Canadas Weather Has Become More Extreme

According to the Insurance Bureau of Canada, severe weather caused $1.9 billion in damage in 2018 alone. No single weather event caused relate claims to rise, but its had a noticeable cumulative effect on the industry.

That same report from the IBC lists several major examples of Ontarios extreme weather and how much they cost the insurance industry in 2018:

- A storm in early April causing over $40 million in damages

- An ice storm in mid-April that caused $190 million in damages, mostly in Southwestern Ontario

- A windstorm in early May that caused $380 million in damages in Ontario

- A flood in Toronto on August 7 that caused $80 million in damages

- A tornado in the Ottawa region caused $295 million in damages on September 21

Thats just for Ontario in 2018 alone, but the rest of the country has experienced its own severe weather and natural disasters in recent history as well:

Reason: You Have Gaps In Your Car Insurance

Many auto insurance companies consider the continuity of a car owners auto insurance. If youve had lapses or gaps in your car insurance history, you may be pegged as a high-risk car owner. As a result, your premium rates may increase by as much as 8% per year. The rate increase goes up to 35% if the coverage lapse extends beyond 30 days.

These penalties may also vary depending on your auto insurance provider. Make sure you ask your provider about how an insurance lapse would affect your premium rates.

What to Do About It: Avoid Lapses In The Future

Its in your best interest to keep paying for your cars insurance policy so it doesnt lapse. However, if this is not a feasible option, you can ask your insurance provider about suspending auto insurance on a car thats out of use. This way, you can avoid having insurance lapses on your record.

Does My Location Have An Impact On The Price Of My Auto Insurance Premium

Yes, the town or city that you live in affects the price of your auto insurance premium.

Every city and town is different in its own way each area has unique demographics, wealth levels, and weather conditions. Not to mention, each town and city has various levels of auto accidents.

Auto insurance providers use these location-related variables to determine the price of your auto insurance.

For example, if you live in a densely-populated city with high levels of auto collisions, like Toronto, then youll likely pay more than a driver that lives in a small, rural community in northern Ontario.

Read Also: Where Is My Carcareone Card Accepted

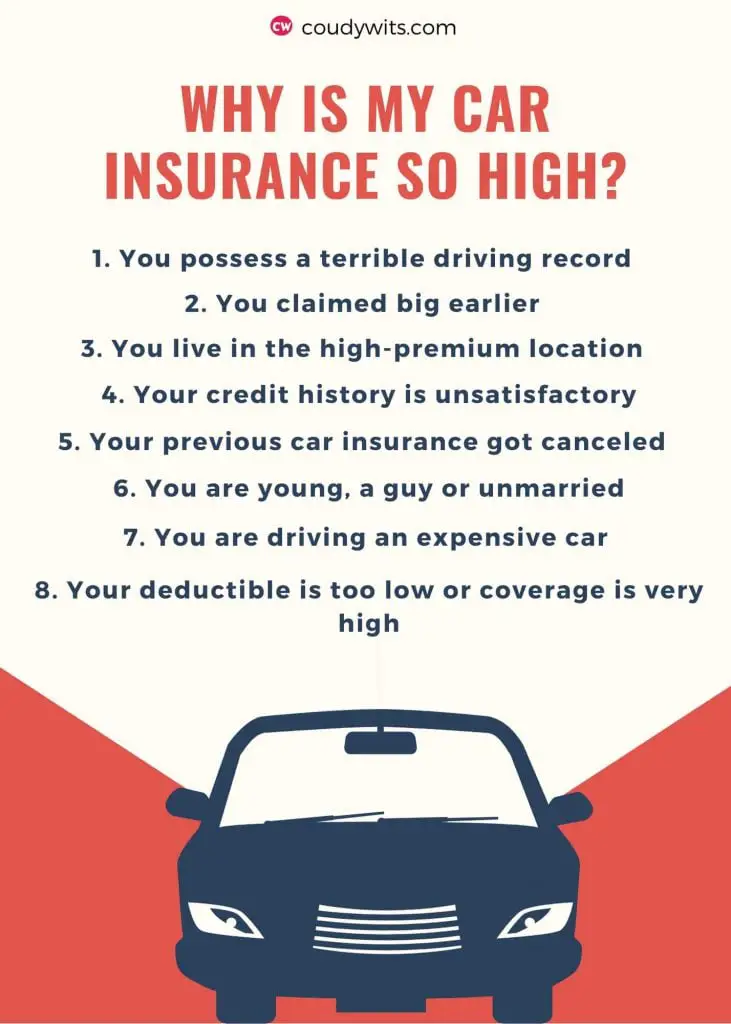

What Other Factors Can Affect The Price Of My Car Insurance

Lots of factors influence the cost of your car insurance, including your individual circumstances. The higher the accident risk, the higher your insurance premium is likely to be. Risk factors include:

- Your age. Young drivers typically pay more for their car insurance than older, more experienced, drivers. According to our latest Young Drivers research in November 2020, the average annual premium for 17-24 year olds is £1,063.**

- Your postcode. Some areas are considered at higher risk of theft and vandalism than others. For example, an inner city suburb car will probably cost more to insure than one from a rural postcode.

- Your job title. If your occupation is considered high risk, you could end up paying more. For example, a labourer might have a higher premium than a secretary.

- Your car insurance group. Generally, the higher the group your car is in, the higher your premium will be.

**50% of young drivers between 17-24 years old could achieve a quote of up to £1,063 for their car insurance based on Compare the Market data in June 2021.

Consider Your Coverage Types And Amounts

All the different types of car insurance can make it difficult to determine what exactly is worth paying for. At a minimum, you need to fulfill your states requirements and also purchase any coverage your lender or lessor requires. But beyond that, you can weigh whether each add-on coverage option is worth the price.

For instance, maybe you should drop uninsured motorist property damage insurance from your policy if you already have collision insurance. Or maybe you dont need rental reimbursement coverage anymore because you could borrow a family members car if needed.

Read Also: Carvana Car Lease

Vpast Insurance Claims Can Be A Reason Why Your Insurance Cost Is So High

Insurance providers review your claims and driving records for 3-5 years to conclude what type of driver you are.

The number of claims you make typically affects rates, regardless if youre liable or not. Insurance companies charge based on risk, and information displays that youre prone to file new claims if youve lately made one. When you prompted a collision that led to an insurance claim, this could increase your rate. Yet even not-at-fault accidents can raise premiums in some states.

Not all claims will push your rates up. An issue of claim might not be the reason for high insurance, suppose you file a minor claim or have a plan that incorporates some accident forgiveness. If the damage isnt severe, estimate the expense for repairs out of pocket compared to a possible premium increase from additional recorded claims.

Why Is My Car Insurance Quote So High If Im A Safe Driver

Theres a simple answer to this question you need to re-shop your auto insurance policy. Auto insurance providers offer various plans at different rates. Because of this, Insurance Provider A may offer less coverage at a higher price than Insurance Provider B.

If youve not found the ideal plan for you, consider reaching out to an experienced insurance advisor. Insurance advisors can provide you with multiple quotes within a few short minutes. Doing this allows you to compare dozens of plans until you find the perfect match for you and the rest of your family.

However, if youre planning to switch providers, we urge you not to cancel your auto insurance policy prematurely. Doing this creates a gap in your history, which doesnt look good the next time youre looking for a provider.

Read Also: Ca Car Registration Cost

Develop Good Driving Habits

Your age may be out of your control, but your driving habits arent. Many insurers offer car insurance discounts for drivers who meet one of the following criteria:

- Qualify as a safe driver

- Qualify as a good student

These discounts can help offset any increase due to your age or previous moving violations.

Reason: You Have Bad Credit

In most states, auto insurance companies use your credit score when calculating your car insurance premiums. Therefore, if you have a poor credit score, you may end up having to pay higher insurance premiums. However, the cost increase may depend on the auto insurance provider you choose and where you live.

According to the Insurance Information Institute, credit-based insurance scores are confidential ratings based on the insured individuals credit information. Many insurance providers use credit scores in combination with other factors to help determine premiums. This is typically the case for insurance lines such as personal car insurance.

What to Do About It: Invest in Credit Repair Services

According to actuarial studies, insured car owners with poor credit scores are a higher insurance risk. This is because they tend to file more claims. Taking the necessary steps to improve your credit score may simultaneously lower your insurance premiums as well.

Before you ask your insurance provider, Why is my car insurance so high?, keep in mind that not all insurers calculate rates in the same way. Therefore, one carrier may weigh your credit score more heavily than another. For instance, auto insurance companies based in California, Massachusetts, and Hawaii do not even consider credit scores when calculating premiums.

Recommended Reading: Average Sales Commission For Car Salesman

Change Your Insurance Policy

Some types of coverage may be optional or unnecessary in your state. For example, if you drive an old vehicle that you plan to replace soon anyway, you might choose to set coverage limits or do without uninsured motorist coverage.

This limits what your insurance company will cover in the case of an accident with an uninsured driver or hit-and-run, but it can save you money on your premium.

Residence And Parking Location

It may seem like a non-factor, but your home address and where you park your vehicle matter. Parking on the street or the driveway in a low-income neighborhood presents a greater risk of damage and theft, whereas a residential complex with a gatekeeper, personal garage, or secured parking lot positively affects the premium.

Don’t Miss: How To Clean Car Door Panels

A Recent Accident Or Claim

Whether or not you’re at fault, being involved in an auto accident can cause a rate hike. Being deemed at fault could signal you’re a risky driver, especially if you were under the influence. Even if you’re not at fault, filing a claimespecially a large onecould lead to a premium increase.

If you’ve filed previous claims or been involved in other accidents, you’re more likely to see your rates rise. That’s because the number of claims and accidents on your record affects how risky the insurance company deems you. Still, you should always file a claim, even in a minor accident. Other parties in the accident could sue you later, and your insurance company may not honor your policy if you didn’t report the incident.

Practice Good Driving Habits To Lower Car Insurance Cost

Following safe driving habits and holding an accident-free driving record is perhaps the most straightforward and evident approach to reducing your insurance rates. A few states provide safe driver courses that can restrict the points on your license, and you may be able to reduce your rate if the insurance agency accredits the course.

Many insurance companies offer discounts for signing up for defensive driving courses. Be sure to inquire with your insurance company regarding this offer before registering. Each state has its ordinance and requirements regarding accredited defensive driving courses, and you may check throughGEICO more about this.

If you choose to sign up for the class, either in-person or online, the violation may be lessened or excluded from your record entirely. Hundreds of money annually can be saved by avoiding mishaps and tickets altogether.

Also Check: How To Make Freshie

What Affects Car Insurance Premiums

Know the factors affecting car insurance premiums and learn how to lower insurance costs.

You pay one amount for car insurance, your best friend pays another and your neighbor pays still another amount. What gives? Most insurance companies look at a number of key factors to calculate how much you’ll end up paying for your car insurance.

Take a closer look at these factors that affect your car insurance premiums to clear things up some of them also come with bonus suggestions for keeping costs down.

Improve Your Credit Score

According to the Insurance Information Institute, insured drivers with lower credit scores generally file more claims and are therefore a higher insurance risk. Taking the steps to improve your credit score may simultaneously improve your insurance premium depending on your location, your insurance company, and how drastically your score improves.

Car insurance companies all determine rates differently so just because one company weighs your credit history more heavily does not mean that another company will do the same. In fact, California, Hawaii, and Massachusetts do not even take your credit into consideration. Because each provider calculates premiums differently, it is generally recommended to shop around for the best quote, even if you have lower-than-average or poor credit.

Also Check: Walmart Car Key Copy

Compare Quotes From Multiple Companies

The insurer you choose has a huge effect on what you pay for car insurance. We have found that the insurer with the highest rates can be as much as 81% more expensive than the cheapest insurer for identical coverage. Because of this discrepancy, we recommend that you compare quotes from multiple companies to get the cheapest car insurance rates.

| Driver profile |

|---|

You Have A Poor Driving Record

Car insurance for people with accidents, violations, or other bad marks on their driving record can make insurance companies view them as high-risk drivers. Folks with an abysmal record will have to get an SR-22 to legally drive, which will have a sizable impact on insurance rates in the future.

There are high-risk auto insurance companies that specialize in helping drivers obtain low SR-22 insurance costs. However, many other companies charge a higher premium based on your past if you were previously in an accident and were at fault if you have committed too many traffic violations or were given a DUI. Your best bet is to shop around and compare auto insurance quotes.

If you improve your driving record over time, you could convince insurance providers that you will not repeat your past mistakes, leading to lower-cost premiums in the future. All it takes is time. For this reason, correcting a poor driving record is in your control over the long term, but you will have to work and wait to get there.

Read Also: Fix Clear Coat On Car

Insurance Fraud In Ontario Raises Rates

Insurance fraud costs $1.6 billion dollars every year, which works out to about roughly $165 in extra insurance paid for each of Ontarios 9.7 million drivers every 365 days. Its also worth noting that insurers have paid out $1.02 for every $1 they earned in 2016. Theyre not turning as much of a profit as we tend to think!

Insurance fraud in Ontario is a major contributor for rising rates, making it doubly important to get all possible information from the other driver in the event of an accident. Fraud isnt an issue in Ontario alone, but the province is feeling its effects more heavily than other provinces due to its sheer size.

Take Advantage Of Discounts

Even though discount availability varies by state and insurance company, auto insurance discounts are the quickest way to automatically lower your premium regardless of your age, location, and driving history. When you are getting a quote, be sure to inquire what discounts may apply to your new or existing policy. There are many types of car insurance discounts including:

- Multi-policy discounts

- Anti-theft and safety restraint discounts

- Hybrid car discounts

- Full pay or auto-pay discounts

- Defensive driving discounts

Also Check: Alternative To Car Wash Soap

How To Lower Your Car Insurance Rates

Now that weve answered the question, Why is my car insurance so high? the next question to ask is, What can I do about it? Fortunately, lowering your car insurance rates may not be as hard as you think.

In some cases, it may be as simple as switching to another insurance company, but you can also try one of these other strategies:

Crashes With Uninsured Drivers

Many people get behind the wheel without car insurance. And that makes insurance more expensive for everyone else.

When an insured driver has a crash with an uninsured driver, someone has to pay out. And that someone is the underwriter of the insured driver.

Because of this, premiums get higher for everyone.

It’s thought that uninsured drivers add £30 to the average insurance policy.

Don’t Miss: Request Paper Title Florida

Auto Insurance Rates Are Personalized To Each Individual Driver

If its come time to renew your auto insurance policy and seeing a higher premium is giving you sticker shock, you may be asking: Why is car insurance so expensive? The cost of car insurance fluctuates due to industry factors, but its also influenced by information about the policyholder, the vehicle thats insured, and other variables.

In this article, well examine what shapes car insurance rates and how you can get a better price. If you want to find cheaper car insurance, the best way to do so is to compare rates from some of the best car insurance companies. Use the tool below to get free quotes for low-cost auto insurance from top providers in your area.

Distance You Drive To And From Work

Your rates will rise if you commute long distances regularly or travel on dangerous roads. Insurance companies will ask where you work when you apply. You may be saving money on housing costs by driving to work, but it can also increase the cost of your car insurance. Although this is not something you should move over, it might be something to think about if you are already planning to move.

Don’t Miss: Does Carvana Buy Out Leases

Questions Youve Asked Your Insurance Agent

Merely asking your insurance agent about a possible claim can affect your rates, even if you decide not to file. Such inquiries, especially if you tell the agent about damage, could be recorded in a database that many insurers use when evaluating risk. That might count against you when you shop for new insurance. If youre simply wondering whether the repair costs exceed your deductible, its better to check your coverage information on the declarations page of your auto policy.

Potential For Injury Or Damage

Another rate-setting variable is a car make and models overall safety record, says Loretta Worters, a spokeswoman for the Insurance Information Institute, an industry-backed nonprofit that helps consumers understand insurance issues.

Insurers not only look at how safe a particular vehicle is to drive and how well it protects occupants, but also how much potential damage it can inflict on another car, she says.

If the model you drive is more likely to cause damage in an accident, your liability insurance premium may be higher. You can check a cars safety rating on the Insurance Institute for Highway Safetys website.

The good news is that if you have a car with safety features, such as antilock brakes, an anti-theft system or blind-spot indicators, you may be able to qualify for an insurance discount.

Don’t Miss: Az Title Transfer