Because You Cant Afford To Replace Or Repair Your Car Without The Insurance Payout

If you have enough savings to afford to replace or repair your vehicle without the help of insurance, you might be able to avoid paying for full coverage insurance. However, if you know you wont be able to do so, youll want to maintain full coverage, so you dont have to worry about getting your vehicle in working order if something happens.

Best Full Coverage Car Insurance Companies

In case youre choosing which car insurance organization to go with, you ought to consistently attempt to track down a decent cost. Yet, in case youre searching for more than savings funds, you should consolidate different components into your choice, for example, client assistance and coverage highlights. Beneath weve featured some of the best car insurance organizations for full coverage dependent on a mix of cost, client care, and coverages.

Geico: Of the insurance organizations accessible to practically all drivers throughout the country, State Farm and Geico are the cheapest. Despite the fact that Geico is more costly than State Farm on average, that doesnt mean itll be more costly for you back up plans utilize a wide scope of components to decide rates and your quote could be altogether different from your neighbors. Notwithstanding its reasonableness, Geico is known for its excellent customer service, with hardly any complaints from clients and good grades for claims fulfillment from J.D. Force. The mix of moderate rates and solid client experience makes Geico an incredible company for full coverage customers.

Erie: Erie is the wisest possible solution: it has probably the cheapest full coverage rates in the nation and has extraordinary customer services. The issue is that Erie is only accessible in 12 states generally in the Midwest, Appalachians, and Northeast and Washington D.C.

Ology For Selecting The Cheapest Full Coverage Car Insurance

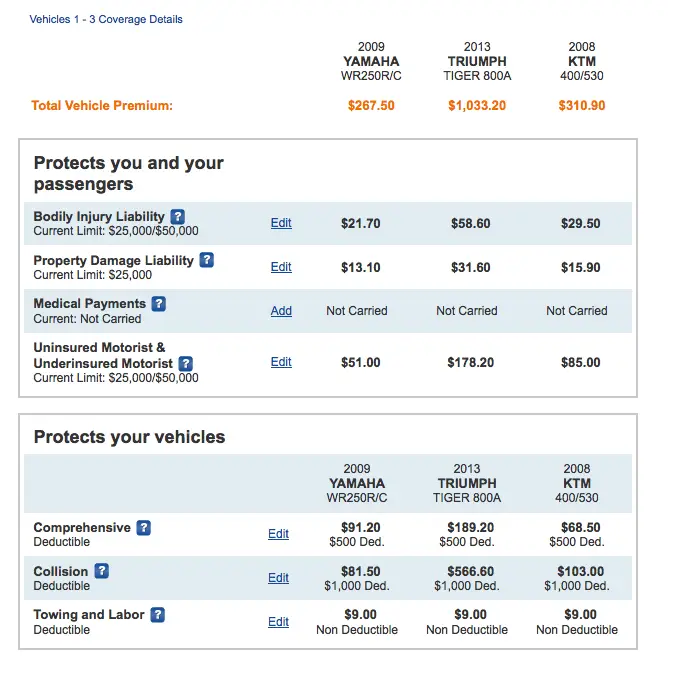

WalletHub editors ranked 17 major car insurance companies to determine the cheapest full coverage auto insurance. Premiums reflect the average of a series of quotes sourced from Quadrant Information Services, using California ZIP codes and the following coverage limits:

- $100,000 bodily injury liability coverage per person

- $300,000 bodily injury liability coverage per accident

- $50,000 property damage liability coverage per accident

- $100,000 uninsured motorist coverage per person

- $300,000 uninsured motorist coverage per accident

- $50,000 uninsured motorist property damage coverage per accident

- Collision coverage with a $500 deductible

- Comprehensive coverage with a $500 deductible

Average and lowest full coverage premiums by state were determined using the coverage limits listed above, plus any other coverage required by the state .

You May Like: How To Report A Car Stolen

State Wise Full Coverage Cost Analysis Along With The Cheapest Insurance Company In Your State

We always impose on the fact that your geographical location plays an important role in the final cost calculation of any insurance type. Also, every state has its own auto insurance laws which also affects the cost.

Every state has different insurance companies that can provide you to get the full coverage insurance. But again comparing rates for each carrier might be confusing.

Hence, we have analyzed the average rates for full coverage insurance and state minimum liability for all the states in the USA along with the cheapest insurance company in that state.

Please note the following average cost as per the typical coverage level and deductibles in the USA. For full coverage, the liability limits are 50/100/50 along with collision and comprehensive deductibles at $500 each.

| State |

|---|

Get Cheapest Insurance Rates from Leading Companies now!

Heres The Best The Marketplace Has To Offer In Comprehensive Coverage

With decades of combined experience covering the latest news, reviewing the greatest gear, and advising you on your next car purchase, The Drive is the leading authority on all things automotive.

The Drive and its partners may earn a commission if you purchase a product through one of our links. Read more.

The best auto insurance should fit the way you want to live, but it shouldnt cost an arm and a leg. Cheap full coverage auto insurance is available you just need to know where to look. Ive rounded up the top insurance companies with the cheapest rates to help you on your journey. Whether youre carrying full coverage on a financed vehicle or making sure the family car is safer than Fort Knox, keep reading to discover how to save money on full-coverage insurance.

This review may include references to products or services where The Drive has an affiliate relationship with the providing company. The Drive and its partners may earn a commission if you purchase a product through one of our links. Read more.

Don’t Miss: How Much To Lower A Car

How Do Life Events Affect Auto Insurance Premiums

Certain life events can either raise or lower your insurance rates, especially if you are under 25.

1. Roommates and Car Insurance

Insurance companies often assume that roommates allow each other to drive their vehicles and want to make sure this extra risk is covered. To do this, they often require roommates who share a vehicle to have all parties listed on the policy. If your roommate is not listed, you might have to exclude them in writing.

To cover yourself and your roommate, you can add each other to your policies. To exclude your roommate from your policy, depending on the insurer, you might have to provide documentation showing that they have their own insurance policy. Others might just allow you to say it.

2. Marriage And Car Insurance

Once you get married, if you haven’t already added your spouse to your policy, call your insurance company and add them. Updating your status from single to married can significantly lower your premium. Just making this change can drop your annual premium by up to $89 or more.

Updating your auto insurance policy with your spouse’s information and switching to just one policy for the two of you also simplifies things. If you don’t add your spouse as a driver, they can’t drive your vehicle without taking on the risk of driving without insurance.

3. Renting vs. Buying Your Home

When Should I Drop Full Coverage Auto Insurance

You can drop your full coverage auto insurance down to standard insurance coverage after you pay off the sum for a car and the title belongs to you. In a case where you are planning to sell a car, you can drop the coverage as soon as you have secured a buyer for your car.

Lastly, if the car that you bought for a higher price, has been around for a couple of years and you see that the price has reduced significantly then you can drop the coverage.

Recommended Reading: How Much Is A Paint Job For A Car

Save Money With Cheap Car Insurance

Not everything in the world is the same. Even the most identical twins do not share every feature. Its the same with car insurance quotes. Before you shop for the best rates for car insurance, here’s what you need to know about auto insurance quotes. Depending on the auto insurance company, car insurance quotes will vary by thousands of dollars a year. For the same coverage, a driver might receive a quote from one carrier for $25 per month and another for $135 per month.

Our team of car insurance analysts reviewed hundreds of quotes that were gathered around the country. Our study reveals that obtaining multiple free car insurance quotes is often the best way to find cheap car insurance.

Buy Only The Coverage You Want

You cant drive legally without the state-required coverage. But if you own your car outright without a loan or lease, and your car is already on its last leg, you may want to consider foregoing comprehensive and collision coverage.

The maximum amount your comprehensive coverage will pay you is the market value of the car which decreases with each passing year minus your deductible. If this amount is more than your premium, then it will be useful. If not, you would be better off saving the money you would have otherwise spent on the premium for repairs.

We suggest using the Kelley Blue Book or Edmunds.com car value pricing tools to determine how much your car is worth and decide if what you pay for your comprehensive coverage is actually worth it.

Also Check: Where To Get Car Stereo Installed

What Coverages Does Cheap Full Coverage Car Insurance Provide

Typically, full coverage car insurance includes liability, comprehensive, and collision, depending on state laws and requirements.

But the policy also has the following coverage:

Comprehensive insurance covers injuries and damage to your vehicle that results from:

- Weather damage

- Falling objects

- Theft and vandalism

- Accidents that involve animals

Collision insurance covers damage when your vehicle is involved in an accident in situations such as:

- Crashes with other vehicles

- Being the victim of a hit-and-run

- Driving into stationary objects such as stop signs or light poles due to error or unfavorable driving situations

Personal injury protection covers the medical costs for injuries you sustain in a crash that may or may not be your fault. A PIP claim is paid regardless of who caused the accident.

Uninsured motorist coverage takes care of the cost of property damage and bodily injury in an accident if another driver is at fault and doesnt have insurance.

Underinsured motorist coverage deals with the expenses due to an accident in which the driver at fault has car insurance, but their insurance limits are insufficient to cover the damages.

How To Find Cheap Car Insurance

Everyone wants to save money without forgoing quality. Some insurance companies focus on the bare necessities for you to drive legally bodily injury and property damage liability with the minimum limitsalong with a claims process thats spotty at best. Rather than take a chance on that cheap car insurance company, you can get quality coverage that wont break the bank with Nationwide.

Nationwide insurance professionals can quickly design a car insurance quote that meets your precise needs, even for those on a budget. We provide flexible coverage and billing options, allowing members to pay monthly, quarterly or semi-annually online, through the mail or over the phone. Its important to keep long-term flexibility in mind when deciding on an insurance carrier, and to not just go with the cheapest car insurance option available.

Recommended Reading: How To Get Water Stains Off Car

Lower Your Auto Insurance Rates

Shopping for a Car insurance quote can get pretty pricey, depending on your circumstances.

Some things about your insurance rates can be customized while others you can’t control. Luckily, there are a number of savings and discounts available that can lower your car insurance premiums.

Outlined below are some steps that drivers can take by getting cheaper car insurance rates and discounts.

What Is The Cheapest Car Insurance For Male Drivers Between 20 And 25 Years Old

Young male drivers between the ages of 20 and 25 pay an average of $386 more every six months than any other driver in the U.S. Because insurers consider males high risk, they pay higher premiums than female drivers in the same age group. As they get older, the differences in the premium amounts even out, but it is more difficult for young male drivers to find cheap auto insurance. Here’s a look at some companies that offer the cheapest car insurance for under 25 male drivers, and some tips for finding additional discounts.

When you look at the top five auto insurance companies, GEICO offers the cheapest premium rates for male drivers who are between 20 and 25 years old. Here is a list of the top companies to use as a starting point for your search for cheaper car insurance. You can start with GEICO, but remember to look at other companies’ rates to make sure you are getting the best possible premium.

The average 6-month premium for young male drivers from the top insurance companies

- GEICO – $845

- Liberty Mutual – $1,227

Don’t Miss: Will My Car Insurance Pay For Repairs

Finding Affordable Car Insurance

Everybody wants the best value for their car insurance premium. But what makes Nationwide unique are the high-quality benefits members can get:

- Dependable, customizable car insurance. You can choose the auto insurance policies that suit your lifestyle and budget.

- Top-notch claims service. Nationwide Claims Service is there when you need it, 24/7. You can file a claim online or by phone.

- An annual On Your Side® Review to ensure your coverage is meeting your needs.

- Accident Forgiveness helps you avoid increased rates in the event of your first at-fault accident.

Best Cheap Full Coverage Car Insurance

Most states require that you carry at least minimum levels of certain car insurance coverage to drive legally. While these coverage limits ensure that you comply with the law, the coverage they provide is minimal and does not include coverage for damage to your vehicle.

To determine the car insurance companies to feature, Bankrates insurance editorial team first reviewed average premium data obtained from Quadrant Information Services. We also analyzed each companys available coverage options, discounts, policy features and third-party rankings from sources like AM Best, Standard & Poors , the National Association of Insurance Commissioners and J.D. Power.

Based on our research, we have assigned a Bankrate Score on a scale of 0.0 to 5.0 to each company. The higher the Bankrate Score, the more highly a company ranked in each of the scoring categories.

If you are searching for the best cheap full coverage car insurance, these companies may be a good place to start. These providers are some of the cheapest in the nation, but also offer exceptional coverage:

| Car insurance company | Average annual full coverage premium | Monthly premium cost |

|---|---|---|

| $121 |

Read Also: How To Check Oil In Car

Full Coverage Versus State Minimum Insurance Rates Based On The Age Of The Driver:

The drivers age decides if the driver should be in the high-risk category or low-risk category. High-risk category drivers are mostly the young and new drivers who have less experience on the road and hence they get the highest insurance rates.

Until you reach 70 years your insurance rates will keep decreasing as directly proportional to your experience. Once you reach 70, the rates will start increasing again. As per the insurance companies, a driver of more than 70 years of age comes under the high-risk category.

Following are the rates of drivers from 16 years to 80 years for both Full Coverage and State minimum insurance rates:

| Age |

|---|

| $1,146 |

Save Money With Cheap Auto Insurance

Are you looking for cheap auto insurance but worried about sacrificing quality and service in favor of a more affordable rate? GEICO has you covered. The word “cheap” might be scary when it comes to an auto insurance policy, but it doesn’t have to be this way. With GEICO, cheap car insurance means something completely different. It’s affordable. It’s good for your budget. All while providing you with 24/7 customer service and top-of-the-line insurance for your vehicle.

Here at GEICO, quality doesn’t fall by the wayside when it comes to providing customers with affordable auto insurance and great customer service. Get a free car insurance quote to find out how much you could save. Keep reading to learn more about what makes our cheap car insurance different from the rest.

You May Like: What Color Is My Car

Erie Auto Insurance: Best For Multi

Another provider of cheap comprehensive insurance is Erie Insurance. This company provides cheap full coverage insurance quotes online and is known for customer service. The main downside of Erie Insurance is that coverage isnt available in every state. You can only get an auto insurance policy if you live in these regions.

|

District of Columbia |

Erie Insurance might be right for you if:

- You live in a covered state

- You have had one accident

- Your credit score is excellent

To learn more about this cheap auto insurance provider, check out our review of Erie auto insurance.

How To Find Cheap Full Coverage Car Insurance

Full coverage car insurance is a type of policy that extends your coverage beyond liability-only insurance. It includes coverage for collision and comprehensive damages, but policy rates are higher. However, drivers pay less out of pocket after an accident with full coverage insurance.

You can get more affordable full coverage auto insurance if you raise your deductibles and lower your coverage limits. However, this strategy is only recommended if you drive an older vehicle or can afford to repair or replace your car since youll be paying more out of pocket in return for lower annual rates.

Since full coverage auto insurance costs more up front, its important to shop around with multiple companies to see which can offer you the best monthly rates. Auto insurance costs vary based on your age and driving record, so search for companies that cater to your unique driving situation.

If you want to save the most on car insurance, compare auto insurance quotes from at least three companies in your area. Comparing rates from multiple companies side by side is the fastest way to find one with the cheapest full-coverage car insurance.

Read Also: What Wiper Blades Fit My Car

Nationwide Car Insurance Discounts

You can get more affordable car insurance rates on Nationwide coverage with our car insurance discounts, such as:

- Multiple policies discount When you carry multiple types of insurance policies from Nationwide , you could qualify for lower premiums on each policy than if you had separate policies from different insurers. Think of it as a discount for bundling.

- Good student discount Cheap car insurance for students is possible with Nationwide.

- SmartRide® discount SmartRide is a tracking tool we offer to reward safe driving. Heres where rubber truly meets the road plug the device into your car and it will track your driving habits, such as hard braking, speed and so forth. With a steady hand at the wheel, your low-risk driving can earn you lower insurance premiums.

- Paperless discount You’ll save money on stamps and avoid late fees if you sign up to have your Nationwide bill paid automatically at regular intervals from your checking or savings account. Some policyholders may even earn a recurring discount when they agree to receive documents electronically.