Major Claims And Disasters

There are some exceptions to paying your deductible or applying only one. Here are some examples:

- It may apply per season or by calendar year.

- For flood insurance claims, there may be distinct deductibles for your building structure and contents.

- You insure your car and home with one insurer, and it has agreed that you will only have one in a loss that affects the two.

And How Your Deductible Affects Your Insurance Premium

When you buy car insurance, youll have to make several choices about your insurer and optional coverages. Youll also have to choose your insurance deductible, which can be more challenging than it sounds. Should you try to save money by picking a higher deductible or feel more secure by going with a lower one?

To choose the right deductible for you, youll need to consider your driving history, your emergency fund, and the costs of different deductibles, along with several other factors. Heres what you need to know about your options.

What Happens If You Have A Zero Car Insurance Deductible

Some insurers offer a zero deductible. Under some circumstances, you may be able to waive the fee during the process. However, these plans may have higher costs, and you may need to meet specific criteria to qualify. An example is having the additional endorsement for windshield replacement insurance where you don’t pay if your windshield is cracked or damaged.

You May Like: How To Detail My Own Car

Should I Choose A Low Or High Deductible Amount

Keep in mind that a lower deductible for car insurance normally will result in a higher premium, because youre assuming less of the cost for a claim. And a higher deductible typically will lead to a lower premium, because youre assuming more of the cost if you make a claim.

If you have a car loan, your lender may require a certain deductible amount, so be sure to check before selecting an amount.

Otherwise, there isnt a right or wrong deductible amount, it really comes down to what youre comfortable doing. Generally, if you would rather pay more for car repairs than for insurance, a high deductible might be worthwhile. Consider the following:

- A high deductible might make sense if it doesnt make you feel nervous that you will have to pay more to fix your car if you file a claim.

- You might opt for a high deductible if you have the money already saved to pay the difference between your repair bill and claim payout.

- If you dont live in an area prone to hail, flooding or animal collisions or have a long commute or drive in an urban area, you may be less likely to file a claim, which means a high deductible might not be a bad choice.

Higher Auto Insurance Deductibles

- Pay more out of pocket if you have a claim

- Premiums will be lower each month

- May need to save emergency money in case of a claim to cover higher deductible

Still not sure what deductible makes sense for you?

- High Deductible Scenario

Scenario: A tree branch crashed down on the hood of your car during a thunderstorm.

You take your car to the mechanic and find out its going to cost $1,500 to fix it. Since you chose comprehensive coverage with a low deductible of $250, youve been paying a little more each month for your premium and will only be paying $250 out of pocket for the damage. Your insurance company covers the remaining $1,250.

Scenario: You hit a tree with your car.

Now, lets say you hit a tree with your car, which is covered under your collision coverage. You wanted to pay less on your monthly premium and selected a $1,500 deductible for your collision coverage. The estimate to repair the damages on your car is $1,500 the same as your deductible. In this instance, it wouldnt make sense to file a claim since the amount youre paying for your deductible would be the same amount to cover the damages on your own. By the time you paid your deductible, there wouldnt be anything left for your insurance provider to cover.

Recommended Reading: How Long Does It Take To Tint A Sedan

If You Are Not At Fault Do You Have To Pay A Deductible

It depends on the facts. The other driver is responsible for the accident. Their liability coverage should cover your damages. You should not be required to pay adeductible. You may have to pay a deductible if the other driver has no insurance or is underinsured. This depends on the coverage you have. You can use your collision coverage to cover your damages if the other driver denies your claim or if your claim is complicated and takes a while to settle. Your insurance company will cover your damages up to the amount of your deductible. Then, you can ask the at-fault drivers insurer for the money back through a process called subrogation.

Am I Required To Pay A Deductible For Every Claim I Make

Many people are under the misconception that they must pay a deductible with every claim they make. This is not necessarily true. If you are found not at fault in an automobile accident, the other partys insurance company is responsible to pay your deductible. If you are found 100% or partially at fault, you will have to pay a deductible for repairs to your vehicle.

Also Check: How To Cancel Geico Auto Insurance Online

What Is Your Risk Of Making A Claim

You may be more likely to file a claim if you:

- Have accidents on your record

- Drive on busy roads

- Live in a city where cars are commonly stolen

When choosing your deductible, consider the likelihood of having to pay itperhaps even repeatedly.

Filing a claim could lead to an increase in rates for up to five years depending on the circumstances, state, insurer, cost, and a number of other claims.

Definition And Example Of Insurance Deductibles

Insurance deductibles have been part of insurance contracts for years. When you sign up for a plan, you agree to pay a certain amount before the provider pays. It’s the amount of money that you pay when you make a claim. Often, it is stated as a dollar amount.

It could also be listed as a percentage of the costs. That is more common for earthquakes, windstorms, hail damage, or higher-risk assets.

You’ll have to come up with your part of the bill before a claim is paid. Once you pay it, the insurance pays the rest of the claim. It will pay up to the policy limits and send the money to you or the people who are owed.

Suppose you backed your car into one of the light posts in the mall parking lot and caused $1,000 worth of damage to your car. If your deductible is $1,500, the insurance will not pay to repair the damage. If you had a $500 deductible, you’d pay $500, and they would pay $500.

Often, there are discrete types of coverage under the same policy, each with its own deductible. You may also have one deductible for your home and its contents.

Another example of different deductibles on one policy is an endorsement or rider. The rider may have no deductible, even though the rest of your policy does. One reason many people buy a rider is to avoid a deductible on high-value items.

You May Like: How To Remove Scuff Marks From Car Door Panels

Who Pays A Deductible In An Accident Do You Pay If Youre Not At Fault

When there’s a car accident, the at-fault driver is required to pay the car insurance deductible. However, if no one is deemed at fault, each car owner is responsible for his own deductible. If the at-fault driver does not have insurance or sufficient insurance to cover the other driver’s expenses, the no-fault driver can use his car insurance as secondary coverage to pay the costs.

How Does My Deductible Affect My Insurance Premiums

It may be tempting to choose a higher deductible to keep your monthly costs down, but thats not always the right move. Think carefully when selecting your deductible: If you go too high and get in an accident, the cost of filing a claim may be financially devastating. On the other hand, if you choose a very low deductible, youll be responsible for a high monthly payment.

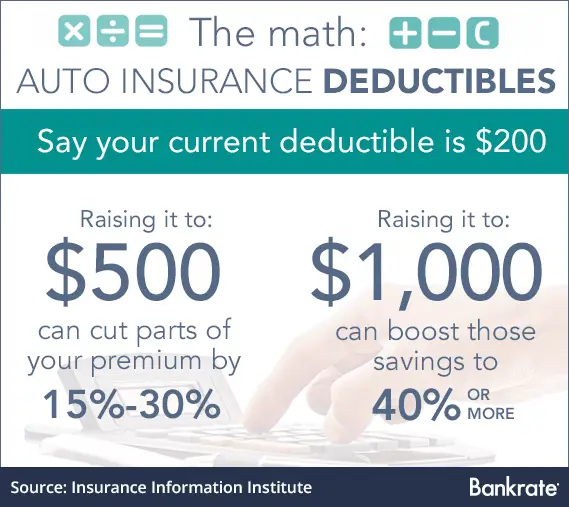

While no two insurance companies have the same deductible-to-premium ratio, generally, increasing a deductible from $200 to $500 could lower your collision or comprehensive premium costs by 15% to 30%, according to Nationwide.

Recommended Reading: Power Supply For Car Amp In House

Should I Choose A High Or Low Deductible

The best auto insurance deductible for you depends on your finances and needs. Remember that a high deductible usually means a lower car insurance premium and vice versa. But a higher deductible isnt always the right answer.

When choosing your insurance deductible amount, ask yourself two questions.

How Does A Deductible Work

Let’s consider what happens in a car accident for which you have coverage. If the damage inflicted costs significantly more than just your deductible amount, you’d only be responsible for paying out the deductible , whereas your insurer would cover the amount of damage in excess of your deductible sounds like a good deal, right?

Here’s an example: Your vehicle is damaged in an at-fault accident, and you’re unsure of how much the damage will cost you. You do, however, know your policy states a $1,000 Collision deductible, so what happens next? Regardless of who your insurer is, let’s talk about 2 ways that you can handle this situation.

Option 1: Your insurer first confirms the total cost for repairs. In this instance, they determine that your repairs will amount to $10,000. You communicate to the insurer that you’d prefer to take your car to your local mechanic. Since your policy states a $1,000 deductible, they will send you a claims cheque for $9,000 to cover the cost of repairs.

Option 2: Alternatively, you could choose to take your vehicle to a preferred repair shop , typically offered as an option by your insurance company. In this case, once the repair costs are finalized, the insurer would pay for the damage directly to the repair shop and you will be responsible for paying your $1,000 deductible once you pick up your vehicle.

You May Like: Repair Clear Coat Car

Progressive Insurance: Best For High

Progressive auto insurance is also available nationwide and is a great option for high-risk drivers. The insurer has full coverage options, plus add-ons like roadside assistance, gap insurance, and rideshare coverage.

There are many available discounts, including those for safety features on your car, going paperless, and paying your premium in full. Progressive has an easy quote process, which allows you to compare other auto insurance companies right on its website. Progressive received 4.5 stars in our in-depth review.

Read more in our full review of Progressive insurance.

The Value Of Your Car

High-worth vehicles are expensive to insure compared to cheaper or old vehicles. As such, getting a high deductible on an expensive vehicle can save insurance costs. On the other hand, a high deductible on low-worth vehicles may not be necessary as the high deductible amount may even be more than the value of the car.

Also Check: Can I Sell My Leased Car To A Private Party

Do You Pay A Deductible If You Hit Another Car

There are a few different coverages on your policy that could respond to you hitting another vehicle when you are at-fault for the accident. Your bodily injury liability and property damage liability will pay for the damages to the other party, and those coverages do not have a deductible. But if you have collision coverage and you want the insurance company to step in to cover the repairs to your vehicle, you will have to pay your collision deductible.

What Exactly Is A Deductible

A deductible is the amount that you are responsible for paying in the event of a claim. It applies to any insurance policy and varies depending on the contract. This may seem quite simple on the surface, but its not something you should take lightly. The deductible you choose has a real and potentially significant impact on your life!

The amount of your deductible influences the cost of your insurance. Essentially, the higher your deductible, the lower your insurance premiums, and vice versa. But if you do file a claim you will have to pay the amount of your deductible. You get itif there were no deductibles, insurance premiums would be higher.

Read Also: How To Restore Clear Coat On Car

When Is A Deductible Not Applicable

Though rare, there are some exceptions where a deductible is non-applicable. For instance, if another insured driver is responsible for your damages and injuries, a deductible does not apply. In that event, their insurance company must reimburse you, but if you have collision damage, you may want to settle things more quickly through your insurance. In case of partial or shared responsibility, the deductible will be applied in part or entirely – dependent on various factors. Be sure to look at the details of your policy to find out about any clauses regarding a non-applicable deductible.

Factors To Consider When Choosing A Deductible

- Likelihood of filing a claim

- Your savings

- How much a higher deductible will lower your premiums

- How much a lower deductible will cost per month

- Deductible amounts for different types of coverage that you may need to use in an accident, such as PIP, collision, and comprehensive and whether the total amount is affordable

- Whether or not your loan or lease requires a specific deductible

Read Also: Title Transfer Bill Of Sale Az

What Is Your Insurance Deductible

Your insurance deductible is the amount youll pay out of pocket when you make a claim before your insurer picks up the rest of the bill. Choosing your deductible allows you to decide how much financial responsibility you want for claims and repairs. A deductible is typically only required for certain types of auto insurance coverage, such as:

- Collision coverage: Pays to repair your car after its damaged in an accident with another vehicle or in a collision with a structure, like a fence or a guardrail.

- Comprehensive coverage: Pays to repair your car after a non-collision situation such as hail damage or theft.

In some states, you may also have a deductible for:

- Uninsured/underinsured motorist coverage: Pays to repair your car after damage caused by a driver without insurance or without sufficient coverage.

- Personal injury protection : Pays your medical bills when youve been hurt in an accident.

- Mechanical breakdown insurance : Covers the costs of some mechanical repairs, much like a warranty.

- Auto glass coverage: Pays to repair damage to your cars windshield.

When Do I Have To Pay My Car Insurance Deductible

Youll pay your deductible when your claim is approved but you wont have to write a check or pay your insurer. Instead, your insurer will deduct your deductible amount from the payout of your claim.

For example, if your claim is approved for $4,000 and you have a $500 deductible, youll receive $3,500 from your insurance company for the claim.

Recommended Reading: Where Is Synchrony Car Care Accepted

What Is Car Insurance Deductible

Car Insurance Deductible: When you purchase an insurance policy, you agree to pay a deductible and a premium. Basically, the deductible is the amount you have to pay to settle damage: it is deducted from the total amount of the damage. The premium is the amount you pay in exchange for the protections guaranteed by the policy you purchase.

Deductibles allow your insurer to transfer some of the risks of insuring your vehicle in order to reduce the premium you would have to pay without a deductible. However, not all claims are subject to a deductible, which we will discuss in more detail below.

Examples Of When You Have To Pay Car Insurance Deductibles

- When you use PIP insurance to pay for your own medical expenses regardless of who was at fault.

- When you file a claim with your collision insurance after accidents you cause.

- When you use your own comprehensive insurance to cover vehicle damage.

- When using uninsured motorist property damage insurance to cover vehicle damage after an accident with an uninsured or underinsured driver.

- When fault is shared in an accident and you use your own insurance to pay for your vehicle damage and medical expenses.

Read Also: Grom-car Bluetooth Pairing

What Is An Auto Insurance Deductible

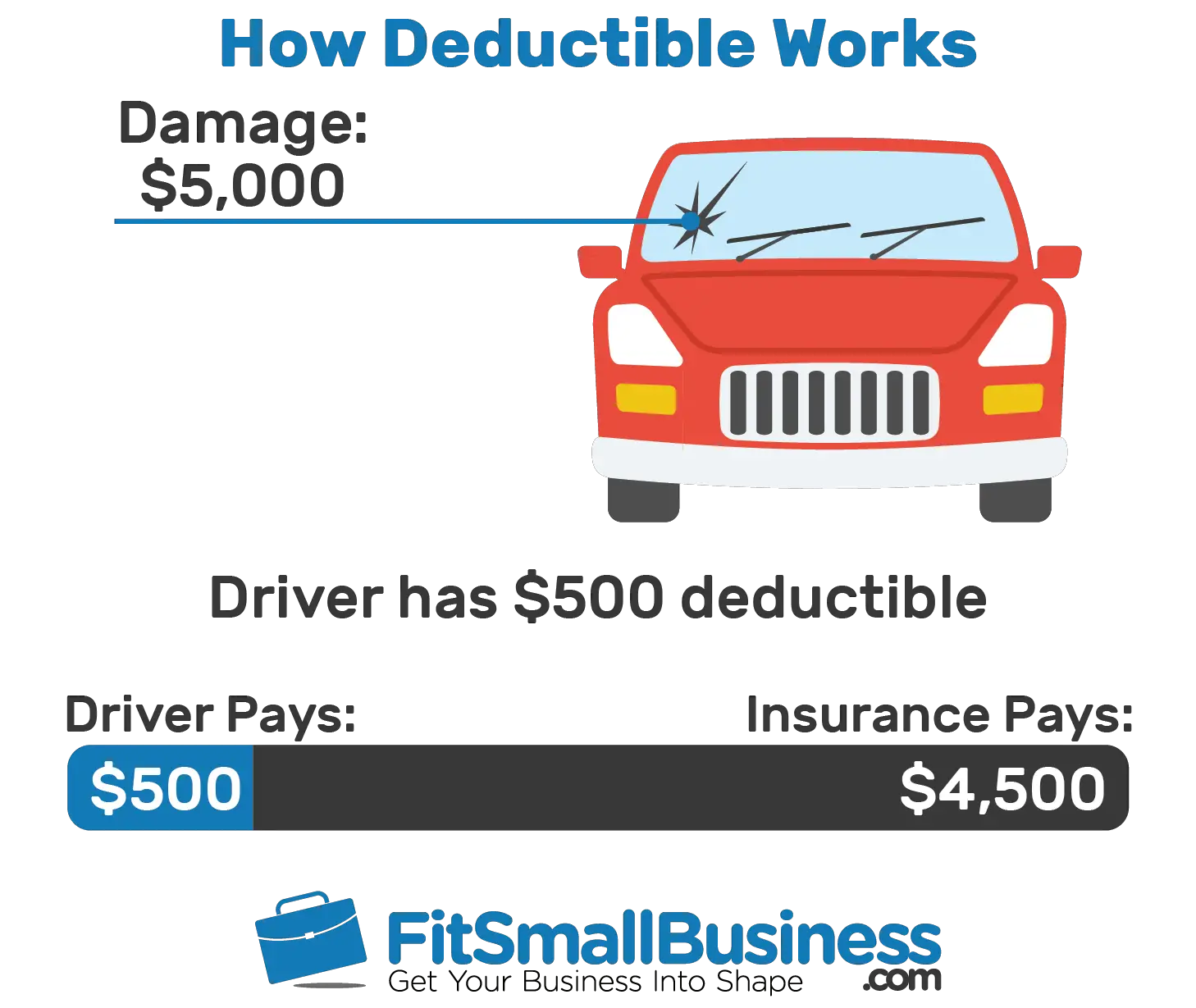

A car insurance deductible is the amount of money you agree to pay out of your own pocket for car repairs or replacement after an accident. If you are involved in an accident causing $5,000 of damage to your vehicle, and you have a $500 deductible, the insurance company should pay $4,500 of the claim while you are responsible for $500.

Your insurance deductible amount is something you will determine with your insurance agent or carrier before finalizing your auto insurance policy. However, you should have the option to change your deductible at any time.