even cover the cost of interest. Paying only the minimum is how you wind up with a massive credit card debt.

- If you make purchases on your card before paying off previous amounts, it will be added to your balance and youâll pay interest on the whole lot. This will change your minimum payment amount as well, if the minimum payment is based on a percentage of your balance.

Itâs always a good idea to pay off as much of your credit card balance as you can, as early as you can. This way, you avoid getting hit by high interest rates.

So when youâre calculating your interest, just remember to use the right amount for your repayment value and add any extra purchases onto your balance, and the above method should work to calculate your interest.

Where To Get A Car Loan

If youre looking to take out a loan to finance your auto purchase, you have plenty of options to choose from. When it comes to financing your vehicle, you should be sure to come prepared in order to ensure that your negotiation with a car dealership is successful and you dont wind up paying more than you bargained for.

Online rates comparison tools like can help you to learn more about what rates you qualify for. Monevo lets you compare loan offers from different lenders for free. If you see a loan that meets your needs, you can apply quickly and easily online, and have the funds available to you in as little as one business day.

Read Also: How Many Miles Do Car Batteries Last

How To Calculate Monthly Interest

The Balance 2020

Calculating interest month-by-month is an essential skill. You often see interest rates quoted as an annualized percentageeither an annual percentage yield or an annual percentage rate but its helpful to know exactly how much that adds up to in dollars and cents. We commonly think in terms of monthly costs.

For example, you have monthly utility bills, food costs, or a car payment. Interest is also a monthly event, and those recurring interest calculations add up to big numbers over the course of a year. Whether youre paying interest on a loan or earning interest in a savings account, the process of converting from an annual rate to a monthly interest rate is the same.

Home Loans And Credit Cards

Home loans can be complicated. It is smart to use an amortization schedule to understand your interest costs, but you may need to do extra work to figure out your actual rate. You can use our mortgage calculator to see how your principal payment, interest charges, taxes, and insurance add up to your monthly mortgage payment.

You might know the annual percentage rate on your mortgage, and keep in mind that APR can contain additional costs besides interest charges . Also, the rate on adjustable-rate mortgages can change.

With credit cards, you can add new charges and pay off debt numerous times throughout the month. All of that activity makes calculations more cumbersome, but its still worth knowing how your monthly interest adds up. In many cases, you can use an average daily balance, which is the sum of each days balance divided by the number of days in each month . In other cases, your card issuer charges interest daily .

Also Check: What Oil To Use In My Car

How Much Will The Total Loan Cost

It can be difficult to understand exactly how much you’ll pay when you have several competing loan offers. One might have a lower interest rate, while another offers lower fees. Figuring out which offer to choose means you’ll need to calculate the total cost of the loan including interest and fees. Calculators help with apples-to-apples comparisons. For example, some amortization calculators show you lifetime interest which you can use to compare interest costs from loan to loan.

Consider more than just your monthly payment amount when reviewing the terms of a loan.

In addition to your monthly payment, its crucial to focus on the purchase price, lifetime interest, and any fees.

APR is another useful tool for comparing loan costs. On mortgages, some APRs account for upfront costs in addition to the interest rate you pay on your loan balance. But the lowest APR isnt always the best loan. You might not even qualify for the lowest advertised APR. If the APR is low but closing costs and fees are high, and you don’t keep your loan for very long, you won’t see the benefits of that low APR.

With mortgages, you’ll also want to take into account other costs, such as property taxes, homeowners insurance and homeowners association fees. A good mortgage calculator can help you account for all of those costs to get the true cost of the house.

Get Help From The Financial Professionals At Cactus Jack’s Auto

Financing a car purchase can be overwhelming, so the experts at Cactus Jack’s Auto are available to answer any questions from Glendale-area drivers and do the heavy financial lifting. Calculating an interest rate is always easier with a trusted advisor walking you through the steps, so stop in and lets talk! Basic information on how interest rates affect your payments are available online with our monthly payment calculator. If you have any questions, dont hesitate to reach out to our finance center.

Read Also: How To Protect Car From Hail Damage

Loan Payment Calculations Explained

The Balance / Julie Bang

Loan payment calculations, or monthly payment formulas, provide the answers you need when deciding whether or not you can afford to borrow money. Typically, these calculations show you how much you need to pay each month on the loanand whether it’ll be affordable for you based on your income and other monthly expenses.

How To Calculate Auto Loan Interest For First Payment

When figuring out how to calculate auto loan interest for the initial payment, the steps below can help:

The number you get is the amount of interest you pay in month one.

You May Like: How Much Does It Cost To Transfer A Car Title In Az

How To Figure Interest On A Car Loan For First Payment

When it comes to knowing how to figure interest on car loan for the first time, you have to take into account that this initial payment will be slightly different from subsequent payments. This can be done easily using the following steps:

How To Pay Less Interest On Your Loan

To further minimize your loan costs, try to pay off your debt early. As long as there’s no prepayment penalty, you can save on interest by paying extra each month or by making a large lump-sum payment.

Depending on your loan, your required monthly payments going forward might or might not changeask your lender before you pay.

Recommended Reading: How To Buff Out Scratches On Your Car

How To Figure Interest On A Car Loan For The Future

After you begin to pay down your initial principal, you will then be required to determine your new balance to see what you will be paying going forward. Here is how you can calculate these payments:

Errors in the calculation and the fact that the numbers are rounded will cause you to not have an exact calculation each time, but it does give you a good idea on how to calculate the interest rate on a car loan.

How Do I Manually Calculate An Auto Loan

Buying a car often requires taking out a loan to finance a portion of the costs. To calculate your monthly payment, you need to know your loan term, the interest rate and the amount you borrowed. The longer your loan, the smaller your monthly payment will be but the larger the total amount of interest you will pay over the life of the loan. Knowing how much you will pay each month will help you figure out if the loan will fit your budget. You will need a scientific calculator to raise a number to a power.

Don’t Miss: How To Burn Mp3 Cd For Car Using Windows Media Player

Simple Interest Car Loans

Most auto loans are simple interest loans, which means that the amount of interest you pay each month is based on your loan balance on the day your payment is due. If you pay more than the minimum due, the interest you owe and your loan balance can decrease.

On a simple interest loan, interest is front-loaded and amortized. With an amortized loan, part of your monthly car payment goes to the principal, which is the amount you borrowed, and part of your payment goes to the interest charges. Because the loan is front-loaded, a larger portion of each car loan payment applies to interest at the beginning of the loan term and at the end of the term more applies to the principal balance.

For example, If you have a $25,000 car loan with a 48-month term and a 4% interest rate, youll pay an estimated $83 in interest and $481 in principal during the first month of the loan term. By the last month, youll only pay an estimated $2 in interest, and $563 will apply to the principal amount.

Interest Is What You Pay To Borrow Money From A Lender When You Finance The Purchase Of A Vehicle

Interest charges are included in your monthly loan payment and can add thousands of dollars to the amount you have to repay. Thats why its important to understand how car loan interest is calculated, what factors can affect your rate and how to minimize interest charges.

Recommended Reading: Home Depot Car Key Programming

How To Calculate Interest On A Car Loan

To take a car loan means commonly that to buy a car. Car loan also is known as a hire purchase loan. Here in this article, you will see how it works and how to calculate our monthly installment for a car loan.

Calculation